BitConnect Closes Exchange After State Crackdown Over Unregulated Sales

Content adapted from this Zerohedge.com article : Source

by Tyler Durden

Following various red flags, including allegations by none other than the founder of Ethereum and Litecoin that it was running a Ponzi scheme, Bitcoin investment platform BitConnect announced it was closing the company's cryptocurrency exchange and lending operation after receiving two cease-and-desist letters from state authorities for the unauthorized sale of securities and suffering from denial-of-service attacks.

In addition to offering cryptocurrency exchange services, BitConnect offered to let people receive interest on their digital coin balance by lending or investing their capital.

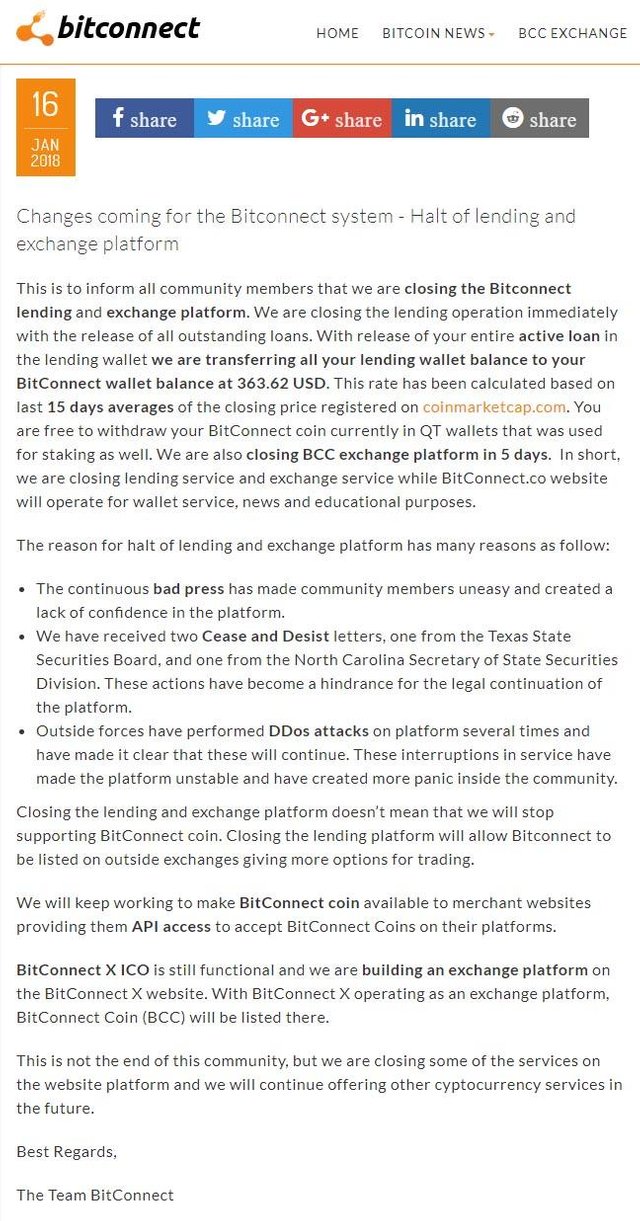

In a blog post – titled "Changes coming for the Bitconnect [sic] system – Halt of lending and exchange platform" posted on its website, the company said that is "closing the Bitconnect [sic] lending and exchange platform."

It concluded that "This is not the end of this community, but we are closing some of the services on the website platform and we will continue offering other cyptocurrency [sic] services in the future."

Both the Texas State Securities Board and North Carolina Secretary of State Securities Division warned that the firm isn't registered to sell securities in those states, the company said on its website Tuesday. BitConnect offered to let people receive interest on their digital coin balance by lending or investing their capital.

According to the statement, the company will "continue offering other cryptocurrency services in the future." The questionnable BitConnect X ICO – which was explicitly named in a cease and desist letter served by the Texas Securities Board – will remain "functional." As Bloomberg notes, BitConnect's token, BCC, was among the world's top-20 most successful tokens until its price plunged 65 percent since Jan. 3, as the states announced the actions.

Launched a year ago, the coin still has a market cap of over $200 million, after taking a massive dip to $33, ot -87%, as per CoinMarketCap. By comparison, its value fluctuated around the $425 mark less than 10 days ago.

In addition to its legal trouble and inability to protect itself from continuous DDoS attacks, the company blamed the closing of its lending and exchange services on "bad press." That is despite the fact that most of this bad press circulated around the severity of their legal troubles.

According to the Next Web, prior to the closure, "the shady Bitcoin investment scheme was mired in a litany of legal troubles, including cease and desist orders from the UK in November, as well as two more from from the US this month – one from the Texas Securities Board and one from the North Carolina Securities Division."

Leading up to the announcement, BitConnect promoters suddenly began distancing themselves from the project. Coincidentally, the website was struggling with a series of server downtime – all of which began shortly after the cease and desist orders rolled in.

News of BitConnect's closure, which were specific to what many had deemed a "shady business" hit on Tuesday afternoon and were widely anticipated by many in the business, and hit around the time the wave of cryptocurrency selling accelerated, briefly dragging bitcoin below $10,000.

It is unclear how much of the broader selloff was catalyzed by the news of BitConnect's woes , but judging by the sharp rebound in bitcoin and its digital currency peers in the past hour, the market appears to be re-normalizing slowly, realizing that the crackdown against BitConnect is not a broader attack on the cryptocurrency space but merely removal of some of the better known "bad actors."

Sad for the victims of this scam, but good for crypto in general. It had to happen one day and better now then later. After this downturn stops we can go on in a way healthier environment

I think a secondary benefit is that all the people who were pushing this scam are having their reputation destroyed by this too. Hopefully people will not take there advise next time they start pushing a scam.

Who would take investment advice from someone who are proven to promoted scams? The internet never forgets : )

I agree it is a good day for crypto since this was a ponzi scheme that needed to go down.

As for the victims, I am not sure I feel sorry for them. I witnessed a number of debates on here with people defending bitconnect claiming it wasnt a ponzi scheme in spite of being shown that it most likely was.

It is hard to defend someone like that as being a victim. If one chooses to ignore something, isnt that on them?

I kept hearing about bitconnect being shady, turns out to be true. In these early days of crypto I think it would be wise to heed people's warnings about certain coins/companies, there is so much room for shenanigans right now. Still feel bad for any newbie innocents that didn't catch word

You're so nice for commenting on this post. For that, I gave you a vote!

Awwww @rewardpoolrape, I'm lovin it.

Also, I agree it is easy to abuse the reward system, do you have any recommendations for lowly minnows on effectively using flags? I think we are in a situation where people are afraid to use flags because they fear making enemies with whales

I think there are two types: The promoters who earned on affiliate commission by bringing others in and for them I am not sorry at all. But a bigger group are people who believed these scammers and for them it is sad. Lets hope they learned, education can be expensive.

I appreciate your comments @michiel

I think a secondary benefit is that all the people who were pushing this scam are having their reputation destroyed by this too. Hopefully people will not take there advise next time they start pushing a scam.

Who would take investment advice from someone who are proven to promoted scams? The internet never forgets : )

This is one of the stains on the crypto industry although this has nothing to do with crypto....there are ponzi schemes in many different asset classes. Sadly, there were many on here defending bitconnect when the evidence pointed to it most likely being a ponzi scheme.

This could be one of the turning points in the crypto world although the feds might use it as an excuse to crack down with regulation.

This most certainly will be used by regulators for further crackdowns, they will be like - we are here to protect you, have you heard of bitconnect?

Sad, this will give sceptics a reason to be vocal.

I think they will use whatever they can to regulate the industry, they might not even give a reason

@zer0hedge...ho its really a bad. Situation for the who invest in the bitconect..i think this bitconnect running from the last 2 years with a good profits intitially we need to invest the 100 usd and they give a daily basis intrest 1 t0 2 % based up on the trade..its a good to investors..but present the decisions taken by them is really a sad to here to the all investors..they need to lose more amount ..from 1 week onwords tottally crypto field is crashed because of the uk and usa tradings stopped ..by the yesterday only total 50 % rates was down and total in lose state and traders also not investing any thing in the coins...thank you for sharing information with us....

Yeah bro bitconect did a very good job in the last 2 years but it is destination for them.

It's very unfortunate that there are many people who will see their investment go to nothing. Yes, they gave back people's investments. However, they gave it back in their worthless BCC. Prices were ALREADY tanking at that point. ALSO, people were having difficulty accessing the website amidst the plummeting prices.

Let's further backtrack and look at this correction in general. I've seen several articles where people were taking out MORTGAGES just to purchase Bitcoin. This is one of the numerous reasons why you do NOT do that. This market is volatile and ONE thing could trigger a massive chain of events that leave MANY people in a worse position than when they entered.

I still don't understand their reason for shutting down. Could they not feed the people at the top of their ponzi? Why would you cite bad press as a reason for closing, but continue your ICO which virtually has the same name as the platform that received bad press!? What's your take on this @zer0hedge?

Please invest only what you're willing to use, and do your due dilligence!

-Y.D.H.

Perhaps they are just beating the feds to the punch @brokecollegegrad.

They see the writing on the wall....the horses were starting to close in..it was only a matter of time.

Perhaps now they can flee.

As for people taking out mortgages to by crypto, that is stupid. So is using credit cards, lines of credit or HELOCs.

Only use what you can afford to lose.

I hate to say it, but there's still 0 evidence that this was a ponzie scheme...

It just seems like such a successful business model that the State went after them and forced them to shut down by any bogus means they could sum up.

DDOS attacks? By who?

I still think these guys who created Bitconnect were great, but maybe just unable to take on the Rothschilds... I don't blame them, many have tried and failed too.

Don't be surprised the State closed this down.

The State closes down any competitors it has.

Bitconnect was a direct competitor to the Wall Street Goldman Sachs Loyd Blankfein Trading Bot Market Rigging Casino Gulag model of International Finance.

No wonder they closed it down.

What makes me mad is that so many peope are willing to knowingly drag you down in this ponzi scheme for their own benefit and they call themselves "blockchain adoptors" , some of the best known public figures related with crypro are advocates of this shit, called bitconnect - this will hurt the crypro-community in the short term.

As my boy Suppoman tweeted yesterday - BIT-GONE-NECT!

BitConnect’s lending service will be shuttered, effectively immediately, while its exchange platform will close in 5 days, according to a post on its website published Tuesday.

“In short, we are closing lending service and exchange service while BitConnect.co website will operate for wallet service, news and educational purposes,” the post explained.

The announcement blames a myriad of factors, perhaps most notably the cease-and-desist letters issued in recent days from regulators in Texas and North Carolina.

Both letters stated that BitConnect was engaging in the sale of unregistered securities tied to a token sale.

It is good that the Ponzi scheme was shut down and I do feel a bit sorry for the people involved because I think they were just trying to ' get rich quick ' without really knowing what all the hype was about. If I am honest up until about 3 months ago I was unsure what cryptocurrancies were all about and then to find out there is more than one and how you can earn them - to the normal everyday joe it can be confusing. There is a saying however that says ignorance is no excuse, the information is out there if you look for it which clearly these people did not

It's awesome to see a slight rebound for the other coins. There are definitely a few bad apples out there, I think the more we as a community (including reddit and other forums discussing crypto) crack down and get word out about these shady coins/companies the better off we will all be. I feel like we are all kind of watching eachothers backs and wanting crypto to succeed as a whole because we believe in it. Sometimes that requires some pruning...

It's about time this scam got shelved. I wonder if there is anyway to short the coin that is still trading as surely this will go to zero sooner or later.