BTC Market Insights: Key Levels, Dominance Trends, and the Golden Cross Opportunity

Micro (Daily Timeframe)

BTC's previous high failed to break the Point of Interest (POI).

This is a respected area, often leading to rejection since the POI acts as both a support and resistance level.

Volume profile POI is at 65k (this is the longest volume bar on the right side).

ABOVE = bullish sentiment

BELOW = bearish sentiment

BTC respected the previous key level at 53k.

Key level: 53k to 50k (Expect some reaction when a key level is reached).

High volume bars = Indecision Area.

The positive aspect is that BTC's current price is in the "oversold area," a respected zone where buyers tend to react, as seen in previous dips.

BTC Weekly Dominance at 57%

ALTSEASON WHEN?

It's simple: BTC dominance needs to break the upward slope support around 53% before we can expect a massive pump in altcoins.

BTC dominance is currently at 57%, which is quite high.

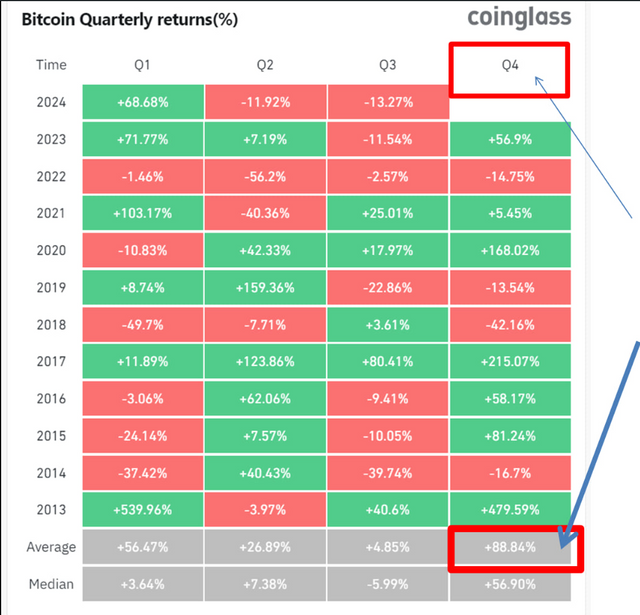

BTC Quarterly Returns (%)

Historically, Q4 has the highest returns in Bitcoin.

Try to hold your coins during this last quarter (October to December) to take advantage of the opportunity.

There's approximately 14 months left in the current cycle, and holding during this quarter is still beneficial.

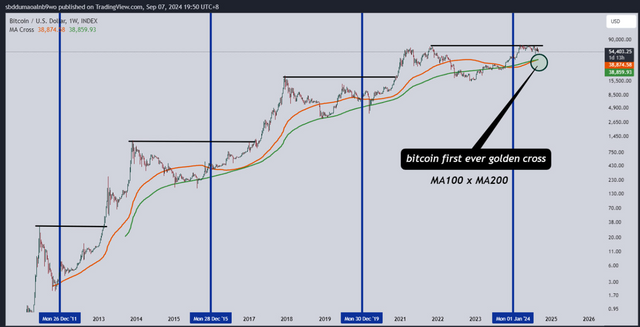

Macro (BTC Weekly Timeframe)

The first-ever GOLDEN CROSS is happening right now. 🚀🚀

Orange line = MA100

Green line = MA200

Reminder: Focus on the macro perspective, stick to your game plans.

If you're not yet confident in futures trading, prioritize learning and focus on long-term strategies to avoid missing opportunities.

The best time to buy was during the previous bear market's bottom; the second-best time is NOW.