Investing Legend Calls Cryptocurrencies "Biggest Bubble Of A Lifetime"... But There Is A Catch

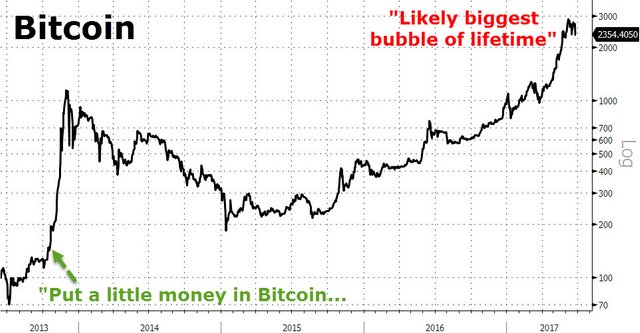

Former Fortress Principal Michael Novogratz left the firm's colossal macro hedge fund almost two years ago, but has been discussing investments in virtual currencies since 2013 when he told a UBS conference...

"Put a little money in Bitcoin...Come back in a few years and it’s going to be worth a lot."

He was of course correct, Bitcoin was trading around $200 at the time and as recently as two weeks ago was worth $3000.

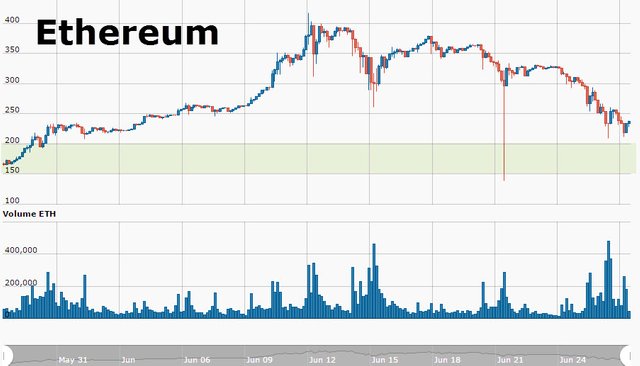

But today, Bloomberg reports that at the CB Insights Future of Fintech conference in New York, Novogratz told attendees that he has cut holdings (in Bitcoin and Ethereum) after the cryptocurrencies' latest "spectacular run," warning that "Euthereum had likely hit its highs for the year," and "cryptocurrencies were likely the biggest bubble of his lifetime."

However, while this all sounds desperately downbeat, Novogratz is still very "positively constructive" on the space overall. He should be - he has 10% of his net worth invested in the sector.

As Bloomberg reports, Novogratz says cryptocurrencies could be worth north of $5 trillion in five years -- if the industry can come out of the shadows.

"The Nasdaq got to $5.4 trillion in 1999, why couldn’t it be as big?" the former hedge fund manager said in an interview, referring the Nasdaq Composite Index.

"There's so much human capital and real money being poured into the space and we’re at the takeoff point."

To get there, though, companies need to develop sound business principles to satisfy regulators and lend legitimacy to the budding industry, as Novogratz says cryptocurrencies face "monster regulatory risk."

Novogratz said he took some profits on his bitcoin and ether holdings as prices surged, but still has 10 percent of his net worth invested in the sector, including blockchain-based assets he bought in fundraising mechanisms known as initial coin offerings.

He’s looking to add more ether if it falls between $200 and $150...  and more bitcoin if it falls to $2,000...

and more bitcoin if it falls to $2,000...

Novogratz ended with some more serious advice...

"Pay your taxes, because nobody in that space pays taxes. It’s a bunch of libertarians," he said, adding he thought a core group of developers have good intentions.

"There really is a revolutionary spirit amongst the guys that are building this system."

Concluding that Bitcoin could become a viable store of wealth, similar to gold, while ethereum could be the platform underpinning the Googles and Facebooks of the future, while money transfers to securities settlement will probably be done using blockchain technology.

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

If Novagratz says that crypto could be worth 5 trillion in the next five years, then where is the bubble? I personally feel that we aren't in a bubble that is going to pop. Sure, there will be correction and consolidation . . . . but every time the market goes down 25-30 percent, people forget that these very same coins have gone up HUNDREDS of percent.

This seems a bit relevant, even though I do not believe we will POP

I am quite lost... he said biggest bubble but then could be worth 5 trillion haha... He's taking both sides!

Maybe what he mean is its bubble short term but a long term asset years from now. Why not take some profit short term and buy back later when its cheaper.

True but now your speculating. :)

Precisely. Anyone not leaving in a core position longterm is a fool. Crypto is totally different than any other asset class than we have ever seen in history so people easily misjudge it. Cryptocurrencies are not companies with earnings and its all based on Metcalf's law. In other words, the more users the more demand for the token. Its like gold was invented 9 years ago and its value started off near zero but its growing into 8 trillion dollars. Just imagine in 20 years how big some of these Internet currencies will be. Beyond people's wildest dreams baring that nothing catastrophe happens that can't be worked out.

Yeah I think the bubble is in fiat...

Yes i agree with you that investing in bitcoin is a wise decision. Imaging those who bought at the rate of 200, they will be smiling to the bank now. Good one.

Or Ether at sub $10 :-) I remember that only 7 months ago. Imagine when Steem blockchain hits 5 million (latest estimate is a million by this time next year) active users with several successful Steem social apps eating away at FB, Reddit and Instagram. Steem at $2 will seem very cheap one day. People should be smart and not sell too much Steem. Its going to be like Bitcoin returns one day.

Ok

Just more FUD headlines.

ETH and the alts are the biggest bubble.,,

BTC is undervalued IMO

Don't forget get the free stellar tokens that every bitcoin holder (as of 26th june) has the right to claim !

If crypto currencies are a bubble then I believe that it may last up to a lifetime because it has brought about life changing solutions to our industry especially in area of banking and finance.

Will Bitcoin drop below $2,000? Maybe on August 1st?

Nice Post!

I take the small coin strategy!

https://steemit.com/cryptocurrency/@jrose1010/the-small-coin-strategy-potential-to-make-hundreds-of-thousands-maybe-millions

Congratulations your post is wonderful.

Keep on posting good content!

@zer0hedge speculators should remind each other of the risks and those individuals with substantial amounts of cryptocurrencies could transfer into physical assets - I mean the real issue is the monetary system's fault-lines are rupturing were distrust in the system is crashing...

Admit it, central bankers have lost respect and are among the most disrespected professions I can think of.