Is Bitcoin Money?

Authored by Valentin Schmid via The Epoch Times,

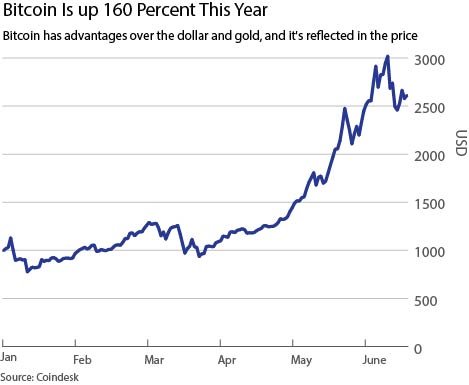

Up 158 percent against the U.S. dollar this year, bitcoin is now the best-performing currency. Many are confused as to how this mathematical protocol can be worth more than $2,600, and why it keeps going up. The short answer: Bitcoin is money, just a little better and cheaper than the alternatives.

If you don’t understand money, you cannot understand bitcoin. For most of us, money is the U.S. dollar, the fiat currency of the United States issued by the Federal Reserve and maintained by the commercial banking system.

But even this system is confusing. Most people don’t hold Federal Reserve notes anymore; they hold money in checking accounts or use their credit cards to buy things.

This is electronic fiat money, stored on the servers of banks like JPMorgan Chase and Bank of America.This type of money is a great medium of exchange. Because the state mandates the acceptance of fiat money by all commercial actors, you can pay everywhere with dollars and, as a bonus, the prices of consumer goods seldom change more than a few percent per year.

Other attributes that make the dollar useful as a medium of exchange are its divisibility, recognizability, and indestructability—at least in electronic form—and the ease with which it can be exchanged.

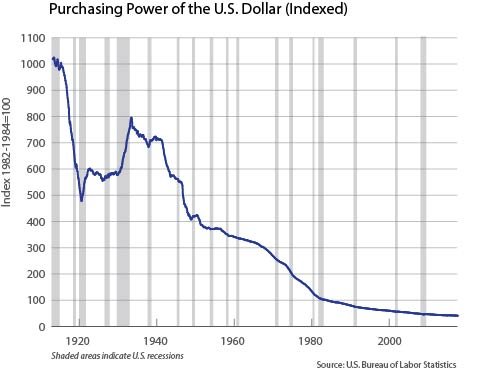

However, there is a problem with the dollar as a medium of exchange over time. Since the creation of the Federal Reserve in 1913, the dollar has lost about 95 percent of its purchasing power. This devaluation is hardly visible over the course of days, months, and even years, but it is painfully felt over the span of decades.

So it’s hard, if not impossible, to exchange the same value over time with the U.S. dollar, and investors need to expose themselves to other assets to protect purchasing power. This is a general problem of fiat currencies and bank money, which are both prone to mismanagement by the state and banks, mostly because they can be reproduced at will. More dollars chasing the same amount of goods leads to rising prices.

Value Over Time

This is the reason why people have traditionally resorted to gold to protect themselves from monetary inflation. Gold is also easily recognizable, divisible, durable, and concentrates a lot of value in little space. One troy ounce now costs about $1,250.

However, its uses as legal tender have been limited since the demise of the true gold standard at the beginning of the 20th century, and it is not easily transferred in physical form like the electronic dollar. Furthermore, its price is relatively volatile when measured in dollars in the short term, and the IRS collects tax on gains in dollars, making gold even less exchangeable.

But gold cannot be replicated at will and therefore is a better way of exchanging value over time. One dollar bought almost 20 bottles of Coca-Cola in the 1930s. It now buys less than one. One ounce of gold bought 700 bottles of Coke in the 1930s; it now buys almost 800.

Decentralized Electronic Money

Once one understands that money needs to be able to exchange value in time and space, it is easier to see why bitcoin is so attractive.

Although it cannot handle as many transactions as the banking system, it is relatively easy and cheap to transfer. Hundreds of thousands of businesses and individuals voluntarily accept bitcoin as payment. Its mathematical properties are recognizable, infinitely divisible, and indestructible.

As a medium of exchange, mainly because of legal tender laws, bitcoin is not as widely accepted as the dollar or other fiat currencies, but it is easier to transfer than gold and it is also subject to taxation.

In the long term, bitcoin has similar properties to gold because it cannot be replicated at will and the number of coins is limited to 21 million. This means that bitcoin is better than the dollar for transferring purchasing power through time. It is similar to gold, although gold has a far longer track record.

Its decentralized management is another factor making it attractive for people who distrust fiat currency and the banks.

Cheap Alternative

Given that bitcoin is better than gold in the short term and much better than the dollar in the long term across the dimensions we have described, it’s not surprising that people chose to diversify their money holdings into this independent currency due to frustration with the mismanagement of fiat money and manipulation of gold prices.

There is another reason why bitcoin is attractive as a currency. Despite its record high in dollar terms, it is still cheap in aggregate. All Bitcoins are only worth $43 billion. All gold ever mined is worth around $7.5 to $10 trillion, although estimates vary. As for the U.S. dollar, just the M2 measure of bank money, including checking accounts, puts its worth at $13.5 trillion.

If bitcoin were to establish itself as an alternative currency and store of value alongside gold and the dollar, a total valuation of $1 trillion would not be inconceivable. That’s $47,600 per coin.

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

Many gold bugs argue that "real money" needs to have some real use, like gold's utility for electronics and jewelry. But central bankers and academics have responded that money is really just an agreement. In other words, whatever is accepted as a medium of exchange is necessarily "money." And Bitcoin seems to prove the point that money need not have any other utility. It needs to be accepted. And the question as to whether it will hold value, or serve as a store for value, is shown by your inflation chart to be entirely a function of how much money is put into circulation. Bitcoin itself cannot be inflated indefinitely. It is thus scarce, like gold. But there is inflation in the cryptocurrency space by virtue of many new coins being circulated. This is great, because it will make it impossible for the central bankers to corral all crytpotcurrencies into their domain. But it will also mean that the market will determine which crypto will be the cream that rises to the top. Bitcoin definitely has a great headstart.

It's all dependent on how you define "money" - the fact that Bitcoins structure does not allow the Federal Reserve banking cartel to control the purported value of it makes it that much more appealing to me!

Ask that teenager who became a millionaire from crypto if it Bitcoin is real money!

Yeah, but he's still a millionaire because he turned his crypto for fiat.

The dollars make him a millionaire not the btc in his wallet.

Yes...but as companies start to adopt & accept crypto-currencies we will no longer have to transfer them to a fiat based currency. Russia is experimenting with Ethereum, India just announced Bitcoin will be accepted officially. So, it won't be long...full Steem ahead!

Very nice informative post

I think bitcoin is near future of money Alternative

Bitcoin is the MONEY

informative one

Great article and a very interesting read!

I had a conversation with someone about Bitcoin's status as money. The obvious question was if it can be touched like gold or cash. I jokingly showed my Trezor which I had with me ... "look, I'm touching it now!"

I think the big point is what value it has and what features make it a currency.

As an aside: Bitcoin is much easier to divide evenly than gold. :)

Bitcoin is Money because it has one of the most important qualities that defines what money is, and that is store of value; anything else that depreciates over time can't be money and never wil be.

Bitcoin is definitely money as it provides a medium of exchange , a store of value, and a unit of account. By unit of account, it just means that prices can be stated in terms of money. Even here, Bitcoin can fulfill this function as you can price goods and services in terms of Bitcoin instead U.S. dollars or other types of currencies.