Bitmex - Leveraged trading - learn the secrets

Bitmex is an incredibly complex exchange where you can do leveraged trading uptil 100 x on both short / long positions on bitcoin .

You can register on bitmex with the following link to get 50 % off on trading fees

https://www.bitmex.com/register/A0dgYe

Everyday I get a lot of signals for bitmex trades on telegram channels.Most of the signals are incorrect , because , the basic understanding of how Bitmex works is not clear to 90 % of traders .

Some points which will make you a Bitmex pro :-

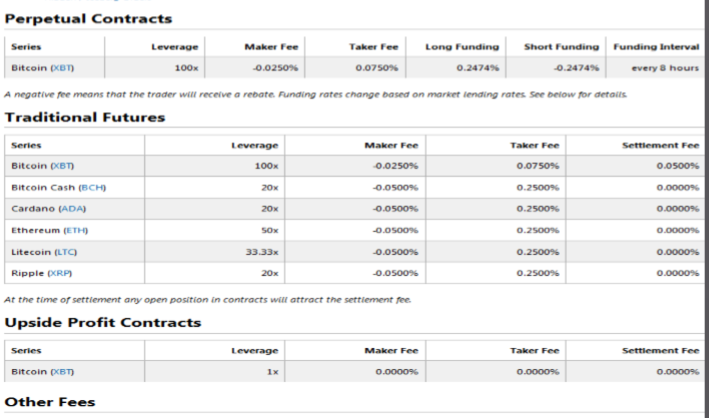

-----Understand the difference between perpetual & traditional contracts

Bitmex has a perpetual BTC contracts where fees are charged as per funding amount.Funding amount is charged on every contract depending on balance between longs & shorts three times a day.If you are trading in BTC perpetual contract close them off before 00:00 , 08 :00 & 16:00 UTC or you pay extra commission ( you can earn also based on funding being + or -). This commission is reflected in Realised PNL amount and can be expensive (approx –0.025 % every 8 hours on total contract amount) . With levarage ( eg 10x , this can be 2.5 % of your equity every 8 hours )

Lesson -

a)Dont keep positions for long and watch your watch on those three time stamps to save fees on BTC perpetual contracts

b) Try traditional contracts for BTC if you want to hold a position for longer time

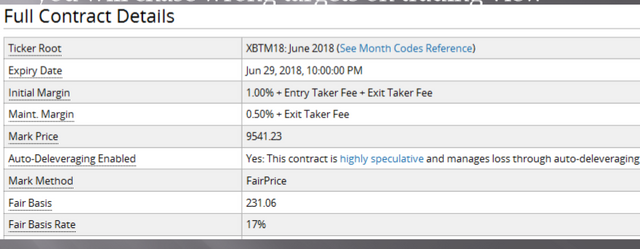

-------Price on bitmex for traditional contracts is higher than the normal exchange price by an amount known as FAIR PRICE ( contracts -BTC ( traditional)ADA , ETH, BCH, LTC ).Have a look at contract page to understand it .This is important to note for your technical analysis .

Lesson -REVISE TARGETS WITH FAIR PRICE.

Example below which shows the price being higher by 260 $ fair price on a traditional BTC contract

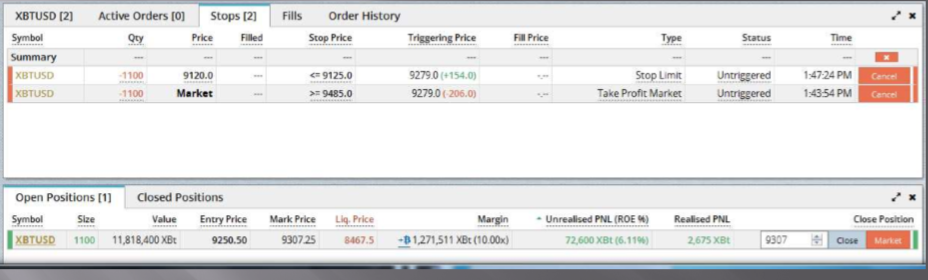

--------Always note your LIQUIDATION PRICE as you will be slammed with an unnecessary fee in case you are liquidated . How to decrease your liquidation price if you want to retain the current trading position ?

Lesson- Don’t trade your whole BTC portfolio in bitmex. Any spare BTC in your account will be used to support the bought position( if you have selected CROSS in margin) .You can also deposit BTC if you are close to liquidation to support existing positions. 1 confirmation is enough to confirm balance

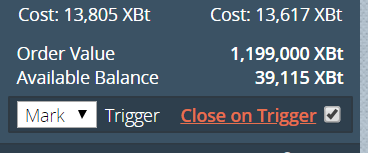

------Always put stop loss /take profit orders in Stop order section . Use REDUCE ONLY or CLOSE ON TRIGGER when putting stop orders to reduce current position or else it will open a new position .

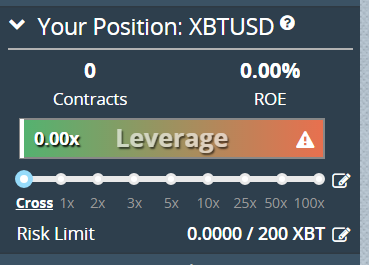

--------Leverages –never use not beyond 10 x unless you are quite sure .10x leverage protects you approximately for a 10 % change in price from your current postion •Remember all spare BTC in account goes to support your position automatically.

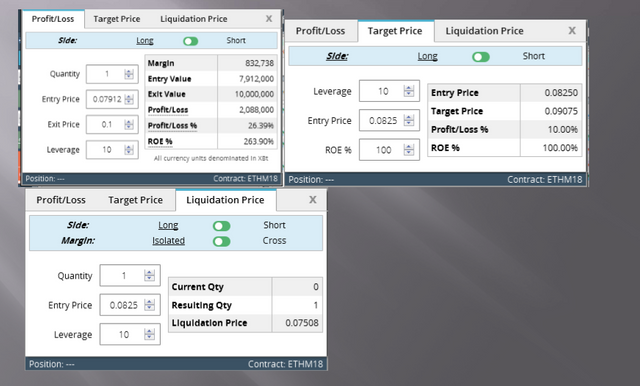

---------Use calculator in left panel to understand your win /loss ratio ,and liquidation amount before planning a trade.

Congratulations @edx! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Great guide thanks https://9blz.com/bitmex-review/