What people are missing about the current bitcoin and cryptocurrency evolution

There are still a lot of naysayers out there and now that bitcoin's around $13,000, it’s really starting to get the attention of the public and most still don’t really understand what’s actually going on and why this is happening. Fortunately for you, I do understand why this is happening and I will guide you through the steps so that you can understand what the future most likely looks like.

In case you’re wondering what gives me the authority to say this… I’m a software developer with over 2 decades experience running my own IT company and I have been studying the underlying blockchain technology since early spring this year. I’ve been working with the code directly and have a fair understanding of how it works and have lots of time because I’m semi-retired. I’ve been able to devote nearly around the clock study to this single subject for several months.

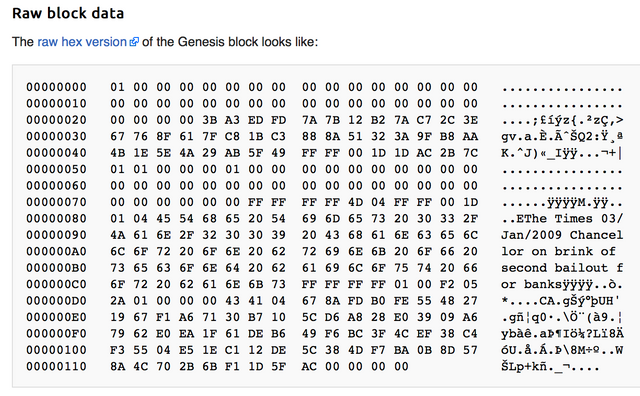

Let me first explain to you that bitcoin wasn’t born in a vacuum. It was released on January 3, 2009 with a statement in the genesis block that hints at a political motivation for its creation and acts as an accuracy check time stamp. That statement reads “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”.

It’s clear that bitcoin was created as a way of disintermediating authority. Technology putting people out of work has been a theme since Alvin Toffler’s “Future Shock” in the early 1970’s, but finally technology has figured out a way to put authority out of a job. This was done by solving the “byzantine generals problem” without the use of central authority. The technology that actually accomplishes this is through the use of encumbrances on a blockchain that distributes network “truth” redundantly using game theoretical algorithms to punish cheaters and reward those who play within the rules.

One of the problems with anything that is in digital form is the lack of scarcity. It is all too easy to create digital copies of something. However, bitcoin cannot be copied because it has encumbrances. An encumbrance is when you have a transaction between two parties and you hand someone a $20 bill and the other party hands you change. By making sure that the exchange is bi-directional and cryptographically signed, we ensure an entanglement that makes it hard to lie in the future about what happened.

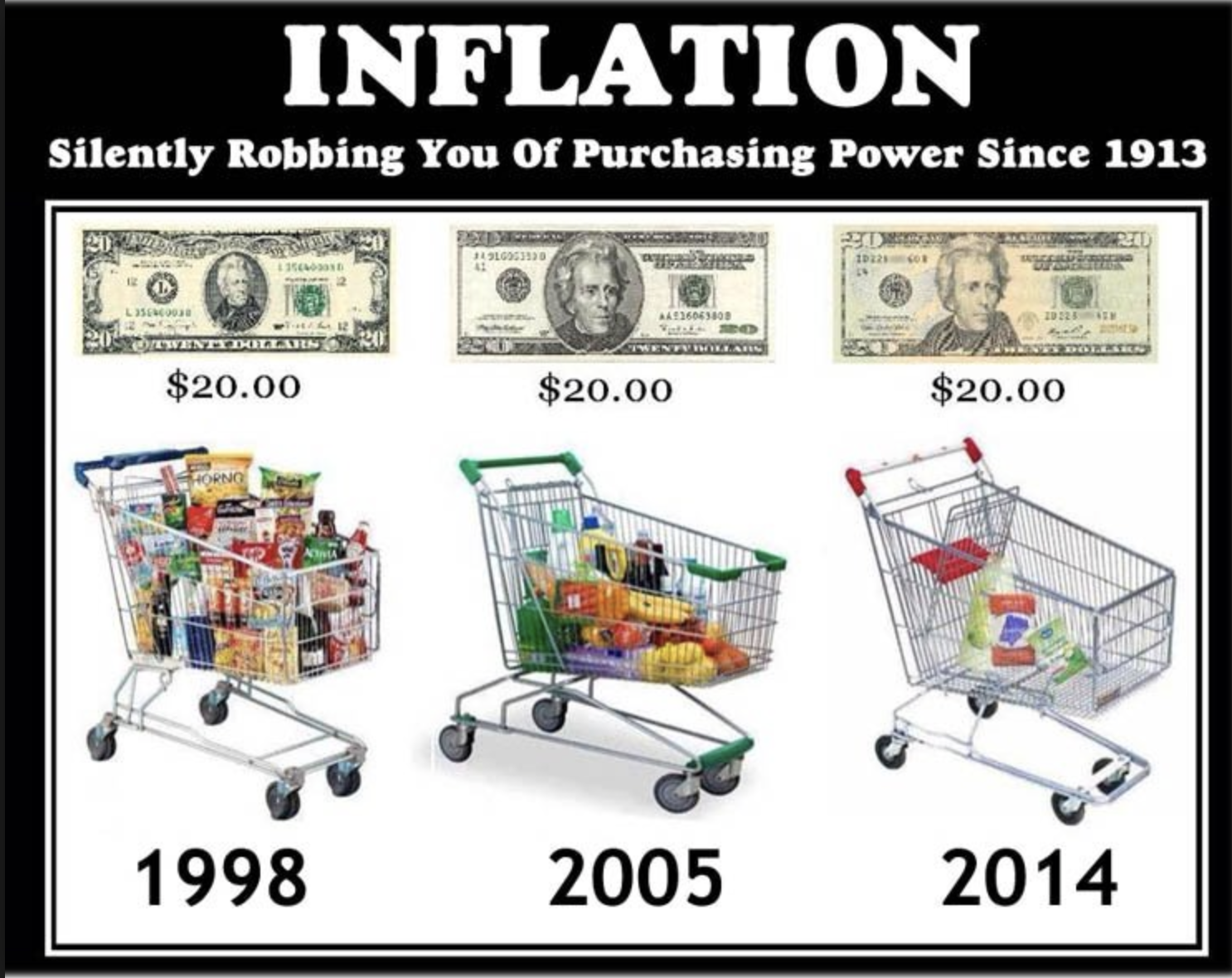

Satoshi didn’t just solve the digital duplication / double spend problem, but he included within the rules a 21 million cap on the total number of bitcoins that will ever be “mined”. This is critically important if you want your currency to have value for the long term. What happens when authority can print up money whenever they want? This…

(Google Images - Wikimedia Commons)

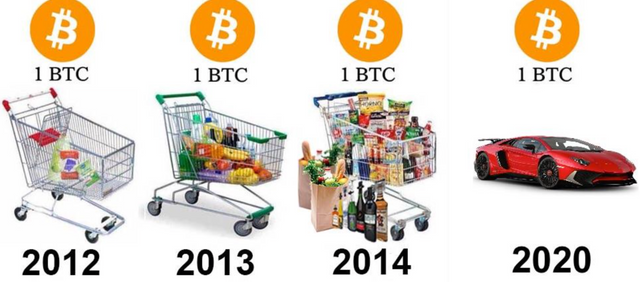

This is what happens when money is limited in value and the GDP (Gross Domestic Product) increases…

(Google Images - Wikimedia Commons)

What do these two images prove? In 1971 Nixon ended the Bretton Woods agreement and took us off the gold standard. The effect this had was to reduce accountability in the political system. How was this accomplished? Because politicians no longer have to go to the people to ask for permission when money is unlimited. They can just crank up the printing press or add a few zeros to the end of the balance sheets. You can’t print up all the gold you need and the same is true with bitcoin which is why politicians hate this form of money.

For example… when Bush 43 was pushing for a war in Iraq by saying that Saddam Hussein was a bad guy, how did he fund that war? The actual cost was put up in the form of debt on future generations. The government borrowed (stole) from Social Security and stuck in an IOU, then cranked up the printing presses later on when the derivatives market crashed in 2008 due to repeal of Glass Steagall by Clinton in the late 1990’s. How do you think it would have gone over with the public if Bush 43 asked “Saddam is a bad guy so we need $75,000 per household, and thanks a lot for supporting the war effort”?

This is why limits on money production are so important. Counterfeiting is illegal for this reason because it passes off the cost on everyone else. Of course it’s OK for politicians to do it, isn’t it? Well they made it “legal” for them to do it, but they realize the consequences are dire for stealing too much from the public.

For this reason, the American public doesn’t realize just how successful the boom in the middle of the 20th century was. But if the GDP was distributed fairly instead of the gradual “quantative easing” reducing our livelihoods then every man, woman and child in the USA would have an average net worth of over a quarter million dollars. Instead, we are all in debt and authority has claimed the vast majority of the gains for themselves.

Now we are in for a period of reckoning. Nations which have had monopoly control over the money supply, no longer have a monopoly because of nationless cryptocurrencies. There is now an exit from this corrupt system and people from all over the world are starting to take this exit.

We have to remember that we in the west have been unusually fortunate for a long time and while we are a long way from what would have been if distribution of wealth had been fair, we still did have improvement in the west compared to the third world. Only about 1.5 billion people out of the 7+ billion currently on this planet have access to banking. Over 5.5 billion people are under banked and at least 2 billion are completely unbanked. The banking system has sacrificed the majority of humanity to poverty in order to create a system of control.

Now authority has been panicking over what is going on with cryptocurrencies because it creates a potential Gresham’s law scenario that will create an equity drain in national fiat all over the world. Articles such as this one are popping up all over the place spreading disinformation. In the future we can expect this scenario to play out...

It looks like for the first time in a very long time, after a period of serious disruption and violence, the use of coercion and violence will be coming to an end and voluntarist principles will then have a chance to spread peace throughout the world.

Donations (public bitcoin address):

3FwxQsa7gmQ7c1GXJyvDTqmT6CM3mMEgcv

Great intriduction to Bitcoin and blockchain technology!

Great post. It really explained a lot and provided really good reasoning. Love the post bro

Exactly my words...

Very well written and expressed. A nice piece to add to my collection on Bitcoins and the Blockchain Technology.

I have a question for you. Over the last two days we have seen not only a spike of bitcoin volatility (from 13,000 to 19,000 on some exchanges and stabilizing around 15500-16000) but also a rise in exchanges inability to maintain servers running. Do you think they will be able to scale to the demand?

I think that market cap will begin to spread out into the altcoins because of the scaling issues. Right now, Steem and Bitshares can do this without breaking a sweat and then EOS (all developed by Dan Larimer) will probably do very well next year. Bitcoin is waiting for off chain solutions such as Lightning Network and Schnorr signatures. Hopefully they will come online soon, but I suspect we could be waiting another year or so. I wrote about this quite a lot over the last couple of months on my blog.

bitcoin is a best in this situation..thanks for discuss about bitcoin.

can i your blog resteemit???

Sure. Thanks!

thanks my dear.

your blog resteemit done..please my profile visit now..

💯 Very informative piece, thanks for sharing this!

were in the dawn of a new era. Im in love with the info and insight you shared within you post. =0 hopefully we've all invested

This post has received a 8.73 % upvote from @boomerang thanks to: @zoidsoft

@boomerang distributes 100% of the SBD and up to 80% of the Curation Rewards to STEEM POWER Delegators. If you want to bid for votes or want to delegate SP please read the @boomerang whitepaper.

This post has received gratitude of 2.16 % from @appreciator thanks to: @zoidsoft.

This post has received a 2.27 % upvote from @booster thanks to: @zoidsoft.