Why was Bitcoin Cash Created?

Bitcoin Cash was created to bring back the essential qualities of money inherent in the original Bitcoin software. Over the years, these qualities were filtered out of Bitcoin Core and progress was stifled by various people, organizations, and companies involved in Bitcoin protocol development. The result is that Bitcoin Core is currently unusable as money due to increasingly high fees per transactions and transfer times taking hours to days. This is all because of the problems created by Bitcoin Core’s blocks being full.

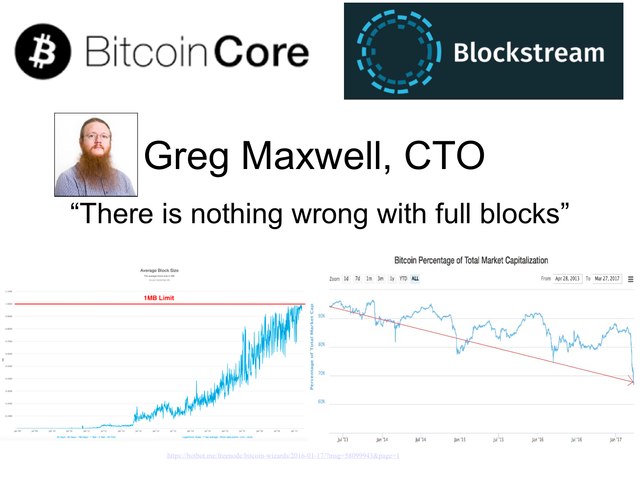

Bitcoin Core developer and Blockstream CTO is one of many “experts” who considers a slow, expensive network to be ideal

Basically speaking, “blocks” are groupings of new transactions that are added to the blockchain. In Bitcoin, transactions are processed block by block. Bitcoin was designed to target 6 blocks per hour, or one every ten minutes. Years ago, an artificial limit to the size of blocks was added to the Bitcoin Core code to prevent a possible attack vector where a mass number of transactions could weaken the network. At the time, transactions were free to make, so an attacker could send a huge number of transactions between his own wallets, forcing everyone else on the network to download and store large amounts of data. The block size limit was arbitrarily set at 1MB (i.e., the size of storage offered by a floppy disk from the mid-1980s). At the time, this was still thousands of times higher than the actual usage of the network demanded. It is clear that the block size limit was never meant to stifle growth of the network, but merely to defend against a theoretical attack vector.

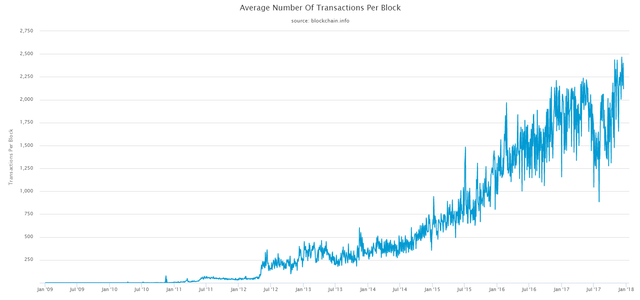

User adoption of Bitcoin began slowly, and it wasn’t until 2012 that the blockchain was processing 250 transactions per block, or approximately 1,500 transactions per hour. It took two more years for this number to double, and by 2014 the Bitcoin network was processing 500 transactions per block.

Today, the Bitcoin Core network is at maximum capacity and processes approximately 2,500 transactions per block.

Chart showing growth of transactions/block overtime

The artificially small blocksize led to network congestion as demand for bitcoin transactions has continued to grow. Remember, to be verified and processed, a bitcoin transaction must be included in a block. If blocks are full, your transaction must wait to be included in the next block, but the next block is already full because others paid a higher fee than you, etc. This congestion has led to an ever increasing “fee market” where users pay extra to “cut in line” and move their transactions to the top of the list of pending transactions, known as the mempool. At the time of publication, there are more than 280,000 unconfirmed Bitcoin Core transactions.

To make matters worse, the developers of Bitcoin Core were either unwilling or unable to increase the blocksize to scale Bitcoin with demand. In their own words, the Bitcoin Core developers view this “fee market” and backlog of transactions as a positive trait of the Bitcoin Core network.

This has caused many in the community to create alternative cryptocurrencies as frustration with Bitcoin Core grew due to increasing fees and transaction times taking longer and longer. As a result Bitcoin Core has gone from nearly 100% market share in the crypto space to below 50% at the time of publication.

Enter Bitcoin Cash: A community-activated upgrade (otherwise known as a hard fork) of Bitcoin that increased the block size to 8MB, solving the scaling issues that plague Bitcoin Core today.

A flawed understanding of economics led to the failure of Bitcoin Core and the birth of Bitcoin Cash.