Part 2: Bitspark Switching to Bitshares and Unbanking The Banked

Bitspark: Unbanking The Banked with Bitshares

In part one we announced our plans to switch to Bitshares from Bitcoin as the alternative cryptocurrency for our remittance business and the reasoning as to why. In this part I hope to follow up with the questions from readers relating to how this might play out practically on the ground particularly in the absence of banks. The development of pegged cryptocurrencies not only are a better way of transmitting value and accessing formerly inaccessible currencies but it also helps to alleviate the liquidity and counterparty risks when dealing with many intermediaries around the world. The important thing to keep in mind however is how does all of this help the customer and if the customer wants cash in the recipient destination, how will payment dispersals in cash work under this system particularly without a bank involved? Let’s dive in.

The Last Mile

The phrase ‘last mile’ in the context of the remittance industry refers to how to distribute the money to the recipient at the destination, the ‘last mile’ of the transaction. As noted previously, the overwhelming majority of remittance payments are made from the developed to the developing world and often in the recipient countries only 20-30% of the population have a bank account. Therefore in order for people to receive a payment they usually receive cash distributed via a money transfer shop who play a crucial role in making everything work. Without them there would be no way for people to receive their money and there needs to be adequate coverage in a given geography for the MTO to be able to distribute cash to enough people to make it worthwhile.

There is however a chicken and the egg situation with growing a distribution network of MTOs. To be able to deliver cash for a sender there needs to be an MTO near the recipient to collect the payment and if there isn't then the sender will not send the money with that network in the first place. Therefore it often becomes the case that only a few money transfer networks survive in every country, these become the dominant methods to send money because they have the geographical coverage to make it work. A new network with 10 distribution outlets cannot compete with incumbents that have 10 000 so naturally new MTO’s will sign up to be an agent of the dominant network as that is what will be most profitable for them in guaranteeing a steady flow of payments to their geography.

Operationally MTOs in ‘sender’ jurisdictions will be receiving a lot of cash (e.g. Hong Kong, Singapore, UAE, Saudi Arabia, USA, UK etc) and MTOs in ‘recipient’ jurisdictions will be ‘paying out’ a lot of cash. At some frequent interval, an MTO network must re-balance their cash reserves, that is to say they need to somehow get the cash piling up on the sender end to go to recipient end so the MTOs there have cash to continue paying out transactions. Often this happens through a complex web of banks, FX brokers and intermediaries, taking more time and becoming too costly the further out you stray from the popular recipient jurisdictions. With developing countries often having less developed and more difficult to deal with currencies and local banks, it makes money transfers difficult and inefficient. Traditionally, the MTO networks need to get money to their bank in a recipient destination and then this bank can send a transaction to the local MTOs which the MTOs can then withdraw in cash to replenish their cash reserves for payouts.

Every remittance network has their own proprietary systems and methodologies in place to make this happen, hardly any are interoperable and in most cases they actively do not want to work with each other anyway- it is a very old industry and mindset. It is therefore crucial for Bitspark to be able to resolve these issues in growing our MTO network, however to grow the same way as the established competitors is not easy and neither is going ‘digital only’ as only a fraction of the market is ready to use digital payments due to cash being king (having a digital balance is meaningless if you can't buy food, pay rent or receive a salary with it) in most countries around the world.

Unbanking the Banked

The root cause of many of the issues in growing a last mile network ultimately revolves around access to a currency and the local banks an MTO network has in that jurisdiction- if solved then it's easier to grow a geographic distribution of MTOs as they can access money faster at more competitive prices than others, we therefore propose that we need to remove the banks and the currency from the equation. By removing the difficulty associated with accessing liquidity denominated in the local currency which was explained in part one, we intend to eventually create a pegged fiat cryptocurrency for every national currency in the world with zero counterparty risk and exchangeable for virtually no cost.

The next issue to solve is that of the banks and ‘De-risking’, which is a huge issue facing the industry and a solution is sorely needed that can enable MTOs to continue to operate or at least operate with better peace of mind without a bank. This, combined with the superior economics brought by Bitspark to MTOs can assist them to operate their businesses more profitably with less risk.

Managing MTO Cash and Digital Balances:

MTOs in sender countries receive cash from senders and draw down upon a digital balance given by their money transfer network provider. That is to say, if an MTO in a sender country funds their account at their provider with $1000 then someone walks into their shop with $100 cash, the MTO will debit their digital balance with their money transfer provider by $100 and receive the cash over the counter. Now they have a digital balance of $900 and a cash balance of $100 (not accounting for any fees). Likewise, MTOs in recipient countries have a cash balance of say $1000 and a digital balance of $0. When they pay out a transaction to a recipient they hand over $100 in cash and are credited $100 to their digital balance, now making their cash reserve at $900 and a digital balance at $100. Usually banks are required to rebalance this but Bitspark is proposing the below with using BitUSD as an example of an existing cryptocurrency on the Bitshares network pegged 1:1 with USD but this could be any pegged cryptocurrency:

Rebalancing a Cash Rich Sender MTO with Bitspark:

- A Bitspark Sendy user has a digital balance of 100 BitUSD in their app and would like make some money. They visit an MTO and offer to sell their digital 100 bitUSD to the MTO for $101 in Cash.

- The MTO accepts this offer and exchanges $101 in cash for 100 BitUSD.

- The MTO now has reduced their cash on hand and also received a digital balance to be used for future transactions.

The amount the user or the MTO can bid or offer can be dictated by a market. In the above example it was essentially a 1% fee paid by the MTO but this can be set to anything depending on market circumstances. If everyone finds that this is an easy way to make money there will be many people offering to sell the MTO their balances so the MTO may only end up offering 0.1%, or perhaps on a busy weekend, the MTO may offer 2% as they really need to get a digital balance into their Bitspark account as they need to be able to continue processing transactions.

In the traditional world, an MTO would need to take their cash to a bank, wait for the bank to credit it into their money transfer system providers account and only then can they being sending transactions again with an adequate digital balance. This eliminates the need for a bank to exist and incentivises an active market for those willing to make some money. The individual in the example offered bitUSD but it could equally be any digital currency, like Bitcoin, it serves the same purpose of being able to convey a digital balance to Bitspark easily to credit the MTOs account.

Rebalancing a cash poor Recipient MTO with Bitspark:

- A Bitspark Sendy user has $100 in Cash and would like make some money. They visit an MTO and offer to sell their cash for 101 bitUSD to the MTO.

- The MTO accepts this offer and exchange 101 bitUSD for $100 in cash.

- The MTO has increased their cash in hand and reduced their digital balance, they can now continue to pay out money to recipients in cash.

This example is the workflow for a recipient shop that will not have cash on hand but a large digital balance. Traditionally this shop would need to wait for their digital balance to be sent to their local bank account and then for them to withdraw the cash in order to continue doing transactions. In the above method this removes the need for the bank and makes things a lot quicker with a market available for individuals and businesses to liquidate an MTOs balances with cash or digital money.

These two methods can effectively ‘unbank the banked’ whereby MTOs can operate and no longer need the use of a bank account. In some jurisdictions it may be a requirement of the money transfer license to have a bank account but this can be a account that isn’t used often so as not to worry the bank meanwhile transactions take place in complete transparency on the Bitspark platform balancing between cash and cryptocurrencies.

Interoperable and Scalable

Bitspark is designed to be a connector for money transfer networks around the world and one of the hindrances to driving greater efficiencies in the industry is the distinct lack of interoperability between platform providers. Western Union MTOs generally are only able to send payments to other Western Union MTOs, the same is true for UAE Exchange, Ria and many more. There are a few ways we seek to achieve full interoperability:

APIs:

Our API has been enabling anyone to send and receive payments in either fiat or digital currencies for almost 2 years now. Existing MTOs who want to connect to Bitspark but perhaps not throw away their existing systems are welcome to use it as it is possible to integrate some or all functions of Bitspark into their own systems using our API. We have even had discussions with MTOs who are simply wanting to buy and sell liquidity via Bitspark in specific currencies with no intention yet of routing payments via our network, that is also possible.

Mobile First

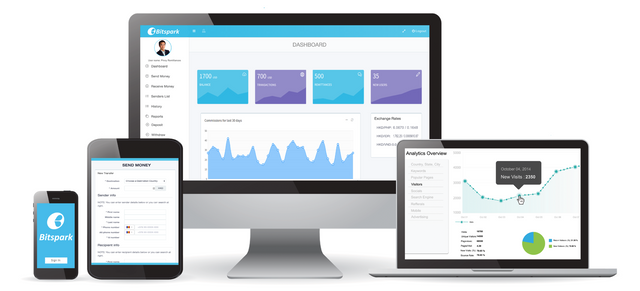

All of what we have described above has been applicable to MTOs however it is also possible for mobile users of the Bitspark Sendy app to top up, cash out and send and receive payments. It is often said the next billion internet users will all be on mobile and being able to bridge the gap between traditional bricks and mortar MTOs and their users via Sendy has been an increasingly bigger focus for us. Sendy users will soon also be able to exchange cash and digital balances with others which is our solution to reaching customers in rural areas in developing countries that may lack nearby MTOs to make payments.

MTOs can reach new customers via mobile and significantly reduce onboarding and operational costs of making payments as all of the compliance work is offloaded to Bitspark and a user can topup at an MTO in 15 seconds reducing delays at the shop window, ensuring higher throughput of customers. Fees for mobile topups and cash out can be set by the MTOs and customer announcements can be made directly to the users phone, increasing return customer rates.

MTO Choice:

We do not prescribe that a money transfer shop use only Bitspark, they are free to use whatever existing platforms they want to but we think given the economics of Bitspark they will likely end up using us. However keeping the other options open is also beneficial to us, often MTOs may run several systems in order to process payments via different networks to different customers and destinations- we can gain access to these networks for payments via the MTO directly and not through us needing to connect to that particular system provider. For example, if an MTO runs Bitspark in addition to System_1 and System_2 then if we have a Bitspark transaction needing to be paid out to System_2’s network (maybe they have better geographical coverage) then we can send a request to the MTO to pay it out via System_2 and theyll be credited the digital balance in their Bitspark account- effectively giving Bitspark instant coverage of everywhere on day 1 with just 1 MTO using the system.

Rolling It Out

As noted, our intention to rollout the new Bitshares based money transfer system will begin with our project with the United Nations Development Program in Tajikistan and quickly follow on from there to reach our existing money transfer remittance corridors. Discussions are ongoing with UNDP and we are currently identifying the appropriate towns and partners for the pilot. In our final Part 3 we introduce our plan for incentivisation for a rollout on a larger scale across new geographies, stay tuned!

It makes me so very, very happy to see businesses discovering the power of Bitshares. I hope Bitspark cuts trail and many, many others follow in their footsteps. Bitspark, salut!

Thanks for sharing

Serious business! thanks for sharing about it all. I really look forward to see where this is going to go. Namaste :)

This is sounding really good George. :)

What's MTO short for? Thanks!

MTO= Money Transfer Operator. In this post we are using it in relation to money transfer shops you may see around the place like a western union shop front for example, thats how the vast of majority of people in the world send and receive money through these bricks and mortar shops (MTOs).

Think I need to read this a couple of times, but looks great, thanks for sharing

pos yang bagus dan bermanfaat..terima kasih

Reading again and again to understand clearly.

Thanks for sharing. Keep supporting

It sounds interesting. Thanks for sharing. I really enjoyed thoroughly 😊

Very exciting...