"I Just Discovered I Owe The IRS $50,000 I Don't Have, Because I Traded Cryptos"

Content adapted from this Zerohedge.com article : Source

A Reddit user posted how he made a lot of money trading Bitcoin in 2017 which caused him to owe a lot to the IRS.

The problem is that the money was lost in the drop in alt-coins.

In January, the alleged trader using the screenname Thoway, bought Bitcoin in January 2017 for $7,200 and sold it at the peak, triggered a taxable event according to the I.R.S.

The bill: $50,000.

Thoway said his lawyer advised him to cash out his remaining altcoins and give whatever is left to the IRS. Thoway, who has not been identified and has apparently gone "missing" from Reddit since his post went viral, told readers that he earns $47,000 a year as an office assistant.

Thoway's lawyer said he should be able to set up a payment plan allowing him to pay down the debt over a long-period of time, likely ten years. Still, Thoway complains that, during that period, his tax payments will likely siphon off most of what would've been his savings, meaning he has essentially been condemned to live paycheck to paycheck for the foreseeable future because he made a profitable trade, but ignored the tax consequences.

"I feel like I might have accidentally ruined my life because I didn't know about the taxes," he said.

While the original post was removed by Reddit for several violations in the comments thread, it's extremely likely that the anonymous Reddit user isn't alone in his predicament.

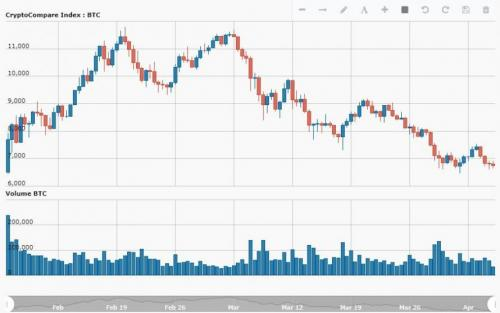

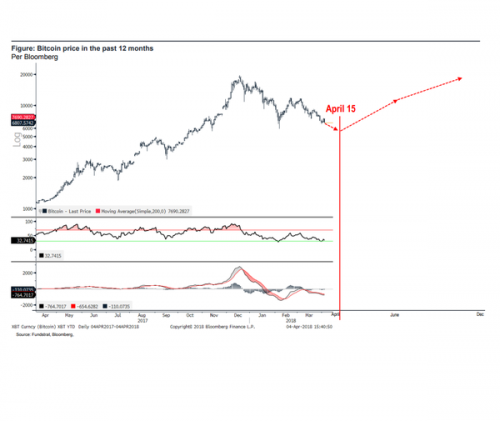

Fundstart's Tom Lee believes much of the downward pricing pressure on bitcoin is due to people cashing out to make payments to the I.R.S. During the past month it dropped 40%.

According to Lee, each dollar pulled out of cryptocurrencies drops the marketcap $20-$25.

Lee also believes that cryptocurrency capital gains amount to $92 billion, about 20% of the capital-gains tax.

"We still like Bitcoin and large-caps,” he said, adding that “while we believe the bear market for alt coins is largely over, we do not see upside for alts until mid-August.”

Non-adapted content found at zerohedge.com: Source

lol governments are more crazy then ever

An they keep getting better at it!

Bro @rocky1 it's help post.tnx for posting.

Poor guy. He is far from alone in this predicament. If he pays the IRS whatever investable funds he has, it will be even more painful when he watches the value of quality coins hit new highs. I think the stage is being set for a tsunami of new institutional money to come into the crypto space once appropriate regulations are put into place and the crypto market is no longer like the Wild West.

It's painful to see people like this who could really benefit from the opportunities afforded by cryptocurrencies to be unable to do so.

We'll refuse pay unless they start accepting crypto!

the government always gets their cut. and then some... and what about debtors jails? i still find it odd they can cage you for financial debt.

There's nothing to read here but fear porn. He didn't incur this tax liability simply by trading crypto. He gambled with 100% of his gains by tossing them into altcoins. He should have pulled out what was his tax on his gains on December 31, 2017 and gambled the rest of what was left. His mistake, and unfortunately that isn't what is being made obvious here. The article makes it appear as if this ungodly tax liability appeared simply because he traded crypto and not because he missed an order in operation, pay your taxes. He had nearly a month in January to decide to do that, but clearly saw the moon, and made the wrong bet.

Hi zer0hedge,

Interesting how Federal Income Tax could entrap and almost destroy a Crypto investor....sad

I did not think about the tax payers having to pay the tax so, drawing out the their profits from Cryptocurrencies thus causing a huge bear market.

Eye opener.

Good content.

The bloody govt. Thank you for warning us though. We'll be sure not to trade on US-based exchanges now.

wooow bro You please do an Upvote on me. We know that you are very kind. Waiting for your upvote.....

Thanks!.. That's really good information, i likes for you post!

Thanks for your good information.

now you also upvote and follow me first time this kind of comment you.

please follow and upvote my post i will never want to upvote and follow by comments.

Link:(https://steemit.com/blog/@nabilhasanfahim/importance-or-significance-of-communication-in-modern-business)

Something doesn't add up with this.

If you read the thread and the original thread, he says it happened because he made good gains on btc in 2017 but sold it within a year incurring the taxes for that year, his losses happened in 2018 and thus he is stuck with a huge tax bill. He'd only owe about 20k if he used his altcoins, so it's up to him what to do from this point.

I'd suggest moving away. That tax bill alone can will set him up in Nicaragua for years. Sunshine, hot latin babes in bikinins....and no crypto tax.

I know what it says, however the article is NOT explicit about the taxable event.

I know about taxes and how capital gain taxes work. The tax rate that is IMPLIED in the article the only one that could cause his taxes to be so high did NOT go into law until after January 2018.

It's a repost of ZH on steemit, which was a repost of the original reddit threads, so what can you expect. I read it on the subreddit first.

the irs has been known to enact laws retroactively... maybe thats what happened?

You will be more suprised if you try to understand more of it. I am actually concerned too for myself and being really careful now on how to actually trade cryto. Every transaction you make, you should consider the tax effect of it and encounter that in your profit/loss.. otherwise what you think may be a great profit can potentially turns out to be a great loss in tax. This scenario actually is one of the easy-to-deal with scenario where he can still sell some asset and be able to re-pay the tax. where some legit just spent the money on houses/cars... and when they see the tax bills, they are legit ruined... because even selling those assets are not enough to pay the tax bill.

so nice you post amazing please please please give me upvote brother please give me upvote