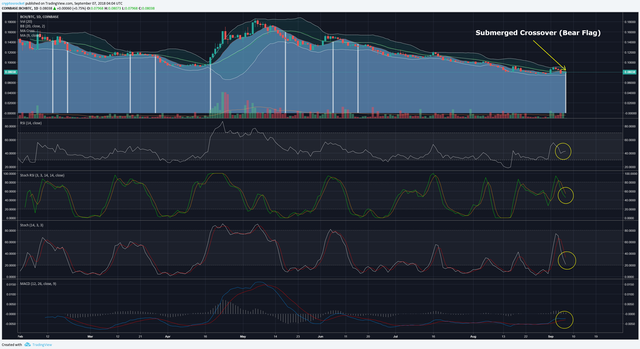

Bitcoin Cash (BCH) Update: Looks Like We’re Going Down A Bit More!

A submerged crossover means that we still have margin to down… in addition, all the indicators in our setup corroborate that.

Let’s take a closer look at each one…

RSI – Since oversold levels have been reached recently, we’ll probably only touch the 30 limit in the subsequent dips.

Stochastic RSI – Clearly indicating a downward trend, confirming the submerged crossover.

Stochastic – Reaching oversold levels soon is very likely.

MACD – It’s getting bullish in the long run, but probably the reversal will be delayed with a few more dives.

The scenario is probably going to be interesting for a jump in soon… it’s worth keeping an eye on. But don’t be in a hurry… always wait for a deeper dip, so you can define your entries more clearly and with a safer margin. Also stay tuned for our future Bitcoin Cash updates.

Conclusion: We can expect lower lows, but a reversal should’t take too long. Another important factor is that the market is usually governed by bitcoin movements… an analogy is the way the moon influences the tide of the seas. Bitcoin pairs act similarly to altcoins pairs… and Bitcoin is following a similar trend to what suggests this Bitcoin Cash analysis, reinforcing the indicators.

DISCLAIMER: None of CryptosRocket content is investment or financial advice. Please do your own research before investing and invest at your own risk. Do not invest more than you can afford to lose and consult a financial advisor if necessary.