Bullish Bitcoin Futures.

Bitcoin and cryptocurrency markets, in general, have been bearish during the first month of 2018 after many digital assets reached all-time price highs this past December. A lot of people have been following the correlation between the newly added bitcoin-based derivatives markets offered by Cboe and CME, alongside bitcoin spot prices over the past four weeks. Over the last few weeks, most of the bitcoin futures contracts have been bearish as traders forecasting the recent downtrend in value ‘shorted’ the market. However, according to recent data, bitcoin-futures bets are showing that a great majority of the contracts are betting ‘long’ on bitcoin’s price — predicting that BTC’s value will be rising shortly.

CFTC Report: Bitcoin Futures Contracts Are Overwhelmingly Bullish This week.

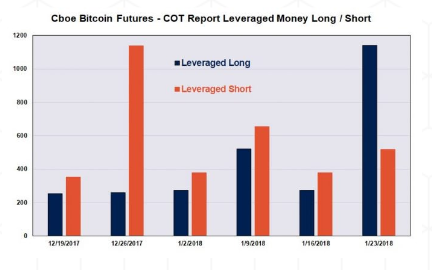

The introduction of the recent futures markets stemming from Cboe and CME had brought a lot of hype and overheated trading to cryptocurrency markets. Following the launches bitcoin’s market value spike to $19K per BTC but since the new year, the currency has seen a 40 percent loss in value. Since the bitcoin derivatives products began, the Commodity Futures Trading Commission (CFTC) has published reports on Cboe’s market performance. Since December the CFTC’s reports show that futures traders were betting against the price of BTC, indicating bearish sentiment and spot prices followed the contract predictions. This past Friday’s CFTC data tells a different story as the contracts are overwhelmingly bullish — meaning Cboe traders expect the price to rise.

This week’s CFTC report states that leveraged positions show 1,142 contracts are ‘long’ (betting the price will rise) while only 518 contracts are ‘short’ (betting the price will drop). The data is in stark contrast to the weeks prior when Cboe contracts bet way more ‘short’ as contract counts indicated shorts overwhelmed longs 4 to 1. Even news.Bitcoin.com’s weekly trading analyst, Eric Wall, has the same inclination as he writes in his most recent report:

‘Shorters Prepare to be Routed’

The columnist Miko Matsumura from the Evercoin blog recently wrote how he believes individuals who short bitcoin markets should be prudent — especially those who don’t have ‘skin in the game.’ For instance, Matsumura says that most futures traders especially the ones trading Cboe and CME products are all just “speculators” who just see the price action. Most don’t understand that the limited downside to shorting is there’s a lot of believers and individuals who see a buying opportunity during price dips, Matsumura adds.

“Where those who short bitcoin are weak because they don’t actually believe in the value of Bitcoin — This means that many of them think the value can “go to zero” — What they don’t see is an army of HODLers, and a mass of people who can’t wait to get into bitcoin at massively discounted prices,” explains Matsumura.

Individuals who try to short bitcoin can lose their shirt if they don’t time their predictions right.

Matsumura’s example can be confirmed by recent investors getting burnedtrying to short GBTC’s stock and the millions of dollars liquidated from Bitmex, Bitfinex, and Okcoin traders trying to bet against bitcoin’s value every day. At the moment most leverage traders are betting long across traditional crypto-exchanges. Bitfinex leverage positions today show 26,982 long contracts and only 18,226 short consignments (59%L – 40%S). The recent CFTC reports documenting bitcoin futures contracts held on Cboe indicate traders are also not willing to continuously bet against bitcoin — And this week mainstream bitcoin derivatives traders stemming from Cboe are predicting a bitcoin price reversal is imminent.

What do you think about futures contracts overwhelmingly betting that bitcoin’s price will rise? If you were to bet right now how is your current outlook towards the price? Short or long?