The BitConnect Whitepaper - Maths of a Ponzi

BitConnect has no whitepaper, so I decided to draft one for them.

An Introduction to Absurdity

From my last video, I was especially surprised at the number of people on YouTube and Steemit who are still on the fence with bitconnect. Some people, who are heavily invested are defending it. I think it is hard to have a clear head about it unless we have something concrete to look at besides subjective evidences. To this point, I will do math and analysis of the BitConnect system.

Since May 26th, 2017, a person who deposited a loan of $1,140 would have received $871.81 in earnings up through August 3, 2017. This is 69 days, with an average percentage paid of 1.1% a day. This is data, pulled from the system, without using reinvesting or referrals.

A lot of critics of BitConnect, I will say you have not done your research and are ignorant. BitConnect's popularity is that this ponzi permits you to withdraw that money. The full $871.81 was available for withdrawal from BitConnect's system. When you go on and on about how only people who do referrals are making money with the system, while this is partially true, I have no doubt that there are pure lenders with no referrals who are sitting in the green, especially if they started in early May. Arguing from ignorance does not help convince people.

So then, what is wrong with BitConnect? Let's do the math on the data above. A lot of people say BitConnect pays 0.9% interest daily. The hard data above taken from their system proves otherwise. However, that loan was above 1k, which adds another 0.1% daily interest to the loan. Many loans in the system are paying an additional 0.1%, 0.2% and 0.25% above the standard rate. Due to this, for the sake of this analysis I will just use a flat 1.0% interest rate. It is perfectly reasonable considering the hard data above demonstrating it is exactly 1% since May. This ignores all the people will higher-tier loans that will throw this over 1%. Let's get to the numbers then:

The Numbers - Compounded Weekly on $10,000 initial investment

10k invested in Bitconnect, in 1 year, compounded weekly interest provides: $337,253

10k invested in Bitconnect, in 2 years, compounded weekly interest provides: $11,373,990

10k invested in Bitconnect, in 3 years, compounded weekly interest provides: $383,591,803

10k invested in Bitconnect, in 4 years, compounded weekly interest provides: $12,936,767,066

There are 1,826 billionaires in the world, but lookout world, the infinite money machine BitConnect was invented!!! Here come thousands of people into your ranks!

10k invested in Bitconnect, in 6 years, compounded weekly interest provides: $14,714,267,184,649

Those are trillions. BitConnect then will be the system to create the world's first trillionaires in just 6 year's time... or it is a ponzi just like I have been saying.

The Numbers - Compounded every 2 days on $10,000 initial investment

On $10k invested, a person can compound interest daily because they will receive $100 per day in interest. The minimum to reinvest with BitConnect is $100. Now there are days where you would not be able to compound due to the low payout on some days. Yet other days have payouts well above 1%. Therefore, I will compound interest every 2 days for this analysis.

In 3 years, they will have $500 million dollars.

In 4 years, they will have $18 billion dollars.

In 10 years of using this amazing trading bot, they will have $49 quintillion dollars.

The entire US Housing Market is worth just $30 trillion dollars. I anticipate a bought of hyperinflation due to the BitConnect wealth creating system!

Absurdities aside, let us delve further into this ponzi.

The BitConnect Whitepaper - Maths of a Ponzi

This part of the post is conjecture, but it is good conjecture because often the best solution to a problem is the easiest answer. If we want to know how BitConnect has kept this amazing ponzi operational, and how it may continue to operate going forward, this is my proposal on how the system operates.

Part I - Reducing Circulating Supply

This picture shows the basic mechanic of the ponzi:

Bitcoin buys BCC, and BCC gets put into lending as "Dollars".

... What a minute!?! Where does BitConnect exchange the BCC token you lend them for US Dollars?

The dirty little secret of BitConnect's system is that they likely never exchange your BCC tokens for dollars. They just keep hanging onto the BCC token. If BitConnect wanted to truly exchange the BCC you lend them back into US Dollar fiat, they would first have to sell those BCC tokens on their internal exchange for Bitcoin, and then exchange the Bitcoin for fiat dollars. This would create 2 expensive transactions for them. Furthermore, it is in their advantage never to do this exchange back into Bitcoin or fiat.

If you buy 10 BCC tokens, give them to the lending bot ponzi, and the lending bot ponzi sells those 10 BCC tokens for Bitcoin, the net market affect is very minimal to the upside, but basically neutral. 10 tokens were bought, held for a short period of time, and then 10 tokens were sold. In math terms, we might say: 10(bought) - 10(sold) = 0

This is the key to their ponzi. If only some of those tokens are sold by the lending bot, this creates a net drain of BCC tokens on the market. 10(bought) - 5(sold) =5(tokens removed from circulation)

People who understand economics, and the supply and demand curve, we know that if you reduce supply of something, this generally favors increasing prices. This is especially the case if the underlying asset has true demand. Demand for BCC tokens for their lending system, combined with ever decreasing supply, favors an increase in price for BCC tokens.

Unlike many other cryptos that operate on boom and bust cycles, BCC has not operated in this manner. The worst bust cycle it faced was going from $11 USD to $5USD during April. In fact, BCC tokens for this chart period beginning on January 20th, 2017, have seen an increase from $0.14 to $77 USD per token. This is an increase of 550x or 55,000%.

Now I will use my original loan example, but rather than describing it in terms of USD which the BitConnect system never uses, I will describe what occurred in terms of BCC tokens which describes the reality of the situation actually happening.

Ponzi with Tokens Model

On May 26th, 75 BCC tokens were deposited into the lending wallet.

During the period up through August 3, "lending earnings" of $871.81 were accumulated, but if we describe these earnings in BCC tokens withdrawn today, and not dollars, only 11 BCC tokens were earned!!!

When we describe this situation in the fictitious dollars example, the year-to-date return on investment would be 76%.

When we describe this situation in terms of the tokens, which is the real situation, year-to-date return on investment would be only 14%. Now certainly, the earnings could have been withdrawn sooner, but had they been left in the lending wallet, this would be the actual situation as of today.

With BitConnect's token magic, 1% daily return transforms into 0.2% daily return in this example.

This means, by limiting BCC coin supply while driving more and more people to the system, this creates a drastic net-demand with ever reducing supply of BCC tokens, forcing the price of the token higher. Then as they are "paid earnings", they receive back a much smaller amount of the tokens initially invested, than the quoted 1% rate.

What this mechanism does, is that it delays the inevitable, and keeps the ponzi going far longer than it otherwise could operate if they truly held USD fiat in the lending wallet.

As long as the net token supply is reduced, the BitConnect operators are content to drain some of those funds to pay affiliates and pay themselves. Meaning, for every token invested, a certain percentage of those tokens are never resold but sit accumulating in the BitConnect system, continually reducing the supply.

Part II - Closed Market Manipulation

90% of all BCC tokens are traded on their internal exchange.

This gives the operators much power in terms of decision making, and legitimate traditional models of trading and manipulation of markets. For example, it may be they have procedures on how to assist the market in going higher.

Certainly, when they issue sell orders for the % of BCC they are willing to sell, they are issuing that as a limit sell order, forcing people to bid-up in order to tap into their token reserves. If they move their bar higher, eventually people will have to pay those higher prices to get their BCC tokens into the lending system. It could also be that they are willing to use outside pools of bitcoin to prop up prices at key moments in trading, it probably is not needed, but it is certainly doable.

Part III - The House of Cards

As an ingenious as this ponzi system is, for making it look like we are getting rich when in fact it is all due to the limiting supply of a token, there comes a breaking point in this model.

There comes a juncture where compounding interest overwhelms price appreciation of the BCC token.

If we analyze a situation without compounding interest, we can assume the following:

$10,000 invested over the period of 1 year at 1% daily interest, should produce a return of $36,500 interest earnings. We need to add the initial investment to this as well. This would be $46,500, available for withdrawal at the end of 1 year, in a simplified example case.

To invest 10k today, we would deposit 129 BCC tokens. To withdraw exactly our deposited tokens at the end of 1 year, the price of BCC would need to be $46,500 / 129 = $360 per token. However, it would need to do better than that simply because of referrals and other payouts BitConnect internally takes. $360 per token in 1 year would put the total market capitalization of BitConnect's token at 2 billion. This would be needed to repay holders if everyone invested according to this behavior.

That said, if investments are compounded as many people have started doing, the situation for BCC becomes dire.

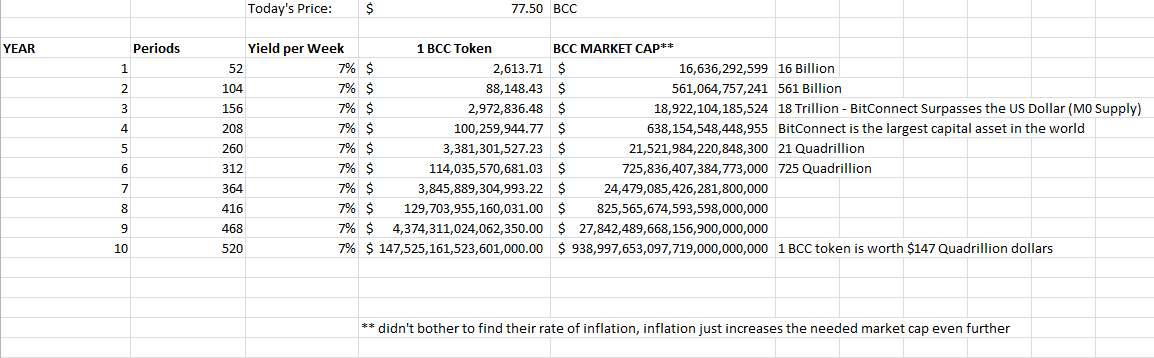

In the weekly compounding of 10k I gave above, we know that the full balance after 1 year would be $337,253 (including principal). The catch here is that the person compounding, could not withdraw that $337,253 from the system immediately. Such withdrawals would be spread out over the course of another 300 days. Therefore in the 1 year plus the 300 days of divestment, the price of the BitConnect token would need to be: 337,253 / 129 = $2,614 This would permit them to withdraw their balance, while that balance being exactly the same number of tokens they originally invested.

At a price of $2,614 per token, with 6,365,000 coins in circulation, the market capitalization of BCC becomes 16 billion. Unlikely, but doable.

If we take this same model out 6 years + 300 days of divestment: 14,714,267,184,649 / 129 = $114 million per BCC token.

6,365,000 coins X $114 million per token = 725 TRILLION

Within 7 years time then, the market capitalization of BitConnect needs to reach 725 trillion for there to be any hope of recouping funds invested.

Sustainability Goals for BCC Token

From this sort of analysis, we can create a financial model, to model the prices BitConnect aught to reach to have any hope of maintaining eco-system sustainability.

BCC has met its sustainability goal so far this year by growing 55,000%. It needs to continue this level of expansion going forward and overtake all other cryptocurrencies to be a long-term sustainable ponzi. The growth continues on into absolute absurdity where BCC token surpasses the US housing market in 4 years.

Part IV - Why is there no trading bot?

All investments entail risk. BitConnect offers 1% average daily return with zero risk. There is no clause where the bot has a bad day and you lose 5%. This never happens.

All investments have thresholds of capital limitations. If I enter an order to buy $50 million dollars worth of Bitcoin on the market, do you see the problem? $50 million bought rapidly in bitcoin would move the market for bitcoin, increasing the price of bitcoin on the exchanges. The point here is, maybe an amazing bot could produce a solid daily return. Then as it gets more and more millions fed into it, that bot will produce a lower and lower return. As it tries to buy that $5 mil chunk of bitcoin with the latest money move in their system, the bot would move prices higher on the markets. Then people would sell against its order, and the bot would be sitting on losses. When you invest a small amount, big things are possible, as you invest millions, your possibilities of what you can do dwindle greatly. Orders take longer to fill, you do not get to be as nimble with your money as day-traders are. You become the wale, instead of trading off the waves the whales make. If BitConnect's bot was real, it would have started producing diminished returns due to this phenomena in trading. Rather, if anything, returns have increased, combine this factor with zero risk which a real bot does not have and we see the problem.

The absurdities outlined above are the final say in how a trading bot cannot produce 1% daily returns on average. It violates economic laws. Their model only works when you take a very small crypto, and let the price spike 55,000% on exchanges. This has occurred so their model has been sustainable. Now, as time goes on and BCC fails to increase 55,000% every half year, their token ponzi fails. Money invested will not be available to divest, since the BCC tokens divested will be insufficient to pay the balances of the compounded interest in the lending wallets.

UPVOTE - RESTEEM - SHARE - TELL OTHERS

BCC existing does not bother me too much. The 101 people lying about hard facts is what bothers me. That 50% of the people in the comments section are deceived bothers me. There is nothing to be deceived about, math is math.

KEYWORDS:

Bitcoin Ethereum Ripple Monero Steem Steemit DASH BTC ETH XRP XMR BCC BitcoinCash BCH BCC Bitconnect cryptocurrency analysis trading make money online investing ponzi scheme scam alert information EOS Smart Contrating trading bot blogging lending bot volatility trading bot bitconnect review best investments online

One of the best articles regarding bitconnect. The problem is people lose their judgment when it comes to earning money. Greed is very powerful. Soon a lot of people with 6 digit accounts will realize how fast money can dissapear.

You got my vote and a resteem :]

Awesome post with a lot of example than you :)

I use bitconnect and I know it is a ponzi scheme. It was clear when I started;by now I almost got my investment back, havent compounded at all. From next week I wont even care if they go bust or not and that will be the moment I will start compounding.

Anyway, if theyre going to achieve their roadmap objectives this month it will give them another boost; it is unsustainable though.

Although I use it, I do not promote it at all, I dont feel comfortable with that, it's one thing to gamble my money, different thing alltogether to tell a friend to put their money in; so I am at 0 refferals.

Thanks for the math. Too bad I havent held on to the bcc I initially purchased, that would have worked out way better for me.

" Yeah so I supported this ponzi scheme to get free money and I know people are gonna lose money but don't care about bag holders because I got my money".

That's why the justice system goes after ponzi schemes.

Suspension of ethics is just too easy for our brains.

Yeah I just realised it's way profitable to transfer all your earnings to bcc, and price is soaring now. I'm also going to stop in investing anything once my profit reaches the original investment. But I still have a month to go... :D

I'm almost there with getting my investment back; for about a week now I stopped taking the interest out as BTC and just kept it in BCC and with the soaring price that made quite a bit of difference. I have to be honest, the site being unavailable most of the day today made me feel a bit uneasy :D

Yeah.. the site will be down spontaneously. And no one even mention it on twitter or blog. Hmm I really wonder how long this scheme can last. :D

https://coinmarketcap.com/currencies/bitconnect/ you called it! crashing hard right now.

hahaha , all such people remind me of creatures who try to explain away their Creator. They try to use all their mental ability to try and explain away something as infinite as the human heart. In layman's terms what I'm trying to get across is there are people who live now and believe now, then you get those who make excuses for now and are also dead now, even though they live now.

Once again crypto-investor bringing Light into darkness, I just want to tell you that you opened my eyes in the last post specially. I was seriously considering an investment in Bitconnect, big for me, and as a believer of Jesus I felt conviction, and as you said I chose to repent for myself. This type of business structure is very profitable at first, just like many temptations, but then it becomes painful and brings tears to people... once again my sincere Thank You

I am glad it helped.

Maybe we can make a Sin Coin that can absolve you of your sins, a blockchain for cleaning Karma or Sin from your Soul, Gods Blockchain on LambSkin to record who gets into heaven!

I think there are many ways to invests, cryptocoins which are a little "ponzi-like" - they would face immediate defeat if there are no further investors. But Bitconnect is pure absurd! The numbers make it so obvious but some people are soo gready they can't see properly as soon as they realize other people make easy back. I'm staying out of it! I think 2-3 more months and it's gonna collapse.

That's what you get for thinking. It will not fail until BTC becomes stable. They have made way to much money off the surge in BTC price currently. It has many months to go before the impending implosion.

Excellent analysis as per usual @crypto-investor I definitely agree with your views about capital limitations. As the level of capital rises, it gets much harder to produce higher level of returns. From reading a interview with Warren Buffet a few years ago, I remember him saying that it's quite possible to earn 50% a year if you're a smaller investor. However, it's nearly impossible to do that with Bershire Hathaway's current size. Likewise, it should be more difficult for larger companies, mutual funds, trading bots, etc. to earn higher returns as they grow in size.

Niiice. We need more people talking about it. tip!

lol. I'm still on the fence. I can't rap my head around 1500% growth but that's on par with the other cryptos. Guess I'll wait and see now that bitcoin has shot up unless I throw in more $ my crypto is spread out everywhere I want it. Except maybe bit connect lol.

Small cryptos have no problem growing 55k %. That growth stalls when a certain market cap is reached. Bitcoin from 2015 to 2017 grew from $200 to $3000. This is only 15x growth. It gets harder to go up the bigger you get, basically. Many smaller cryptos beat that 15x growth all the time, bitcoin's hands are tied though because it is larger. So with bitconnect it is unreasonable to conclude it will surpass the US housing market in market capitalization.