The War On Bitcoin Is Proof Crypto Is Winning

Content adapted from this Zerohedge.com article : Source

It's clear to me now that Wall St. is behind the failure of the New York Agreement. Roger Ver and his championing Bitcoin Cash was used as a stalking horse to destroy Bitcoin's ability to function in the marketplace.

But, it is this very kind of attack that betrays the weakness of their position.

The news of the week is payment processor Stripe just dropped Bitcoin as a means of payment saying the fateful words, "It fails as a currency."

From the post at RT:

"Over the past year or two, as block size limits have been reached, bitcoin has evolved to become better-suited to being an asset than being a means of exchange," the company said in a statement.

That's the bad news.

The good news is that Stripe still believes in cryptocurrencies, just not Bitcoin. The company's statement makes it clear it understands the issues and that other projects may be suitable for future needs, most notably Litecoin and Steller Lumens.

Stripe added that it remains bullish on cryptocurrencies, naming the most promising projects, including Lightning, OmiseGO, Ethereum, Bitcoin Cash, and Litecoin. The company will probably include Stellar cryptocurrency in the list of services it provides.

What becomes immediately obvious is that governments and the banking industry/cartel are fighting a war of attrition against cryptocurrencies. By consistently throwing up roadblocks, perceived or real, to their adoption, they seek to simply slow down their development as a challenge to the existing financial order.

Ultimately, this is a good thing...

First They Laugh At You

Then They Fight You

Then You Win.

Never Attack Down

The establishment never attacks down if it isn't fundamentally threatened by something or someone. It's the first rule of politics.

In 2008, Rudy Guiliani ended his political career by attacking Ron Paul at an early primary debate. In their hubris, they thought they could blind-side and intimidate Dr. Paul by allowing then front-runner Adolph Rudolph Guiliani to grandstand on 9/11 to boost himself to the Republican nomination.

Dr. Paul stood his ground and famously said "NO!" and then proceeded to bring up the concept of blowback. It awoke an entire generation that there was someone running for President who wasn't a complete tool.

Guiliani was soon hounded out of the race and Dr. Paul started the counter-revolution here in the U.S. that culminated in Donald Trump's election in 2016.

Guiliani's mistake was attacking down. In politics, the front-runner has everything to lose in engaging with someone below him in the polls. It's a sign of weakness and insecurity in your lead. By even acknowledging Paul's presence on the stage to score cheap points, Guiliani showed weakness and Paul became a rock star.

The Future is Bright

I know we're on the right track here because they are fighting cryptos in the trenches now. And they are trying to kill the momentum of crypto being on everyone's lips. While the DOW is at all-time highs all anyone can talk about is Bitcoin.

Think about that for a second.

And then think about what's coming next. Because you can see what's happening within the market. The applications platforms projects like Ethereum, EOS, STEEM, NEO, OMG, KMD and others are all not only holding onto most of their 2017 gains, they are also the first to rally on any bullish day, outperforming Bitcoin and most of the alternate currency coins like BTG, BCH, LTC and the privacy coins.

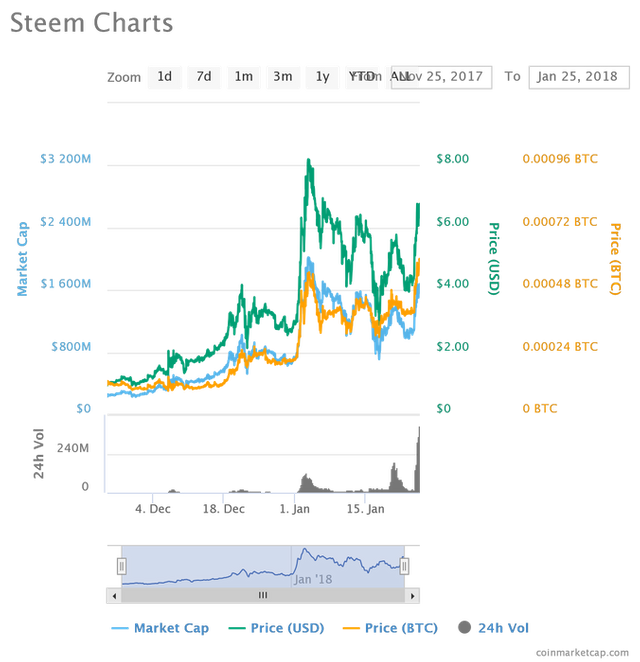

It's especially gratifying to see STEEM do this.

STEEM is now in the top-25 of all cryptos by marketcap. And considering that Steem held as Steem Power is proportional to your voting power withing the network, using the term "market cap" for STEEM is appropriate.

The only one of these offerings with a widely-used working product and a thriving user-base is not only attracting financial capital but intellectual and human capital (the most important kinds) at the right moment in the story.

It'll be the growth of STEEM which helps spear-head the acceptance of these other blockchain-based projects. It's frankly silly to see all of the developers on sites like Medium but not here. This place is the best advertisement for the potential of their products. It's not the competition, it's their advertising platform.

So, keep this in mind when you see yet another post on here about Bitcoin dropping. The Empire is striking back because it has to.

Although all this war will not be able to do anything, the major digital currencies in the market including Bitcoin and Eht have risen in value. In the past 24 hours, bitcoin has increased by 8% and Eth has increased by 10%. While currency prices have fallen by 2% in the past three hours, they still record relatively large daily gains.

And that bitcoin popularity

During the large correction in early January, the prices of most digital currencies fell by more than 50% of their highest value, but on the other hand, the popularity of bitcoin increased. Where investors took the digital currency with the lowest fluctuations in prices. At that time, the bitcoin dominance index rose to 38%, as the currency recovered from its lows after a 32% drop. Over the past week, the bitcoin dominance index has dropped from 38% to 34%, with the volume of daily bitcoin transactions down to more than half, from $ 490,000 to $ 242,000.

Thank you sir for this excellent publication so much grateful to you for your participation.

@zer0hedge

Do u think that ETH can reach to BTC's price one day???

No matter how much bitcoin imposes itself strongly do you know

The decline in daily volume bitcoin has removed the burden of "Mempool" - the place where transactions are stored after verification, resulting in a significant reduction in fees. While the widely used bitcoin wallets, such as buccaneers, charge a fee of about 50 satoshi per byte, equivalent to $ 0.5 for medium-volume trading. This low fee has helped make Bitcoin more accessible to ordinary users, especially for users using bitcoin for small payments. The recent decline in bitcoin transaction fees is clearly due to lower daily volume and not due to specific buy or sell orders, as major companies have not yet implemented the SegWit upgrade or transaction consolidation techniques. As such, when the price of bitcoin rises again, their daily trading volume will increase, so the fees will rise again. In addition, the increase in bitcoin fees will limit the ability of newcomers from ordinary users to trade smoothly and settle their payments.

The rise in fees is likely to affect the bitcoin price in the short term, if the market recovers again. There is also an urgent need to find innovative solutions to reduce purchase and sale orders, as well as the rapid implementation of "SegWit" updates by bitcoin companies to ensure bitcoin returns to previous levels.

I appreciate your great effort. @zer0hedge

When bitcoin price was 20000dollar think the price of satoshi then.

The financial nature of gold is that gold itself is a value, - as a material for making jewelry.

Bitcoin and all the other so-called crypto-currencies have two components - technological and financial.

Because the growth of the imaginary value of bitcoin, is due solely to the influx of new idiots into this financial pyramid.

The growth of the imaginary value of Bitcoin is not due to anything else.

The growth of the value of the asset solely due to the influx of new idiots into the Ponzi scheme is the main sign of all financial pyramids.

But as soon as you try to explain this to any member of the bitcoin witness sect, they will immediately start dragging the conversation into the plane of bitcoin technology.

They, like any sectarians blindly believe and therefore do not want to talk about the most important thing - about the financial nature of bitcoin.

They are ready to talk for hours about bitcoin technologies only - about blockchain and crypto technology only.

That is, they are ready to talk only about that high-tech wrapper, which wraps (hidden) the usual nature financial pyramid Bitcoin and all others usual financial pyramid, in the shape of all the others so-called crypto-currencies.

(Pseudo crypto + pseudo currency) = (usual financial pyramid), which is just hidden in the an unusual high tech mask packed.

Nevertheless, the very idea of obtaining wealth without difficulty, at all times successfully enslave the consciousness of the mass of fools. And various ingenious swindlers, at all times, have successfully used this feature of the stupid masses of the people.

What do u mean by technological shell,I don't get it.

"Power does Not commit suicide." - noam Chomsky

Actually, this war has existed from the beginning. It was only slightly alleviated with NYA (New York Agreement). The Bitcoin Unlimited team was making "Bitcoin Cash is Real Bitcoin" or "Bitcoin Cash Real Bitcoin" everywhere, organizing meetings with T-Shirts where this slogan was, and publishing full size photographs on social media. Roger Ver, who was shown as the leader of the Unlimited team, said Segwit2x would eventually be inadequate and that Bitcoin Cash would sooner or later find out how much of the 8MB block option it is.

Just a small correction/thing to remember here. Roger Ver is not the "leader" of Bitcoin Unlimited, ABC or Cash. He's simply an investor and advocate. The teams that contribute to BItcoin Cash are diverse and tend to consist of skilled developers.

Roger is great most of the time, but it's important to make that distinction currently when a lot of people try to make this or that person out to be the "monopolist" or "leader" of Bitcoin/Bitcoin Cash.

so is this war has existed from the beginning

Digital currencies are the future

Whatever they do they will not be able to do anything

What is bitcoin unlimited team bro,I didn't hear about them.

The earliest people into bitcoin haven't been trying to dupe others into buying bitcoin, which is generally the nature of a ponzi. It's been going nearly 10 years and it's only recently that most people have heard about it. The early people just saw it as an alternative. Whether they were criminals, or kids having fun, finding ways to use their computers other than games, it really doesn't matter. No-one is forcing anyone to use/exchange cc's or using any 'here's a free vacuum cleaner when you join up' bullshit.

For us 'small' people, the financial markets are hazardous, to say the least. I don't have enough returns on my money invested to spend all day analyzing markets for the next buy/sell. I have to have a job. It's clear that all those markets are fixed so that the 'big' people are going to turn me over at some point.

just like the individual, the collective doesnt want to be objective and accept blame. they dont want to take a hard look at themselves with scrutiny. someone else is always to blame. theyre just pissed off and emotionally irrational and just want to kick some ones ass, they want blood, they want war. thats what it comes down to. theres no reasoning with people like that. ron paul stood alone in that room, what a courageous individual.

"In a time of universal deceit, telling the truth is a revolutionary act". George Orwell

Fascinating to watch this now. Truly fascinating. To anyone out there who was either to young or just not politically active, this is what America was like in the immediate years following the invasion. At this point the ONLY acceptable view for right wingers and indeed most of the mass media was...are you ready for this?....that they "attacked us because of our freedom". To even mention our foreign policies which have been fucking with these people's nations and economies as being the driving force behind the terrorist attacks of 9-11 was unthinkable, and not tolerated just 8 years ago. Liberal media? Lol, you must be kidding.

@zer0hedge....bro You would be right, if not for one "but.The financial nature of any so-called crypto-currencies - is inflationary!Infinite growth in the value of an asset in conjunction with the infinite fractionality of an asset is the inflationary nature of the asset.

Macro world and micro world are two infinity.

Therefore, the so-called crypto-currencies - this asset is exclusively inflationary, like any other fiat currency.For us 'small' people, the financial markets are hazardous, to say the least. I don't have enough returns on my money invested to spend all day analyzing markets for the next buy/sell. I have to have a job. It's clear that all those markets are fixed so that the 'big' people are going to turn me over at some point.The value of bitcoin has risen dramatically because, well, what is left for us? QE has destroyed markets and devalued currencies. And it's centrally controlled. A couple of people on opposite sides of the world can keep a cc running.Not really arguing, though I think your wrong about it being a ponzi. I think cc's don't fit into our current financial models because they are decentralised, so they're hard to place. Just putting thoughts to words. Still trying to figure it out myself....thank you for sharing with us...

What is macro and micro world bro??

The most important question at this point is which of these two blocks will be the "real" Bitcoin, and which will be called "BTC" in the stock markets. The Bitcoin stock exchange plays an important role at this stage as a person or organization is not held accountable for that.

Hong Kong-based digital money market Bitfinex is the world's largest stock exchange with its volume. The Bourse has announced that it will call the original quarterly coins "BTC" and the Coin of the SegWit2x chain "B2X".

Officially a stock exchange based in the Seychelles Republic, Bitmex is the second largest Bitcoin stock in the world by trade volume. In a blog post published on October 13, Bitmex announced that they will continue to list the original quarterly coins as "BTC".

Bitmex, on the other hand, stated that he could not list the coins in the SegWit2x chain as "ShitCoin2x".

It is not certain that Coinbase and possibly the GDAX will list the coins in the SegWit2x chain as "BTC" despite signing on NYA.

Explaining that the SegWit2x chain will now list the coins in the SegWit2x chain as "B2X", the company later made a new statement saying that it depends on the hash of which chain to accept as the original "BTC".@zer0hedge

Yeah I agree that the bitcoin stick exchange plays an important role.

I expect the government will outlaw converting crypto-currencies to cash or checks, and force retailers to not accept them. That's not much different than when FDR forced all gold holders to sell to the government, at a big discount.