China Central Bank Advisor: "Bitcoin As A Currency Could Collapse Entire Economies"

An advisor to China's central bank, Sheng Songcheng, said that virtual currencies like bitcoin are assets but do not have the fundamental attributes needed to be a currency that could meet modern economic development needs. Speaking in an interview with financial magazine Yicai, the PBOC advisors said that the adoption of Bitcoin as a national currency by a country "could lead to its economic collapse."

Sheng Songcheng, a counselor at the PBoC, dismissed digital currencies like bitcoin as assets that lack the value basis of a legitimate currency. "Bitcoin does not have the fundamental attributes needed to be a currency as it is a string of code generated by complex algorithms, and does not have inherent value... But I do not deny that virtual currencies have technical value and are a type of asset," he said cited by Reuters. Apparently he is unaware that paper currencies - the type preferred by central bankers - is made of either strings of linen and paper or strings of 1s and 0s, and - while also having no inherent value - can be infinitely created out of thin air.

Sheng, who was the director-general of the Department of Statistics and Research at the People’s Bank of China, holds a PhD in economics from the Shanghai University of Finance and Economics in the 90s. He is currently the professor of economics and finance at a business school in Shanghai.

Sheng warned that the deflationary nature of digital currencies - unlike fiat money there is a hard limit on how much can be reated - would mean that they would not function well as a currency or medium of exchange in modern economies. Expanding on his criticism, Reuters quoted Sheng as stated that "Bitcoin would reach its ceiling of 21 million in 2140. If it is accepted as standard money, that will inevitably lead to deflation and constrain economic growth." Of course, that same feature would assure that consumers' purchasing power does not vaporize every time central bankers make a mistake and unleash hyperinflation.

Think of it as the old fiat vs gold-backed currency debate, only in this case it's bitcoin-based.

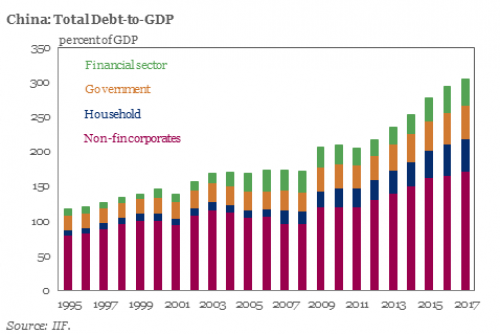

His objection is to be expected: after all no central bank wants to be constrained in how much "money" it can print to stimulate inflation in a world where debt/GDP is 327%; and where China's credit creation dwarfs every other central bank. Recall that in the aftermath of the financial crisis, it was China that served as the dynamo of global "growth" as it doubled its total debt over the past decade, something it would be unable to do if there was a hard ceiling on the amount of currency in circulation.

Sheng’s comments come at a time of increased PBOC scrutiny of the country’s bitcoin trading markets starting in January of this year. The regulatory oversight has resulted in a number of significant changes among Chinese bitcoin exchanges including the addition of trading fees, stricter know-your-customer/anti-money laundering norms and the curb of margin or loan-based trading.However, Sheng’s most stinging criticism of digital currencies was centered on their volatility, alleging “fluctuations in their prices can easily reach 10 to 30 percent” he added according to cryptocoinsnews:

"If a country accepts one of them as its national currency, the entire national economy could collapse due to currency volatility."

Which, however, does not explain why various central banks like the ECB and BOE do hold a favorable outlook on digital currencies. One footnote here is that unlike Bitcoin, the digital currencies envision by central banks would be entirely under their control, in effect simply replacing one form of fiat for another, and better yet, making it digital so there is no place to hide the next time rates go negative.

***

Many governments around the world are still exploring how to regulate and classify bitcoin, whose value surged last month to just shy of $3,000. China has classified it as a "virtual good". Meanwhile, China’s central bank – having opened its digital currency research institute earlier this month – is accelerating its efforts toward launching its own digital currency. As discussed earlier this week, the PBOC completed an early trial of its digital currency on a blockchain late last year.

The opinions offered by the former PBoC official are nothing new when pitted with criticisms of decentralized, state-agnostic digital currencies by other central bankers elsewhere.

Less than a month ago, German central bank president Jens Wiedmann claimed that instant bank payments would put an end to most citizens’ interest in digital currencies like bitcoin. For separate reasons, less than a month ago, Bundesbank president Jens Wiedmann also claimed that digital currencies will "make the next crisis worse."

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

China definitely has the power to influence it's population, miners make no exception, and as a result, it can influence the entire realm of crypto currencies.

Make no mistake, in one hand they encourage mining, but try to discourage the use of crypto currencies as a way to preserve value or payment method, which makes it a perfectly controllable environment for profits.

It doesn't really matter how they use this power to control, all that matters for China in the end is to make money no matter the costs.

I would think Chinese government values control more than money. They use money to control the Chinese population. As long as Chinese economy is running well , the Chinese people will not ask for political change.

This is how I understand the concept of Mandate from Heaven

https://www.thoughtco.com/the-mandate-of-heaven-195113

As long as the peasants are well fed and taken cared off, they will not revolt against the Emperor

No matter if the Emperor is a tyrant or not.

I believe this influence on Bitcoin by the Chinese government thru preferential treatment of the miners and the large investments of Chinese people , will pay dividends by wresting control of the Global economy from the USD/EURO reserve currencies. Chinese yuan might never become a reserve currency despite all the trade China make. But Bitcoin might become a preferred reserve currency for countries who do not want to be allied to US or Europe

China government are a little bit too late on this even if they win ,bitcoin is already taken over the world.African governments are also starting to take noticed .Nothing will stop bitcoin anymore.

That is also well said

Thanks for sharing your thoughts

Keep it up upvoted and I am your new follower

True Flip {ICO} - Already running a transparent blockchain lottery! Bomb! Bonus 20%! Hurry! :)

The platform is already working and making a profit :)

https://steemit.com/ico/@happycoin/true-flip-ico-already-running-a-transparent-blockchain-lottery-bomb-bonus-20-hurry

I have won 1 btc in this lottery when it was launched

the only thing that the bitcoin will destroy is not the economy, but the perception the true money and storage of value. I have no doubt that sooner than later the governments will enter and regulate the crypto space.

one key feature with bitcoin and other crypto is that it's a way around the dollar, and around swift. they will take the risk for that benefit

Tyler Durden is THE best contributor on ZeroHedge IMO.

Just curious, how is it cheetahbot does not comment here?

I was asking this guy the same question a while ago. Copy- pasta! And people upvote this?

Don't get me wrong, there is value in the process of digesting various articles and highlighting the best ones. But I am operating under the impression that Steemit is all about originality, no?

It's definitely disheartening to see that all it takes is scanning ZeroHedge and posting whatever relates to cryptos, money, news events, etc. Hopefully this doesn't get heavily down voted, as the comments on these posts are amongst some of the best. Best to all

You right. ZeroHedge is some kind of brand in my opinion. Collecting money in somebody else's name is just not right.

Because China is going to start new coin and might be it will be the clone of of Bitcoin and i can see the future of China coin where bitcoin got fork and china will build his own coin better way

That may well be Antshares.

Funny how China said that ... as if their currency had some value. What I see is more and more Chinese rushing to BTC

Chinese investors are also flocking to ETH and ERC20 tokens, and they love ICOs. The PBoC is getting nervous about all that.

Well even im nervous about the ICOs. People are rushing in hoping to cash out big but, do they truly understand the software they are supporting......doubtful. I wish people would just buy and hold their ETH and enjoy the uptrend of the increasing value not give their store of value away for some form of a stake in an ETH based company.

I've made money on a couple of ICOs, but I think it was mostly luck. A couple of others I invested in are long-term gambles, so we'll see how they go. Other ICOs I've either avoided because the fundamental ideas were sketchy, or because they were closed to Americans.

So much BS. The Central Bankers constantly send us information that is wrong. They always want us to play by their rules and play their game so they get rich while we get poor.

Im not sure how these Cryptos will fair in the future (no Crystal ball here), but im pretty sure the Cryptos will fair better then that fiat they keep devaluing.

This is the truest test of the fiat v. real store of value debate. If the rules of economics most of us believe in play out, crypto will crush the fiats and transform the monetary system as we know it.

I have to agree with you 100%

HMMM...When was the last time the Chinese currency was worth anything? Their country has been manipulating it for decades.

Let's wait for this Bitcoin segwith2x nonsense before we jump to conclusions. Maybe bitcoin will be worth nothing after that ...or maybe we will have 2 bitcoin after the hard fork

Translation

Economic collapse - Banks falling off their disintegrating pedestals

You watch. If the banks find way to monopolise cryptocurrency it will be the best thing ever invented, according to them.

Fantastic post.

I don't want to scare anyone but banks could easily just generate a ton of FIAT money and buy a ton of crypto then hodl it then sell it all in one shot scaring the living crap out of people then a ton of people will sell theirs creating a gigantic bearish wave down to hell

That would be great if they did. The price would go to the moon. And no reason for them to shuffle it back into constantly devaluing fiat currency to try and save the world banking cabal. So at worst you might have a big surge in bitcoin, then relative price stability as some kind of equilibrium is struck once the dollar, and thereby most of the rest of the worlds fiat money craps out.

Interesting things lay ahead, we'll see what happens :)