Cease and Desist order in Texas regarding Bitconnect, Scam or Not?

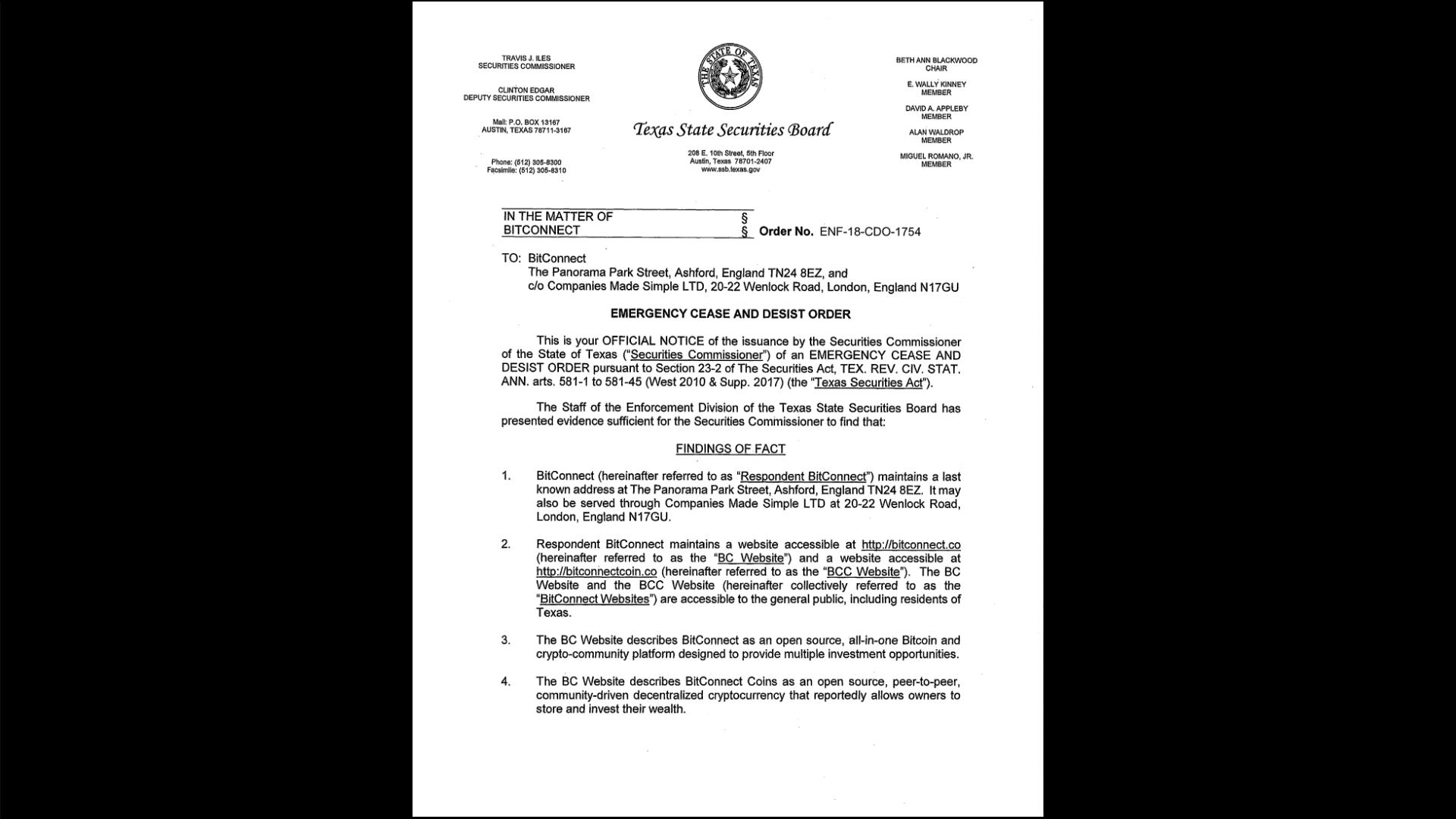

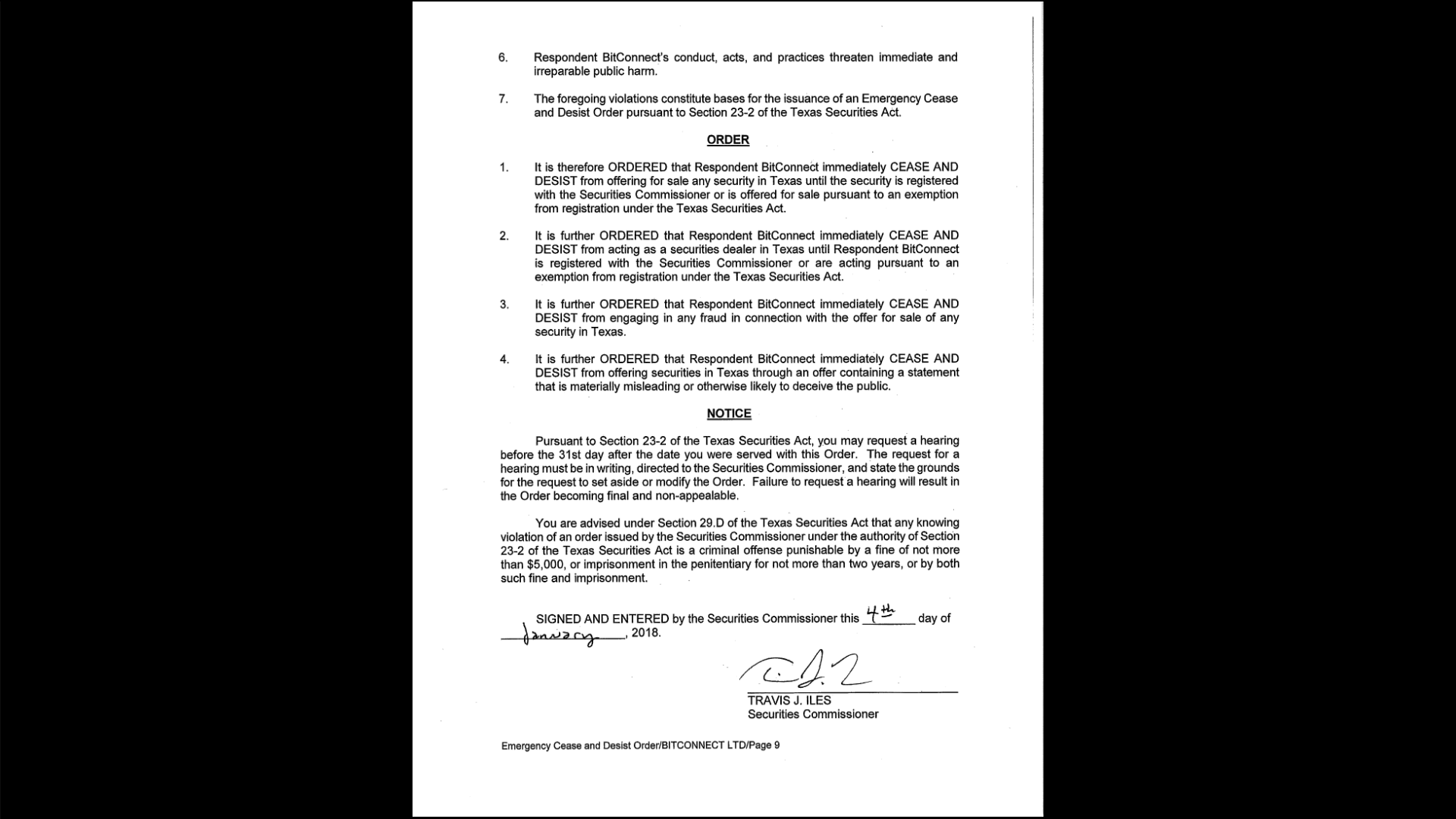

The Texas Securities Commissioner issued an Emergency Cease and Desist Order on Jan. 4 against Bitconnect for the selling of unlicensed securities. According to the Texas State Securities Board news release:

“The Securities Commissioner found that the BitConnect investments are securities, but were not registered as required by the Texas Securities Act and State Securities Board Rules and Regulations. In addition, the company is not registered to sell securities in Texas.”

British company, Texas ruling

As the release clearly states, Bitconnect is based in England and this order does not affect the company directly. However, the regulator does have the authority to ban Bitconnect from dealing with Texas residents. Of course, it is likely to be quite challenging for the company to separate users of Bitconnect tokens in Texas from those in the rest of the world.

Damning commentary

The Texas regulator harshly condemned Bitconnect, writing:

“BitConnect has disclosed virtually nothing about its principals, financial condition, or strategies for earning profits for investors. It has not provided a physical address in England.

“Despite providing no information on how it will make money for investors – including the algorithms behind the Trading Bot – BitConnect is touting its investments as a “safe way to earn a high rate of return.”

“Investing in cryptocurrencies, however, carries significant risk because of regulatory and legal actions, competition from other cryptocurrencies, and the extreme volatility in the price of many cryptocurrencies.”

“The company operates websites and deploys online advertising to recruit sales agents, which it calls “affiliates.” The company provides marketing material to affiliates, including online presentations, and pays them commissions for referrals that result in investments in BitConnect programs.

Sales agents for BitConnect are targeting Texas residents, as well as residents of other states, through websites, social media, and online marketplaces like craigslist.

The sales agents are not, however, registered as agents of BitConnect to sell securities in Texas.

The Securities Commissioner’s action follows BitConnect’s recent announcement that it will hold an Initial Coin Offering (ICO) in the U.S. on Jan. 9. Companies use coin offerings, also called token sales, to raise capital.”

While cryptocurrency enthusiasts have been largely focusing on regulation at the national level, Texas’ ruling shows that sub-national regulators can easily affect the regulatory landscape. This adds an extraordinary level of complexity to regulatory compliance. Cryptocurrency users and businesses may find themselves dealing with countless state and provincial regulators, in addition to national authorities, if other jurisdictions follow Texas’ lead.

The order seems justified given the information about the company or lack of it. Of course the Texas authority has no jurisdiction over a company based in the EU, or the UK in particular. Nevertheless, EU law specifically requires that companies provide the information that the Texas authority points out is completely missing. Hopefully the corresponding UK authorities will take up the matter, but I strongly suspect we are going to have a lot of bad news over this issue in the next few days.

This highlights the need for investors to closely examine potential investments. I have noted that many ICO proposals are sadly lacking in critical information of this nature. I have been particularly alarmed by ICO proposals involving property investments that essentially say that in the event of winding up the enterprise all assets become the property of the founders, to be disposed of as they please.

Buyer beware remains a constant in any financial relationship.