PwC Becomes First "Big Four" Firm To Accept Payment In Bitcoin

Content adapted from this Zerohedge.com article : Source

Regulators may be skeptical of the burgeoning ICO market, where outright fraud isn't uncommon, but that isn't stopping some of the world's largest audit and consulting firms from trying to win their business.

PWC revealed that it will begin accepting payment for its consulting services in bitcoin because it is increasingly working with startups in the city involved in cryptocurrencies and blockchain, the open-ledger technology that processes bitcoin transactions by logging them on a public record. The firm also noted its advisory work for initial coin offerings – which typically collect payment in bitcoin and Ethereum – along with crypto exchanges and crypto funds, according to the Wall Street Journal.

"This decision helps illustrate how we are embracing new technology and incorporating innovative business models across our full range of services," Raymund Chao, chairman of PwC Asia-Pacific, said. "It is also an indication that bitcoin and other established cryptocurrencies have now developed into more broadly accepted forms of settlement."

ICOs have two important characteristics that would pique PwC's partners' interest: Plenty of cash on hand, and many intractable problems.

Of course, PwC isn't the first major company to accept bitcoin: Overstock.com has been accepting payment in bitcoin for years. Dish Network and Microsoft also accept payment for some services in bitcoin.

The US has taken steps to crack down on ICOs, with the SEC having recently opened several civil actions against them. Meanwhile, China has banned them entirely. As the large pots of money accumulated have spurred internal conflict and in some cases outright embezzlement, some of the largest offerings are already crumbling.

But they're on track to raise as much as $4 billion this year alone. And despite the bad press and regulatory scrutiny, the market hasn't cooled.

Overstock.com claims it's building a trading platform that will help legitimize the market, and at least one other company is building what's essentially an exchange for ICO tokens.

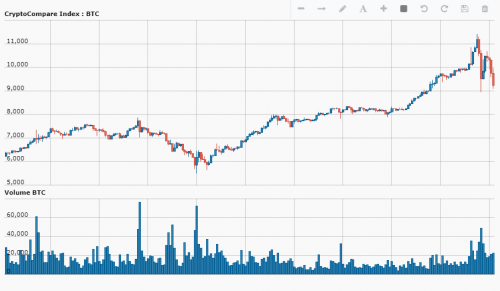

The move also makes sense from a trend-following standpoint. Bitcoin has climbed more than 950% this year alone. And with several new derivatives products hitting the market, PwC will have more options for hedging its exposure.

However, on Thursday, the price of a single coin had fallen 16% to $9,400 a coin, well below its recent peak above $11,000.

If anyone knows anything about ledgers it must be the accounting companies. The faster these accountants come over to Bitcoin the quicker and easier it will be for all businesses. Not a fan of the big 4 in general though

Accountants are seeing an opportunity. If one becomes specialized in blockchain, there is a future, at least for a while. I imagine we will also see law firms that jump on the bandwagon and focus upon it.

In the end, blockchain will eliminate accounts too.

Agreed. I would assume being a blockchain accountant would be a VERY profitable career.

Yes and most likely a new stream of revenue for a field that has been under attack because of software automation for years.

Blockchain is so new that it will give many early adopters an avenue to do something different...at least for a while.

As I said, I think blockchain will ultimately replace accountants...the blockchain does that already.

If cypto takes off like I hope then early adopters might not need to work. Well thats the dream anyway.

That happened already with the early adopters of bitcoin.

I can tell you I plan to be rich off my holding in crypto. I think STEEM will make people very wealthy with a small amount. I put a price of $100 by the end of 2018.

You might want to check out my blog...I wrote a number of articles over the past two weeks explaining how I think steem is going to be a grand slam homerun.

Even 1000 SP will be life changing for many people.

This is a good news, the whole world and all the more powerful companies will accept Bitcoin as a means of payment. Amazon has accepted, followed by ebay, facebook. This is just the beginning of a dizzying rise. Soon it will not be available to ordinary people, because it has little and value will be great.

We need to throw out paper money, the speed of transactions and savings are a great advantage over all other payment methods.

Let's hope PwC does a better job with Bitcoin than it did with the Oscars.

@zerOhedge, Decentralised ledgers are something that should have been first adopted wholeheartedly by the accounting community given its relevance to them. We're probably not very far froma world where every major finacial transaction will be stored on a blockchain and thereby insuring it from fradulency far more than any contemporary system could provide, and also a much more efficient system of ledger update/storage.

PWC won't be the last, it's only going to be a matter of time before other pitch in I believe..

I agree with you. Blockchain is going to come in hot and heavy. It is not a process we are going to see take years before it is embrace. My feeling is 2018 will be enormous for it since there will be a ton of companies adopting it.

People are going to end up doing business on the blockchain whether they know it or not.

Absolutely. The irony is that 90% of people who are throwing money into Bitcoin probably don't realise that crypto currency is just one use case of block chain. The potential for blockchain is practically unlimited.. ... I believe 2018 is going back to the new beginning as it's likely the number of adopters will finally reach tipping point next year and then it's going to be a flood of mass adoption for the technology

Agree 100%.

You are right, tokens are just one app on a blockchain. There are a ton of other uses.

Blockchain development is going fast on the private side. For all the talk about the public chains, we see a lot of activity by the banks and shipping companies embracing private blockchains that are being created. Will these ultimately end up public, I dont know. But the technology itself is being embraced completely.

Bitcoin is still having more dollars transacted across it than any other chain. This too might change...although the security of bitcoin is well established.

Thank you for the post @zer0hedge.

This just shows what is taking place. The blockchain technology simply cannot be ignored. We are going to see it penetrate every aspect of life. All companies are going to be forced to deal with cryptocurrencies.

I find it ironic that the more talk of government regulation, the higher cryptcurrencies go. There is no regulating or stopping this and that is what has the bankers so scared. In the end, it is going to free billions of people from the tyranny of a bankster led world.

Hey @zer0hedge thanks for shared crypto currency news I appreciate your post ✌✌

Good Post 👍👍👍