Cryptocurrency Carnage - Bitcoin Trades Below $2200, Ether Tumbles Below $200

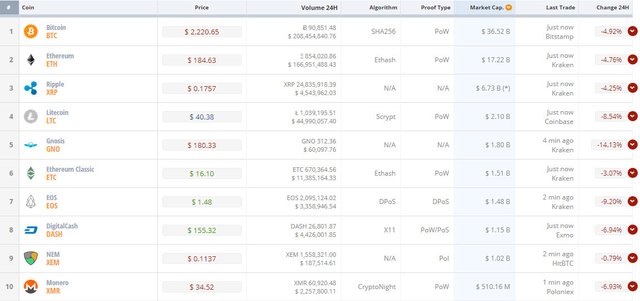

The ten largest cryptocurrencies (by market cap) are all getting hammered once again today as the August 1st deadline for Bitcoin's 'civil war' looms ever closer.

As Bloomberg reports, it’s time for bitcoin traders to batten down the hatches.

The notoriously volatile cryptocurrency, whose 160 percent surge this year has captivated everyone from Wall Street bankers to Chinese grandmothers, could be headed for one of its most turbulent stretches yet.

Blame the bitcoin civil war. After two years of largely behind-the-scenes bickering, rival factions of computer whizzes who play key roles in bitcoin’s upkeep are poised to adopt two competing software updates at the end of the month. That has raised the possibility that bitcoin will split in two, an unprecedented event that would send shockwaves through the $41 billion market.

While both sides have big incentives to reach a consensus, bitcoin’s lack of a central authority has made compromise difficult. Even professional traders who’ve followed the dispute’s twists and turns aren’t sure how it will all pan out. Their advice: brace for volatility and be ready to act fast once a clear outcome emerges.

“It’s a high-stakes game of chicken,” said Arthur Hayes, a former market maker at Citigroup Inc. who now runs BitMEX, a bitcoin derivatives venue in Hong Kong. “If you’re a trader, there’s a lot of uncertainty as to what happens. Once there’s a definitive signal about what will be done, the price could move very quickly.”

All the largest market cap coins are getting slammed..

Source: Cryptocompare.com

Once again it is the so-called 'civil war' that is weighing on the entire virtual currency space as we noted previously, behind the conflict is an ideological split about bitcoin's rightful identity...

Some have suggested this drop may also be exaggerated by India's decision to tax Bitcoin like gold.

it is being reported that taxes are the probable outcome from this enquiry which will render the cryptocurrency legal, but also affect its growth as a decentralized alternative currency.

It seems likely that the regulatory regime that comes in to monitor Bitcoin and its affiliated digital currencies will fall under the Securities and Exchange Board of India (SEBI).

This board will then hope to treat digital currencies much like gold; trading it on registered exchanges and thus promoting a formal tax.

This will also allow the regulators to keep tabs on the transactions in order to stop nefarious uses such as money laundering, terror funding, and drug trafficking.

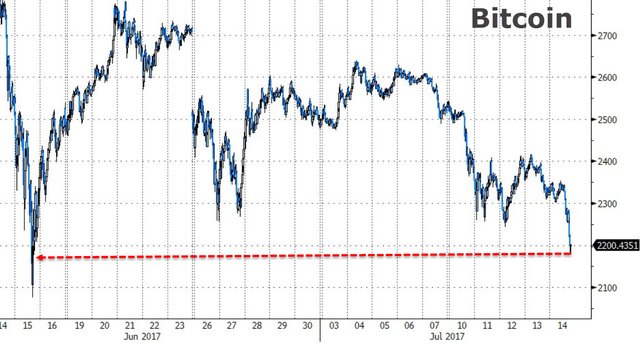

Bitcoin is back below $2000 - its lowest since mid June...

And Ethereum is dumping back below $200...

Source: Cryptocompare.com

Below is an outline of the main events that could unify or divide bitcoin:

By July 21: SegWit2x software is released and supporters begin using it.

July 21 to July 31: The community monitors how many miners deploy SegWit2x:

If more than 80 percent deploy it consistently, that should signal community-wide adoption of SegWit and the avoidance of a split, at least for now.

But if a majority do not deploy, expect anxiety within the community to grow as the focus shifts to the Aug. 1 deadline.

Aug. 1: UASF is deployed by its supporters, who begin checking if bitcoin transactions are compliant with SegWit.

If a majority of miners still do not deploy SegWit2x or otherwise accept SegWit, and if UASF supporters do not back down, then two versions of bitcoin’s blockchain could come into existence: a UASF-backed one where only SegWit transactions are recognized, and another where all trades -- SegWit and non-SegWit -- are recognized.

If a split occurs, bitcoin will likely begin existing on both blockchains in parallel, resulting in two versions of the cryptocurrency. Expect traders to quickly re-price the value of both, likely leading to massive volatility.

“It’s moderates versus extremists,” said Atlanta-based Stephen Pair, chief executive officer of BitPay, one of the world’s largest bitcoin wallets. “It depends on how much a person values the majority of people staying on one chain at least for a little while longer, versus splitting and allowing each pursuing their own vision for scaling.”

As a reminder, investing legend Michgael Novogratz recently noted, that he’s looking to add more ether if it falls between $200 and $150... and more bitcoin if it falls to $2,000.

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

Time to buy more.

Stop worrying about it. Stop give money to the sharks

It's BS I am hodling.

Segwit will be activated as 99% of hash power is signalling and 80% of nodes are running Segwit supported core version.

It will all go smoothly just hype and fear. And from there to the moon with lightning, side chains...

Everyone is worrying about the price of Crypto and us Steemians are over here like . . .

Lol, How can I resteem this GIF?

Haha ill make a quick post tonight if you want to resteem it just reply and let me know!

Holding as well.

yes it all down due to general market trend. Market is taking its blood bath and such position always create opportunity for buying as well.

growing pangs of a new country, civil war the vanguard of stability .

At this times Bitcoin is under 2050$.

I really think if we break the support of 2000$ than we will see big sell. I hope this support will be kept...

Be carefull all!

Buy and hold for at least one year! This helps stabilize the market and maximises returns. Ignore the swings. Thank me later.

Damed if you do, damned if you don't, Bitcoin got big because it is decentralized. It's interesting how they say it's lack of centralization is what's problematic.

Theses are good times to keep on stackin 😎

Buy and hold strong for at least 6 months to 1 year and I think it will be worth much more than it is today!