BitShares Rough Guides – UIA & IOUs – what's the difference and how do they apply to assets like open.BTC ?

IOUs vs UIAs

Background

In BitShares, individuals have the ability to create and issue various types of assets, known as UIAs. A type of these is documented as an EBA or Exchange Backed Asset. Commonly described as an 'IOU', an EBA is said to be backed by a 3rd party finance house or exchange, with 100% collateral in the real asset (and the main topic of this article).

Confused yet? Don't be. As we'll reveal, everything starts from a User Issued Asset (UIA), and the rest is semantics. Thereby, Exchange Backed Assets purchased on the DEX such as open.BTC, open.ETH etc are referenced as I Owe You (IOUs). In other words the right to withdraw the same amount of the backed asset from the central issuer. Compare this to depositing money in a bank - You hand over hard cash, and the bank provides a ledger receipt. You leave the bank your money, (mostly) safe in the knowledge they won't run off with it or go bust. You can withdraw the equivalent value of banknotes again in cash at any point (in different notes, and you don't care about the 'how' part). You are also confident your bank is regulated, your money is safe, and can be accessed at a hole in the wall anytime. Naturally, folks want to feel as certain about their crypto holdings as they would in any traditional bank or exchange.

BitShares then, provides the technology platform, the tools, and all the capabilities required for 3rd parties to create their own UIAs. So, if something goes wrong for an IOU, for BitShares is it just a case of "don't shoot the messenger?", or is there more to it? Let's look further at how we decide such things.

I thought BitShares being Decentralized, my assets are in my possession?

Hence the term, for UIA Exchange Backed Assets you only keep an 'IOU', not the actual asset. Consider the following quote from Mick, a user on the Telegram DEX channel earlier this week: [sic]

Bitshares is a decentralized exchange with a wallet that YOU control, not bitshares. you can only really "store" bitshares and bitassets (bitusd, bitgold, bitsilver, bitcny, etc) in the bitshares wallet. You can also have open.btc open.eth open.eos (user issued assets by openledger) in the bitshares wallet, but those are merely IOU's from openledger gateway service. If you want cold storage for btc eth, get a trezor or ledger nano s hardware wallet.

Let's get through some more basics, especially for newer BitSharians (welcome, btw). You can explore for yourself all the assets. The next few screens will walk through the Asset Explorer from the wallet, and the BitShares blockchain explorer on cryptofresh.com to reveal more.

How to: Browse BitShares UIA - User Issued Assets

~ Supplement ~

The first way to look at any of the assets created on BitShares is go to the asset explorer. Anyone can do this. Go to your wallet. (If you also want to sign up, here is a guide). Suggestion: Use Cloud model if you just want to try it out, or take the extra effort to create an Account model with a .bin file and brainkey for the long-term.

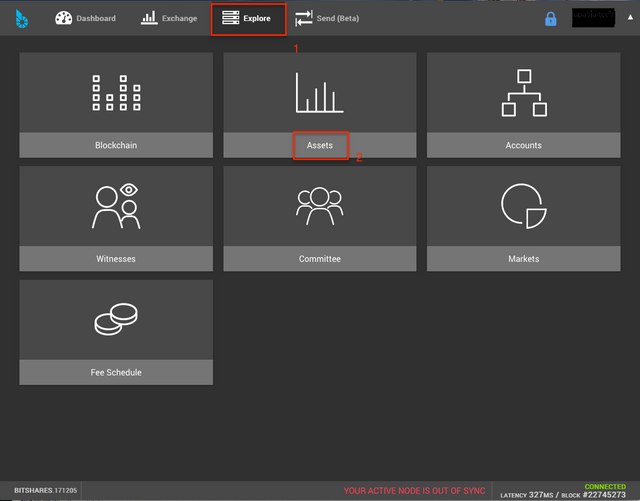

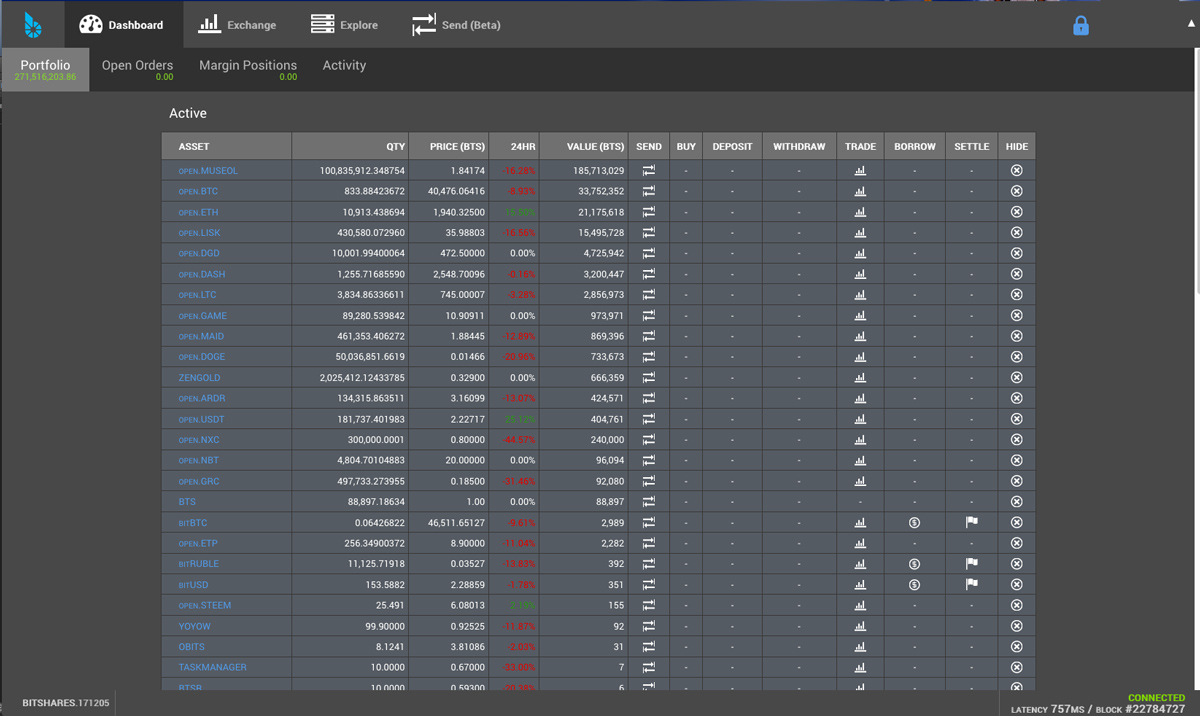

First go to the wallet and select Explore > Assets

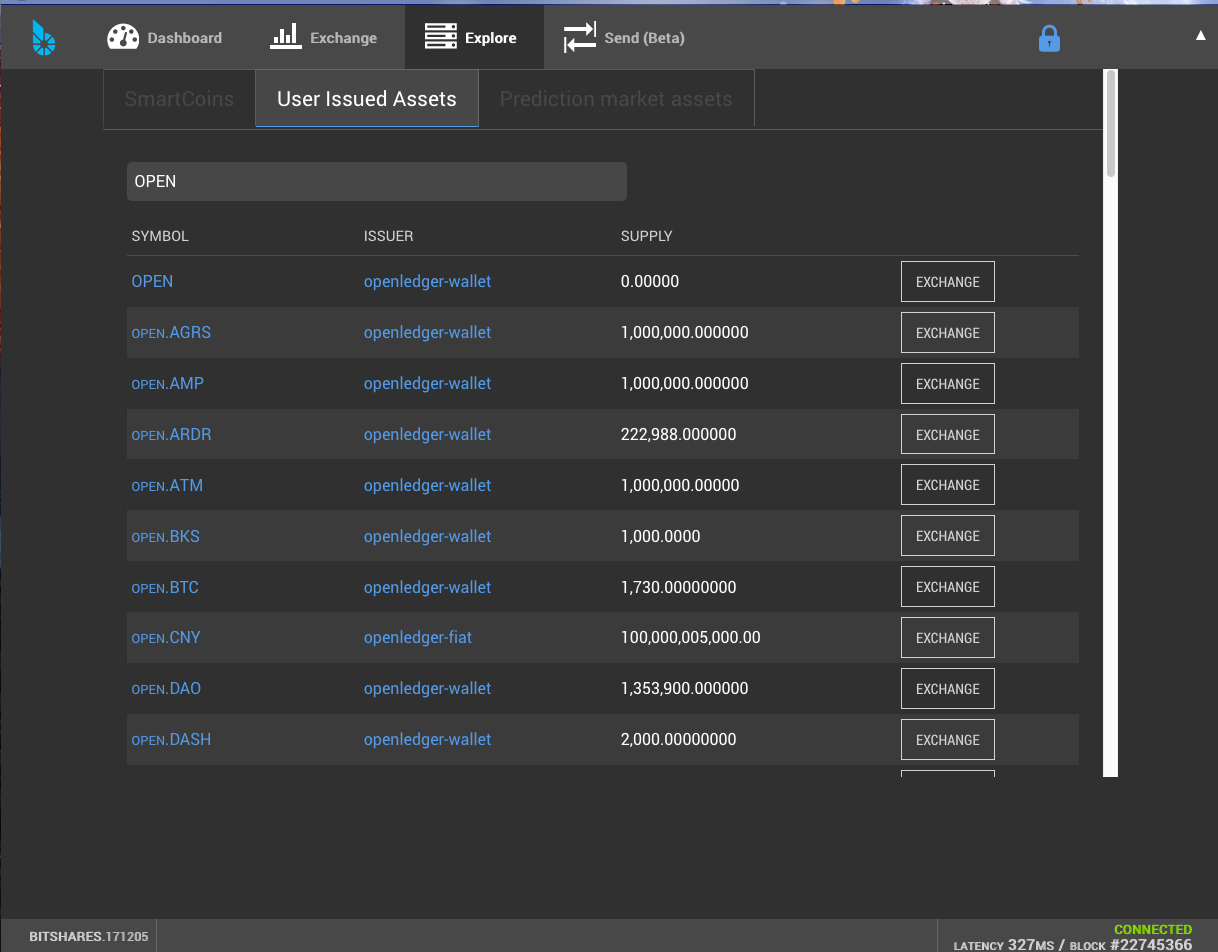

Here we can use 'Filter' to type 'OPEN' and find OpenLedger assets under "User Issued Assets" tab:

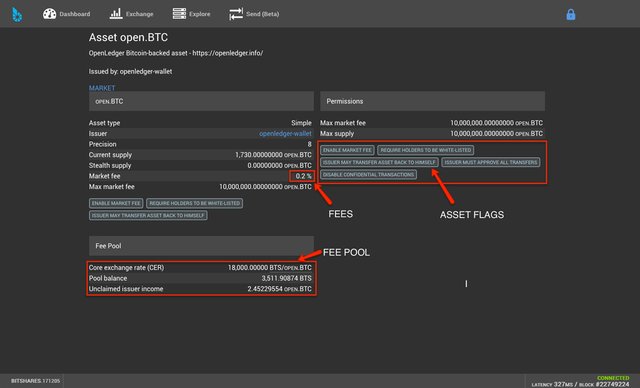

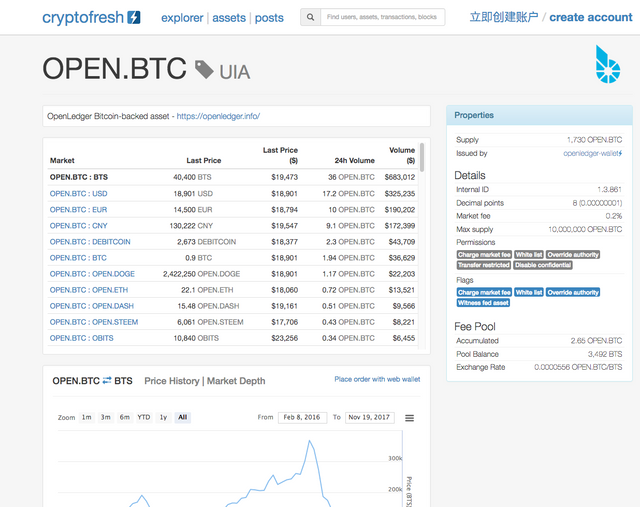

Now we can see more information about the asset including the issuer flags. We can see a market fee of 0.2%, this enables the provider to profit from trading of the asset (fair enough). You can see the flag 'issuer may transfer asset back to himself' is set to true. How/Why/Will they use the flag? Additionally, we can see the total amount of fees that have been left unclaimed. (If kept on the DEX, these fees can also be a tool for asset liqidity). There is a lot more detail still on the topic of flags and fee pools for a UIA, perhaps a good topic for the comments (please feel free) or coming post.

The next thing we want to do is view this issuer wallet in action, as we can look at anyones account by clicking on its name, in this case openledger-wallet

OpenLedger account wallet

OpenLedger account walletCryptofresh blockchain explorer

Another place to find more information is the cryptofresh blockchain explorer:

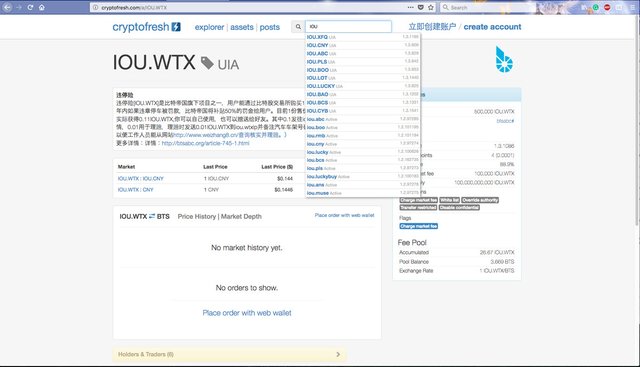

Here if we search for 'IOU' we can only see other assets that have been named IOU.[asset], by what appears to be private entity. Not to be confused with the ones we are interested in. Despite being referred to as such, in the blockchain all appear as UIA (see that grey colored tag), there is no explicit IOU definition or naming.

these are not the assets we're looking for – move along!

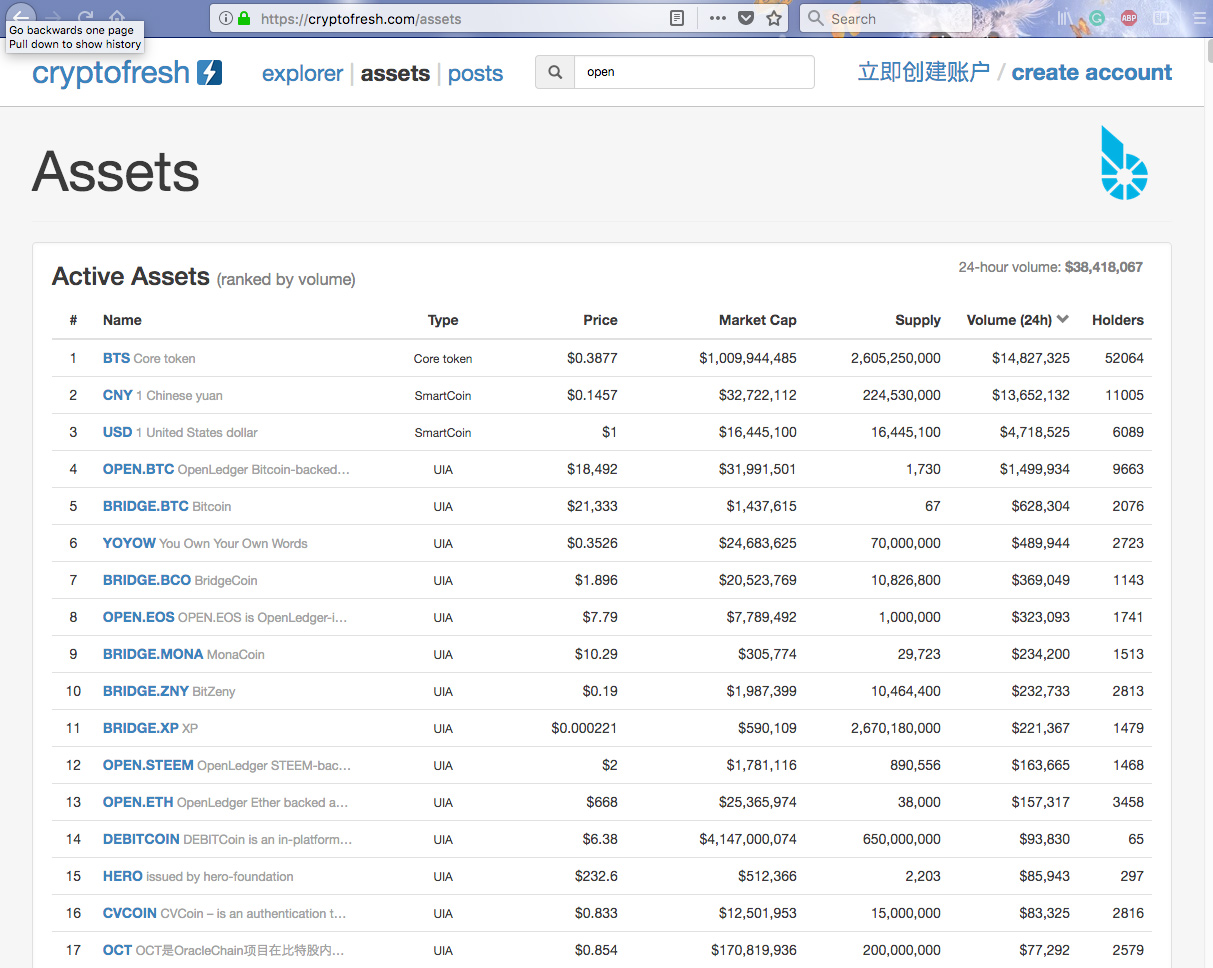

these are not the assets we're looking for – move along!Click 'Assets' to open the page below with the top volume. As can be seen, OPEN and BRIDGE are two of the most noticeable asset prefixes here, and both refer to central exchanges external to BitShares. These are the Exchange Backed Assets, which equate to an IOU for the amount of the holding you purchase. If you Google about it or read the blurb, those external companies state their guarantees to back 100% of your IOU.

Viewing the top assets in cryptofresh

Viewing the top assets in cryptofreshNext we can look at open.btc or any other EBA, but still nowhere do you see it called an 'IOU' or how it is backed. What we can see, is full information of all the trades – We have a very reliable and trusted record.

truth and only proof

truth and only proofChange of question

So, we've got this far and found the IOU definitions, the statements on forums and marketing blurb. So next question, how to audit companies offering services on top of BitShares? How do we know they really have the 100% asset pool to back up these IOUs? Thing is, that's completely down to our judgement of those 3rd parties – In other words, the IOUs are as safe as the central exchanges holding them. What does this leave us with?

Being a DAC, and working as an open eco-system and community does help us to a large extent:

– Witnesses and Comittee are highly diligent, and together with Community will be quick to point out what they consider a scam or not, and tend to share all experiences and information good or bad.

– We can make our own fair judgement to trust the IOU providers, as unrelated and standalone entities that just happen to be using BitShares DEX to offer them. Larger and well established of them will bring liquidity and users to BitShares, and are more likely to be well received than unknowns.

~ Final saving grace ~

Exchange or entity stands to do a lot more harm to themselves (permanent loss of credibility) for having to issue assets back to themselves or pull off any kind of wrong moves with the asset holders. In effect, providers are incentiviced to gain more from doing good than doing wrong.

Conclusions

BitShares is a DAC and the core technology behind the DEX and Token Factory. However, as an open eco-system it invites participation from 3rd parties who can offer up their own assets (UIAs). When these UIA come with a guarantee of 100% backing by an external bank or exchange, we define them as EBA (Exchange Backed Assets) or IOUs.

However, this appears to be loosely defined, perhaps with good reasoning. The BitShares blockchain will merely keep an immutable ledger of these IOU transactions, it is the waterwheel, and source of truth - our "trustless" servant.

Question remains for discussion, whether the role of BitShares should be greater involved with asset issuers, or it's out of scope? Should BitShares then leave UIA/IOU as an open market, instead focussing more effort, perhaps even funded by the reserve pool or workers - on creating more committee assets like bit{usd, gold, silver, diamond, eur, jpy, thb, ~etc}, or even developing side-chains for Bitcoin, Eth, soon EOS, and more? It's a hot topic of discussion, and at times a divisive one.

credit to @xeroc, for a much older post

Thank you. This is wonderful. Resteeming :)

Thanks Tony, talk to you soon on Telegram!

Another most excellent and useful post for us all, especially invested in the Bitshares environment, thank you dearly!

Namaste :)

Thanks a lot :)

Hey guys, great overview! I have a few questions regarding UIAs here:https://bitsharestalk.org/index.php/topic,25574.0.html

could you please take a look?

Hey @ravid, for sure and it appears you may already got some answers looking there now. Have you popped in the Telegram DEX and Traders channel to get some inputs also? We are often there also, or you could drop us a line directly to discuss further (we are doing similar to your idea for Thailand, fiat gateway and pegged local UIA).

Oh, riiiight, I completely forgot! How do I reach you guys aside from telegram? Maybe email? I prefer written conversation as my spoken english is kinda rusty

you are welcome to also send us an email inquiry [at] apasia (dot) tech ... thank you

I did, did you get it?

Hi @ravid, we did and you shall have a reply today. We have been a little busy with Slovenia Bitshares :)

Great overview, thanks. I'm very curious about exploring creative use cases for UIA's on Bitshares. The gateway/exchange (i.e., OpenLedger) is obvious, but what about the many opportunities this platform provides to the entrepreneurial users who either have a business, are creating an application, or simply want the satisfaction of having launched their own token?

I think if there was a good post or discussion about how people/companies can launch a UIA for reward points, gift card balances, commissions, etc.... more quality tokens would exist native to the Bitshares platform.

I'm all ears :) Thanks.

indeed and thank-you for the compliments! Please see our previous article also on creating tokens, https://steemit.com/bitshares/@apasia.tech/bitshares-tour-of-the-token-factory and we'll be surely writing towards the entreprenuers mindset ...

Regards,

Ross Walker (founder @apasia.tech)

Excellent! More knowledge of how bitshares works. Thank you.

Glad you are enjoying the posts, thank you.

Thank you!

Thank-you for the Re-Steem!

Wow! am enlightened.. Thank you

Cool. Please check out our other articles, and welcome to BitShares decentralized world :)

Very interesting, confusing to! I lost my bitshares trying to take them off the exchange (binance) onto my wallet, it tells me on cryptofresh that a user called BRSVD cancelled my transaction! I don't know who that is and how they could do that but I haven't been able to get my coins back . Any thoughts?

Sorry to hear you are having this trouble. Please try for support on the Telegram DEX channel https://t.me/BitSharesDEX to sort this out, the community will help. Or perhaps others will know more than I do and can comment on Binance > Bitshares gateway problems? Could be you need to contact their support also, if you can provide further info and your BitShares account name perhaps.

I was searching for something like this, then I got here.Learnt so much from this post. Thank you @apasia.tech

Our pleasure, thank you

Congratulations @apasia.tech! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPExcellent