Bitfinex + Tether = Cryptocurrency Crash?

Will withdrawing from Bitfinex and avoiding Tether save us a ton of money on the next cryptocurrency crash? We will show a little bit of evidence for it and look at some alternatives for how to reposition in case this is accurate. Thank you to @lexiconical for making us aware of this possibility at https://steemit.com/bitcoin/@lexiconical/red-alert-mt-gox-2-0-brewing-bitfinex-may-be-issuing-unbacked-tether-to-paper-over-banking-service-loss-what-we-think-we-know.

Bitfinex + Tether = Cryptocurrency Crash?

Long story short, in my opinion, the combination of Bitfinex plus Tether looks like a crash coming, a crash coming for everything that's on Bitfinex, a crash coming even for Tether and potentially for some of the other currencies that aren't even directly affected.

The price of Steem might crash even though it's not on Bitfinex or traded in Tether. It just might crash because of the Bitcoin price.

However, I feel holding any Bitcoin, Ethereum, EOS or IOTA makes us extremely vulnerable, especially if we've gotten it on Bitfinex, because Bitfinex is the main place or one of the main places these four cryptocurrencies are traded. A Bitfinex crash equals all of these also crashing.

I will first show a little bit of the evidence. Now, lots of things like this are just gut feelings and guesses, and in 10 years you could say that I was totally wrong or totally right.

The question is, which one is more helpful?

If you want to hedge your bets, I would absolutely say, "Do something besides holding Tether at all costs. Have some diversification on that."

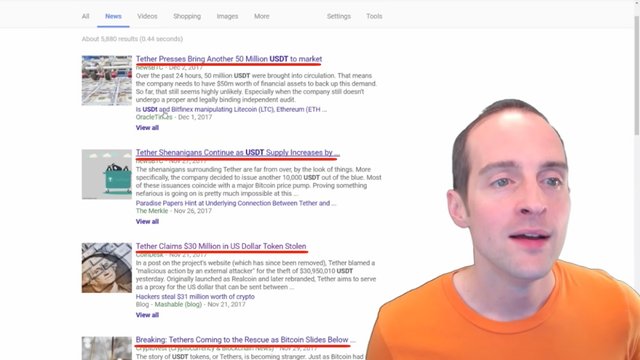

Take a look at the USDT, this is the abbreviation for Tether.

Let's look at some of these recent news stories.

"Tether presses bring another 50 million to the market."

"Tether shenanigans continue as supply increases."

"Tether claims 30 million dollars in US dollars token."

"Tether coming to the rescue as Bitcoin slides below."

"The story of Tether is becoming stranger."

Stranger equals bad.

"Tether continues to issue USDT at an alarming rate."

"Tethers' USDT affects more markets than Bitcoin alone."

I'm just reading these news stories in the order they've appeared in Google. I just did this beforehand and I haven't even seen some of these.

"Tether issued another 20 million US Dollar Tether tokens."

"Tether update, 30 million stolen."

"Tether controversy and mystery."

Now, a huge section of the entire market is currently relying on this strange cryptocurrency named Tether.

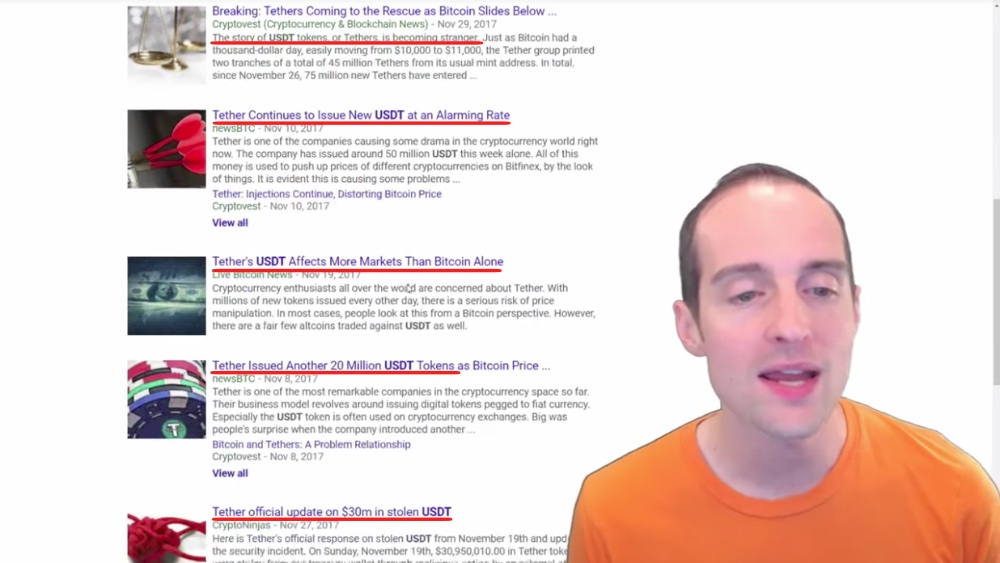

It gets worse, much worse when we look at this little news story, and I've also heard this from several other people.

"Tether the company behind the dollar pegged cryptocurrency…"

Tether is supposedly worth a dollar, but what happens if that doesn't work. What happened recently, "Tether blamed a malicious action by an external hacker."

Interesting!

"Theft of 30 million dollars’ worth of Tether."

This just happened a few days ago, maybe 10 to 20 days ago.

This is on Coindesk.com, a fairly reputable cryptocurrency website, but everything has its ups and downs.

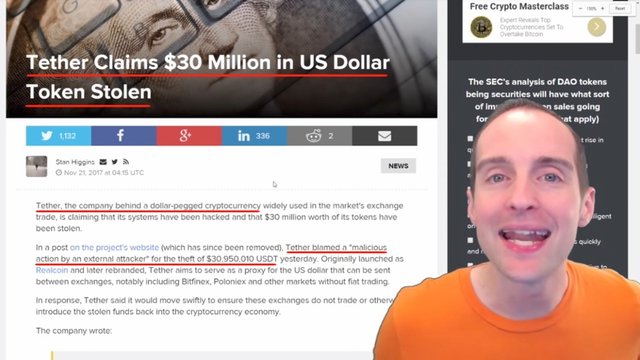

Now, let's look down, here's a nice little line.

"Unclear relationship between Tether and the troubled British Islands-based Bitcoin exchange Bitfinex."

"Long-standing allegations the exchange has been using the asset exchange in fraud and market manipulation."

"Complicating matters is that the companies are said to share a common ownership."

That's really, really, really bad when I'm about to show you this data.

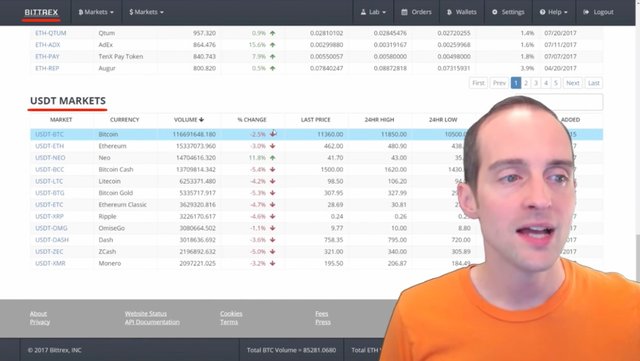

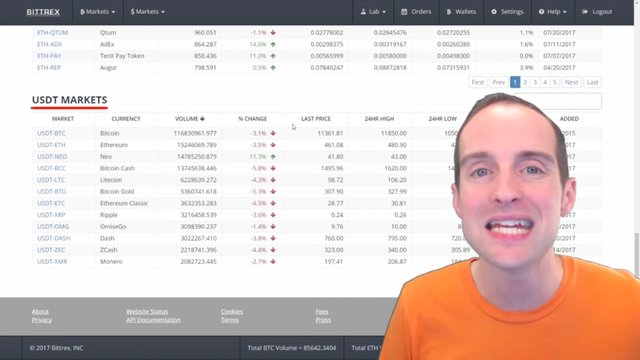

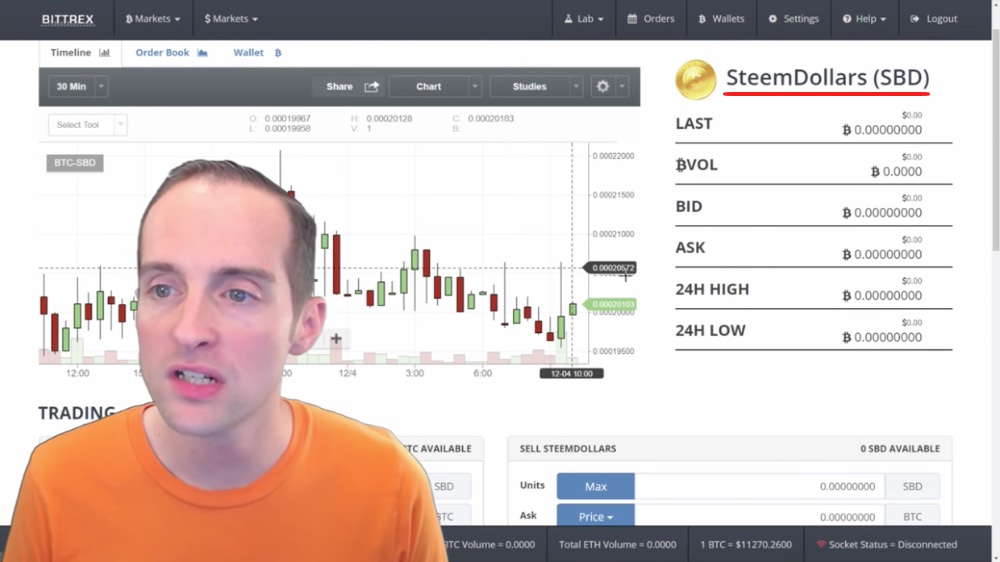

Now, Tether, if you are just casually trading on something like, let's say Bittrex over here.

Let's just say that you're trading on Bittrex and you just see that there's this little dollar sign at the top, and you think, "Okay. Well, I'll just use this little market here."

You scroll down and see that it is USDT.

"Okay, Cool. This is about like a US dollar, right? It's about the same as the US dollar."

Well, these are all Tether markets.

Bittrex and Poloniex among other exchanges, two of the biggest, have a lot of volume on Tether, but Tether is not real money, especially when you consider who owns Tether.

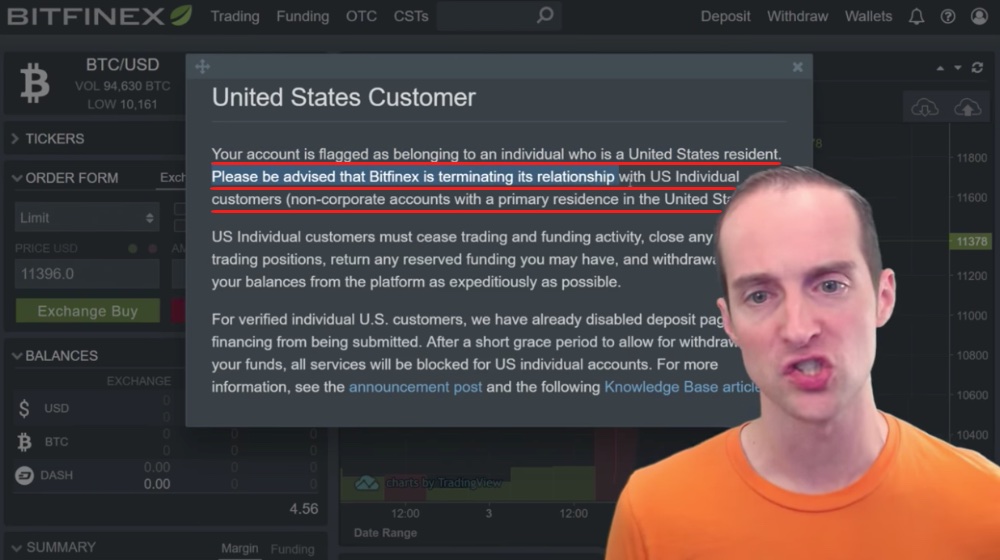

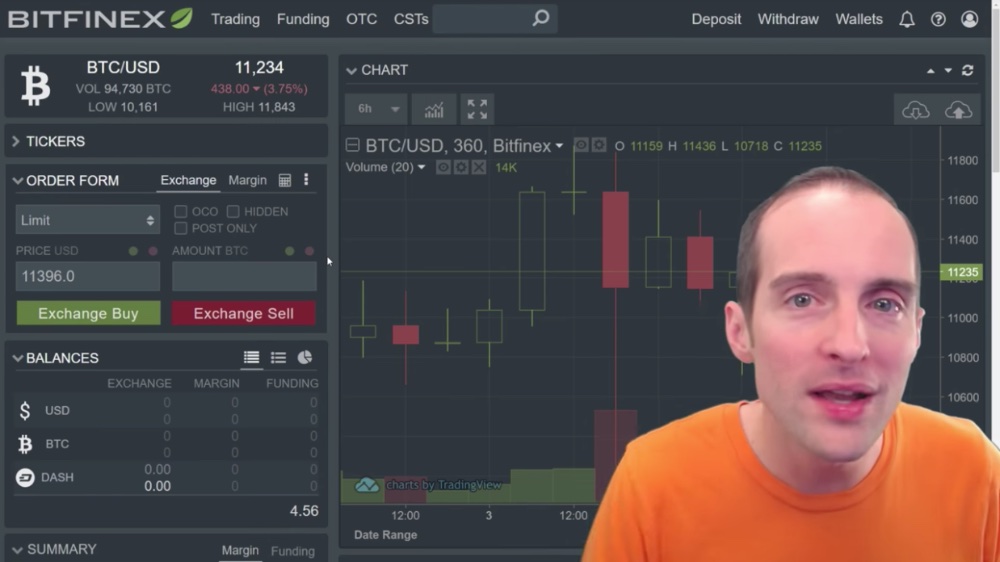

When we take a look at this, I just logged into my Bitfinex account. As you can see, I'm a "United States" customer.

"Your account is flagged as belonging to an individual who is a United States resident. Please be advised that Bitfinex is terminating its relationship with US individuals. US individuals must cease trading and funding activity."

Now, hold on, hold on!

Wait a minute.

Now, that looks really bad when combined with this news story, but let me just show you something else.

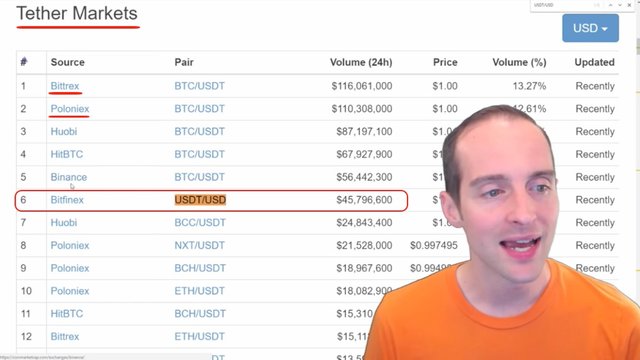

Let's look at the markets for Tether here: https://coinmarketcap.com/currencies/tether/#markets.

Tether is traded on by the two main sites, Bittrex and Poloniex.

Then, there is a Chinese Bitcoin exchange, I believe, and more Asian exchanges.

Now, whoa!

Hold on.

Bitfinex is number six with 45 million dollars from US dollars to Tether within the last 24 hours.

Now, hold on!

The number one place I can actually turn a Tether into a real dollar is on a website that is not accepting US customers.

The US government issues US dollars, last time I checked. Now, Bitfinex is the main place to change US dollars to Tether and back and forth. How am I going to change ultimately?

If you can't change US dollars and Tether back and forth for $1, the whole Tether system breaks down.

I'm going to say that again because it's really important.

If Tether cannot be exchanged for one actual US dollar, which can be withdrawn into a bank account, then it's all imaginary.

Then, it's all just whatever the market offers for it, and that's a huge problem.

If you consider these exchanges here, Tether is being used as a way to trade back and forth with $1.

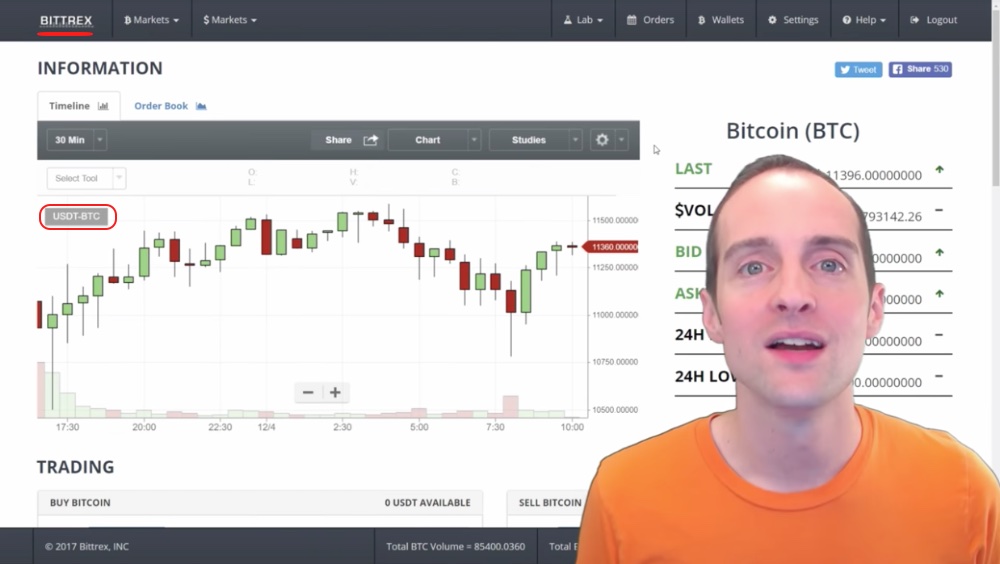

Let's just look at the USD/Tether on Bittrex, my favorite exchange for just trading altcoins.

That means every time someone is buying and selling, someone is on each end of the trade. That means there is a ton of Tether on Bittrex, there is a lot of Tether on Poloniex.

That means a large part of the price is based on what Tether is trading for because a ton of the volume are trades in Tether.

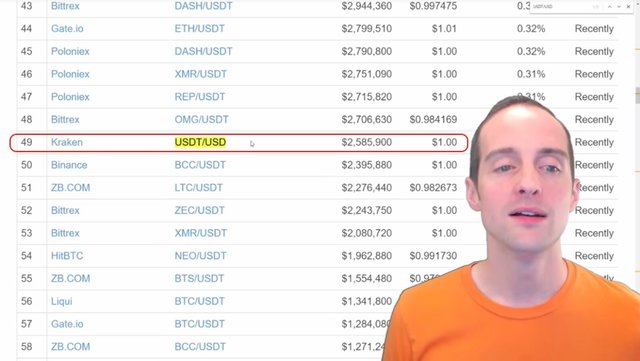

Now, you will notice that the next website you can use is Kraken.

However, how easy would it be for Kraken to remove the USDT/USD trading pair?

That's a very small number of exchanges and you can see there was a fairly small volume of Tether to the US dollar on Kraken.

If you're looking, it's not very easy to turn Tether into real US dollars. It's very easy for the price of Tether and the entire Tether blockchain to become a complete disaster where the price of Tether all of a sudden could go to 50 cents if there's a crash on Bitfinex.

Right now, this whole Bitfinex game is a house of cards, and the house of cards comes down if someone actually reveals what's really going on there and leaks that out. There are all kinds of ways for this mess at Bitfinex to leave the whole market down.

Now, it gets even worse, I will show you something else.

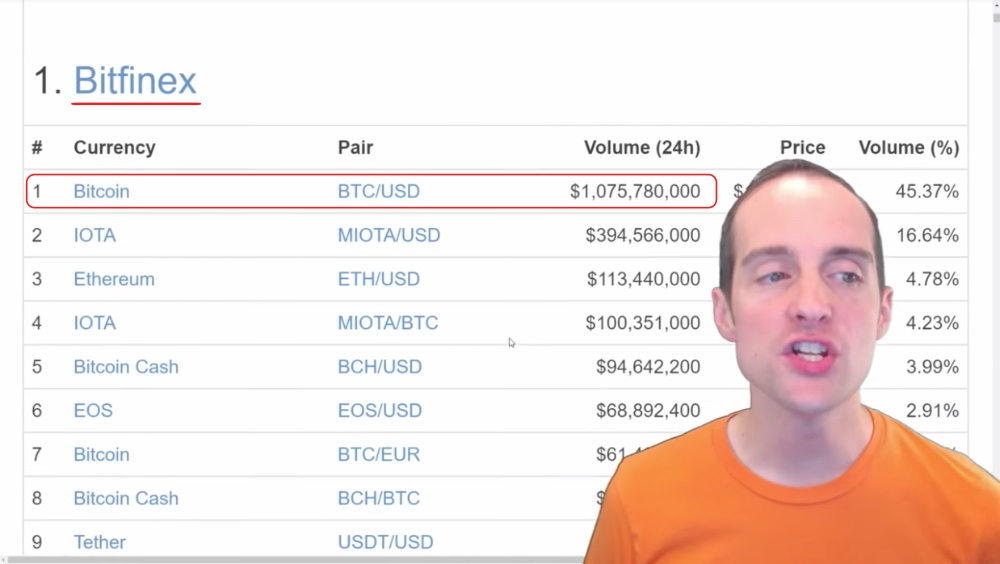

Out of all the exchanges, Bitfinex is number one and it's largely on imaginary money.

One of the main places that trading is going on is Bitfinex, but they already had a huge hack a year ago, and the question is, are we going to see another one?

Right now, a ton of volume on Bitfinex. A billion dollars in 24 hours back and forth between Bitcoin on what is, in my opinion, a completely sketchy US dollar.

Whether you can actually get a US dollar out of Bitfinex is very questionable given Bitfinex's relationship with the banks, given this disclaimer that is on Bitfinex's own website.

This is what's on their website, this is what I get when I log in. I don't trust that at all. I don't trust it at all, and you're telling me this is the number one exchange in terms of volume?

Everything that's being exchanged on here is at risk of a huge crash as well because for most of these, Bitfinex is also the number one volume.

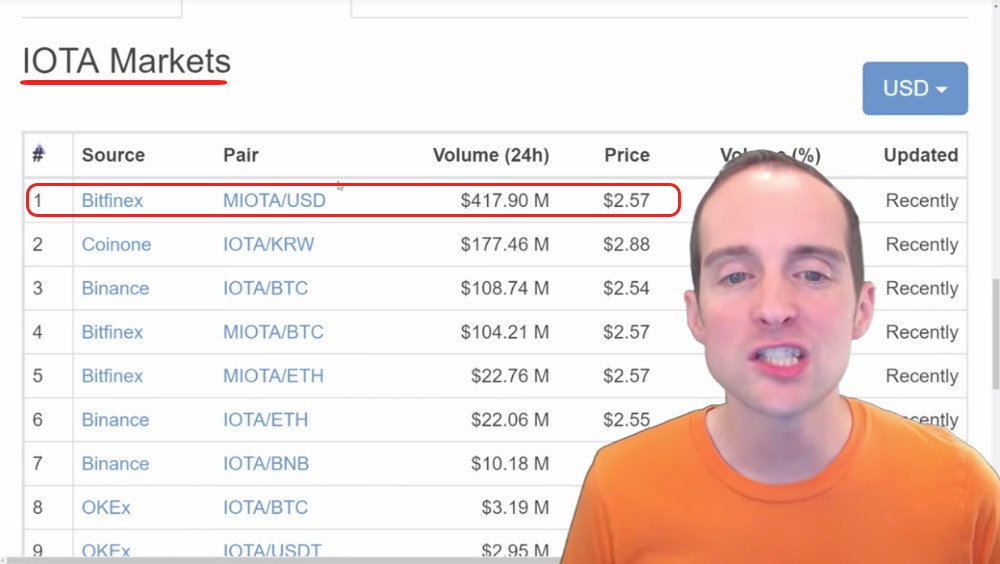

If we look at Bitcoin, Bitfinex is the number one volume. If we look at IOTA, I haven't even looked at this yet, but sometimes you don't have to look, you can just know you're right.

IOTA, number one place, it is being traded almost four times as much as anywhere else is on Bitfinex.

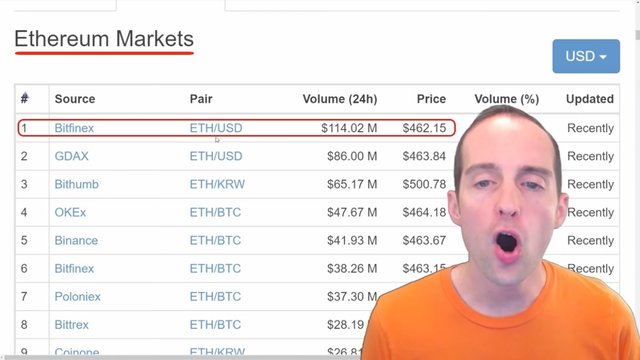

Let's do it again for Ethereum. I don't know if it is number one on Ethereum, we will find out. It's probably number one or number two on markets.

"Oh, Bitfinex is number one on Ethereum!"

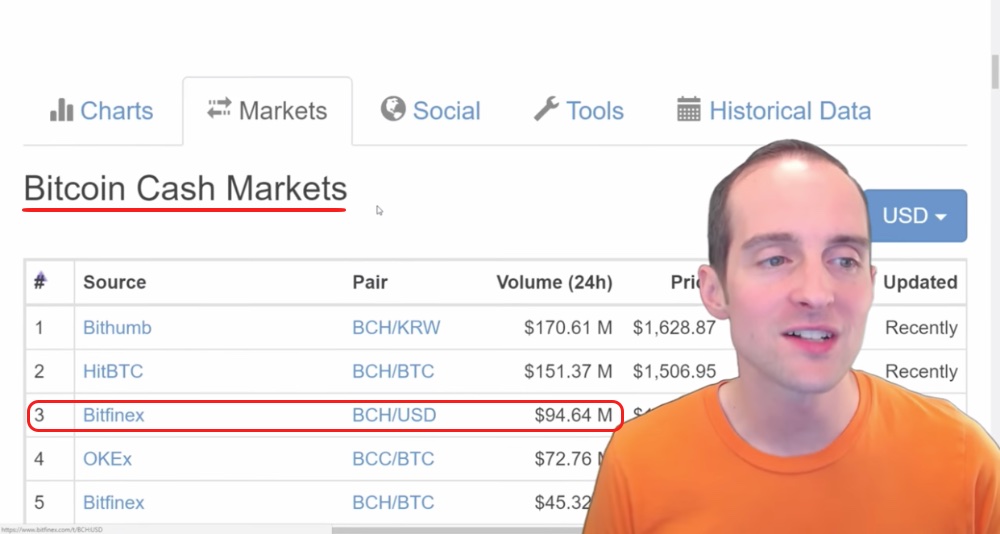

What's Bitcoin Cash being traded on?

Well, Bitcoin Cash is actually being traded on lots of other markets, but it's also up there significantly on Bitfinex.

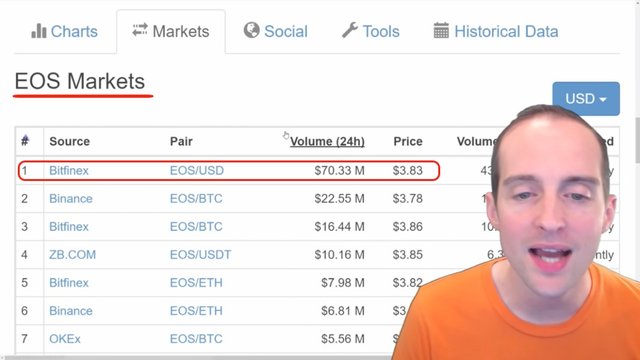

Then we go down here to EOS.

Where's the EOS being traded?

EOS is being traded mostly on or significantly on Bitfinex.

If you're looking at this data, this does not look good. The US dollar versus Tether, the Tether problems, and then Bitfinex suddenly putting this disclaimer up and not allowing US customers to participate anymore, this looks really sketchy.

Combined with Bitfinex being hacked before, combined with Bitfinex losing banking before, combined with Bitfinex's lack of transparency about exactly how much money is in their account versus how much money they're supposed to have on hand for customers, this is looking like it's all going to come down with a combination of Bitfinex and Tether.

I would imagine at some point that there will be some problem with withdrawals on Bitfinex if there's not already. Someone will put in a massive withdrawal on Bitfinex, another hack or something will happen, and then there'll be a big selling wave.

The problem will come in during a selling wave because right now while everyone's buying it's all good. We're popping bottles or whatever, we're celebrating. We're making money and I wouldn't be surprised if Bitfinex is just trying to go through all this period of success and hope that all the mistakes and all the problems can essentially be made up for by all the new money coming in, and maybe that will work.

I wouldn't want to have everything on Bitfinex though.

Maybe it will work, maybe everything will come through just fine, maybe there won't be any crash, maybe it will all work out just fine.

Right now, it looks extremely delicate. I certainly wouldn't want to have a bunch of money on Bitfinex when Bitfinex is not allowing US customers to trade anymore, who suddenly just after losing banking and who also has a mysterious and sketchy relationship with Tether, which pretty much allows, in theory, Bitfinex to just print new Tether as desired.

Bitfinex, if they wanted to, could just sit there and double lend.

"I'll lend you this dollar Tether. I'll lend you this."

The Tether could be lent out 10 or 20 times against an actual US dollar on hand. I don't see any way looking at the data that there's actually that much US dollars available against the US dollar Tether, and the problem will be whenever the selling wave happens and people want to cash out. That could be triggered by a news story, it could be triggered by a hack, whenever that happens, if you got your money in Tether and Bitfinex, you may discover, "Oh, oh. I can't turn this into real money," or whatever rate I'm going to get is drastically reduced.

These little USD/USDT markets on here, all of a sudden the price could absolutely blow up. On Coinbase it might be $11,000 for Bitcoin, but on Bitfinex for a USDT it might be $25,000 to change your USDT to BTC.

The prices for these could essentially blow up at any moment.

Therefore, I encourage diversification when it comes to Tether. I would say this is the area where there's almost no diversification.

I've talked to so many traders that are diversified on things like Bitcoin.

"While I'm not holding all in Bitcoin, I've got some Bitcoin, I've got some Ethereum, I've got some Steem, I've got some NEO," and then all that's being traded back and forth between Tether.

Then often when big profits are made, when you've made a killing because you were right and you sell all that on Bittrex, you're just holding it in Tether because you don't want to lose any money and you're waiting for something to buy into or you're waiting for another downtime to buy.

The problem is there's probably a ton of Tether just sitting on the sidelines on here having sold out of these high prices, and then when there's some kind of issue or a price crash, your inability to cash out, there won't be any way to turn that into the amount of money it was supposed to be.

If I had any US dollar Tether or just Tether for short — it looks like the US dollar Tether because it's USDT — if I had any of that I'd get rid of it. I wouldn't hold any of that right now.

I have nothing on Bitfinex.

Technically, maybe I have four dollars here or something. I've cleaned out my Bitfinex account. I don't trust Bitfinex because of banning US customers. This is, in my opinion, a clear sign of sketchy behavior. It's the same thing most of us do in person. If we know we're deserving of getting in trouble, if we know we've done a lot of things wrong, then what do we try to do?

We start trying to protect ourselves.

If we feel like we're a good person and we trust other people, we don't need to be protecting ourselves all the time.

I know, when I felt like I was a bad person, I needed things like guns, I needed things like baseball bats, I needed all these protections all the time.

I needed knives around in case someone came in and I couldn't get to my gun, I needed a shotgun, a rifle and a pistol just in case I couldn't get to one, or just for each different situation.

When I felt like I was a bad person, when I knew I was doing a lot of things wrong, I felt like I needed to protect myself from other people.

Bitfinex pulling out of the US is, in my opinion, a clear admission of wrong, and it's a desire to then protect itself.

Bitfinex is essentially saying, "We've done a lot of things wrong and we're scared of the US government. We're scared of our customers in the US finding out what we've done, suing us, and we're going to pull out. We're just going to pull out right now. We're essentially going to just hold on to any US customers that weren't paying attention and left money."

If you read the way they do it, if you're a US customer you may or may not be able to actually get your money back. By Bitfinex just doing this, it is essentially going to be able to just keep any US customers not paying attention. Bitfinex will essentially just be able to keep all those US dollars, all those customers' money and not have to pay that back.

That's sketchy.

That's not trustworthy.

I'm saying this out of love because I'm very grateful that Bitfinex has made it so easy to trade. Bitfinex has empowered exchanging all these different currencies and I'm grateful for that. I've used Bitfinex and I made tutorials on it. I put it my courses.

I love Bitfinex.

Don't get it twisted.

I love Bitfinex.

I'm telling this to Bitfinex as someone out of love, "Look, you're messing up. You're slipping. You need to do better. You need to get honest and start telling everyone all these bad things. You need to just get these out there and stop hiding all these messed up things that are going on behind the scenes. You need to get honest with the customers and with the community. You need to tell us why you're pulling out of the US. What are you scared of? What are you afraid of?"

That's what needs to happen for me to have essentially, a restored relationship with Bitfinex.

Until then, I'm calling it like I see it: Bitfinex and Tether's going down.

I'm yelling timber, "It's going down!"

I'd get everything off of Bitfinex. I'd get rid of all the Tether before it's too late because once it's too late, you lose everything or almost everything.

That's my advice.

I'm not right in the short-term lots of times and that's fine. I see what I did before and how things are today. I said to sell EOS at 50 cents and it's $3 today. I'm not right about everything and that's okay. I'm human.

You saw this for a reason today.

You didn't see this by accident.

You didn't make it all the way to the end of this post by accident. Maybe this is a message you need to avoid that big train coming, and running over your investments in your cryptocurrency on Bitfinex, that maybe is being held in Tether somewhere else, I don't know.

Maybe you've gotten through this and you said, "He's wrong. I'm going to put everything into Bitfinex and I'm going to dump it all into Tether right now."

Good! Good!

Because I'm already following my own advice.

If you want a suggestion, I think Steem is a really good thing to put in. I've got all my money in Steem and Steem Dollars.

If you're looking for an alternative to USDT, I think Steem Dollars is a really good one, and the more Steem Dollars pumps the more Steem pumps too.

There you go, that's it.

I love you.

You're awesome.

Thanks for getting all the way to the end of this post. I hope this is helpful for you. If you ended up saving a whole bunch of money, if I'm right and this thing crashes and is a mess, please tell me how much money you saved because of this.

Please, I'd love to see that.

"Jerry, you saved me a $100,000 because of this little video you shot at home. Thank you. Thank you."

"Jerry you cost me a $100,000. I sold everything, and then it went up."

Final words

Thank you for reading this blog post, which was originally filmed as the video below.

If you found this post helpful on Steem, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed?

Love,

Jerry Banfield with edits by @gmichelbkk on the transcript from @deniskj

Shared on:

- Facebook page with 2,230,398 likes.

- YouTube channel with 216,596 subscribers.

- Twitter to 103,989 followers.

Our Most Important Votes on Steem are for Witness!

Would you please make a vote for jerrybanfield as a witness or set jerrybanfield as a proxy to handle all witness votes at https://steemit.com/~witnesses because 100% of my witness earnings pay for ads that will help promote Steem for years? Thank you to the 2200+ of us on Steem voting for me as a witness, the nearly 1 million dollars worth of Steem power assigned by followers trusting me to make all witness votes through setting me as proxy, and @followbtcnews for making these .gif images!

Or

Let's stay together?

- If you want to stay updated via email, will you sign up either to get new emails daily at http://jerry.tips/steemposts or join at http://jerry.tips/emaillist1017 to get an email once a week with highlights?

- If you would like to build a relationship with me online, would you please visit https://jerrybanfield.com/contact/ because I would like a chance to get to know you?

Maybe the tether will be worth more than 1 dollar? If everything is tied to tether why not? SBD was supposed to be as close to 1USD as possible but it is 10 times more now.

You could be right regarding Tether... I never liked this product neither because of the counterparty risk. BUT:

Banning US Customers is normal business practice all over the world in financial products. US Customers cannot even open a bank account anywhere in the world anymore because of harsh regulations.

Interesting I did not realize how common it is to be banned as a US customer probably because I use mostly US banks and exchanges!

Yeah, your government is a pain in everyone's ass in that regard. Even for completely non-crypto related investments, in Europe at least, you somethings have to sign things stating that you are not born in, resident in or holder of a US passport.

Bitconnect has already delivered a black-eye to the crypto space. Another scam-coin crashing and burning could send us into an even deeper funk!

There won't be any crashes. Mass adoption is beginning

You may be right!

LOL

do you mean mass adoption of tether or bitcoin, which of them do you mean sir?

Mass adoption needs mass regulation.

@jerrybanfield You make really good points. I've always though that the US government should make their own digital currency that would be exactly equivalent to the US dollar and completely interchangeable. Crypto US dollar would be one in the same as the US dollar. In fact, it would be controlled and monitored by the US government. That is what the US government wants to do anyway. The Fed can introduce new currency to control the value just like they do with the current system. Banks would hate it though as it would essentially put some banks out of business. Most folks hate the government monitoring their monies, but there are plenty of cryptos out there that people can choose from. My opinion is that if there was a cryptocurrency variant of the US dollar, it would take the place of Tether and actually shield the US dollar from inflationary issues as the world switches to cryptocurrency.

Food for thought...

@socky that is awesome and we would all love it if the US government did issue a 1 USD cryptocurrency!

there already is, it's called bitUSD

for the USD it is steal ok but us In Uganda the government dosent evern know about cryptocurrency

after reading all of this I am still not sure why tether or bitfinex would go down.. both Tether and Bitfinex provide enough value to the markets to stay up and running at the moment, even in worst case scenarios.

It would make so much sense to me, that Bitfinex goes down one day due to it being replaced by a decentralized exchange, until that day comes there is still a lot of space for it to be exploited

@jerrybanfield I agree the Tether is something I would not buy. That being said I actually took advantage of a nice SBD price Hike last night and got some more STEEM in that Trade.

Yes it is amazing how much it is worth today as seen at http://www.steemdollar.com/sd_index.php

It will collapse soon, and when it will happen, it will be mtgox x 10

Cryptocurrency Illuminati confirmed

They should get audited in the near future

I don't think it will crash, but competition is getting higher.