Bitcoin Hashrate Has Been 7 Times Higher Than The Critical Historical Moment, Signaling The Prospect Of Price Hike

Bitcoin once again made good use of the support line in the $ 7,800 area to avoid bearish pressure. Up to now, BTC has had the same move in the 5th week in a row. With prices returning more than $ 8,300, an upside reversal has begun to appear.

In all of this, the main data on the reliability of miners also offers a bullish outlook for assets in the medium and long term.

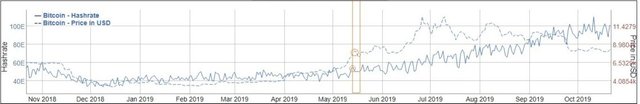

Hashrate, which is an indicator of the level of mining activity on the Bitcoin network, is up 700% from the corresponding figure in mid-December 2017 when BTC reached an all-time high of nearly $ 20,000 / unit.

Price of BTC and Hashrate: Basic explanation

Hashrates are often used as a measure of the miners' confidence in the possibility of Bitcoin taking a long step. The exact nature of this correlation is controversial. Some people believe that the BTC price follows the network's hashrate while others disagree.

In both cases, the relationship is likely to form a positive feedback loop once started, making the origin of the loop somewhat irrelevant for all practical purposes at the present time.

For example, in the BitInfoChart chart, it seems that the mining community's psychology has been closely following the investment community between May and June 2019. As the price begins to follow an increasing trajectory, the next has more hash power.

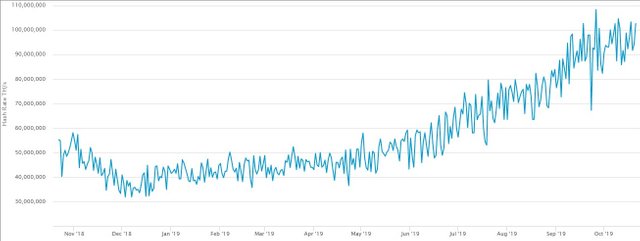

Prices continued to rise sharply in the following months, so the hashrate finally reached an all-time high of nearly 108.5 million TH / s on September 26.

While such trends seem to be miners' reaction to the market rather than a long-term strategic move, they actually act as a useful tool to determine if Bitcoin is heading. Bear or cow.

As BTC began to soar, mining was highly profitable, attracting more miners to join the network. In the end, they have accumulated more Bitcoin than when the market fell.

So now, with more Bitcoin being processed than usual, a lot of miners sell part of the BTC through exchanges. Among other positive effects, this also ensures a higher level of liquidity for the asset. On the other hand, the more Bitcoin is traded in the larger market, the more the price will increase. This further encourages network mining activities, resulting in increased hashrate.

This positive feedback loop continues until an external factor causes the price to fall, thus disrupting miners' beliefs about future profits. The external factor could be anything, from market manipulation to cryptocurrency protests, etc.

Big move is coming?

Returns to the current state of the network. Despite being stuck in the $7.8k - $8.4k range for weeks, Bitcoin seems to have enough confidence in miners to keep the hashrate stable at around 100 million TH/s.

Source: Blockchain.com

This has led many in the community to believe that the motivation to raise BTC price from here can create another positive feedback loop, which can then lead to more liquidity and further price increases.

Disclaimer: This is not investment advice. Investors should research carefully before making a decision. We are not responsible for your investment decisions.