Bitcoin Tumbles Below $4000 - Down 21% From Record High

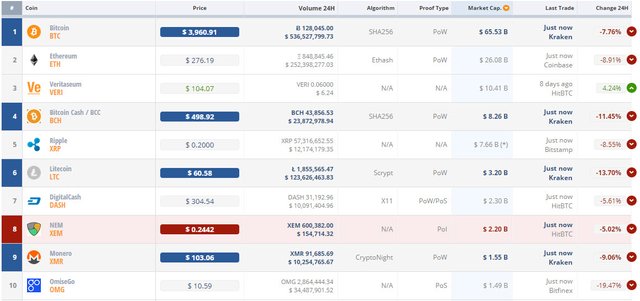

For the first time since August 22nd, the USD price of Bitcoin has dropped below $4000 - down over 20% from its record highs on September 1st.

Crackdowns by China (on ICOs and more recently confusion over Bitcoin exchanges) combined with JPMorgan's Jamie Dimon's comments today saw selling pressure extend as China opened...All but one of the top 15 cryptocurrencies are under pressure..

As we noted earlier, what is ironic is that this is not the first time Jamie Dimon has lashed out at bitcoin: the last time Dimon slammed bitcoin was November 2015, at the Fortune Global Forum in San Francisco. Here’s what he had to say when asked directly about it by an audience member:

“You’re wasting your time with Bitcoin! Virtual currency, where it’s called a bitcoin vs. a U.S. dollar, that’s going to be stopped,” said Dimon. “No government will ever support a virtual currency that goes around borders and doesn’t have the same controls. It’s not going to happen.”

“Blockchain is like any other technology. If it is cheaper, effective, works, and secure, then we are going to use it. The technology will be used, and it could be used to transport currency, but it will be dollars, not bitcoins.”

Speaking to CNBC later in the day, Dimon said he’s skeptical governments will allow a currency to exist without state oversight: “Someone’s going to get killed and then the government’s going to come down,” he said. “You just saw in China, governments like to control their money supply.” And yet, despite said "killing" Bitcoin remained well above $4,000.

That said, Dimon conceded that he wouldn’t short bitcoin because there’s no telling how high it will go before it collapses, saying that it "could hit $100,000 before it drops." The best argument Dimon has heard about owning bitcoin, is that it can be useful to people in places with no other options: “If you were in Venezuela or Ecuador or North Korea or a bunch of parts like that, or if you were a drug dealer, a murderer, stuff like that, you are better off doing it in bitcoin than U.S. dollars,” he said. “So there may be a market for that, but it’d be a limited market.”

What is also ironic is Dimon's admission that his daughter purchased some bitcoin, saying "it went up and she thinks she is a genius."And to think the Fed didn't even have to inject $4 trillion in liquidity to make her feel that way, unlike so many stock "investors."Shortly after Dimon's comment, the chairman and CEO of the CBOE, Ed Tilly - which plans to offer bitcoin futures soon - defended the cryptocurrency after Dimon’s remarks. “Like it or not, people want exposure to bitcoin,” Tilly said. Believers can bet on its rise, and Dimon is welcome to take the other side, he said. “We’re happy to be the ones in the middle.”

* * *

Incidentally, for those who "wasted their time" since Dimon's 2015 threat, Bitcoin is up 1,018%.* * *Perhaps most ironically, while US elites are talking their book in desparation at this 'new-fangled' virtual currency, Russia is working on legitimizing cryptocurrencies and is developing a legal framework that will govern transactions using digital currencies like Bitcoin.Russia’s First Deputy Prime Minister Igor Shuvalov previously said that the regulation would be delayed that was originally set for October.

“In April, we announced that the draft law would be ready in October. However, the situation on the market made us, in addition to the main bill, consider several more options. And now all these projects are postponed, we are watching the situation to understand,” Sidorenko said.

Speaking at the II Moscow Financial Forum, Russian Finance Minister Anton Siluanov reassured Russian users of Bitcoin and other cryptocurrencies that the government has no intention of outlawing or penalizing cryptocurrencies and is working on regulation.

“The state understands indeed that crypto-currencies are real. There is no sense in banning them, there is a need to regulate them,” Siluanov said.

Putin himself has embraced cryptocurrency and met with Ethereum Founder Vitalik Buterin, who instilled the advantages of Russia’s usage of the Blockchain Technology under Bitcoin.

Source : http://www.zerohedge.com/news/2017-09-13/bitcoin-tumbles-below-4000-down-21-record-high

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you! Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

Make no mistake, Jamie Dimon is the leader of Wall Street. Even if he wanted to support Bitcoin, he is not allowed to. It's a conflict of interests for himself and his employer.

However, his comments should not be dispelled. He is undoubtedly plugged into the committees and social circles that will define regulation on the entire market. He seems to be insinuating the SEC will be unkind towards the crypto market. No surprise there. Rickards has been saying the same thing.

If this occurs, it will prevent new liquidity from entering the market and allowing Wall St time to create their own block chain tech to compete against Bitcoin and others. Regardless of the emotional narrative of a "revolution" being attached to Bitcoin, the ultimate metric of what will appreciate in value is number of users, what is legal, and what is used in transactions.

thanks for pointing this out

Great article. Dimon is simply protecting his own. He knows block chain and crypto are the biggest threats the banking industry and financial sector has ever faced and will do all in his power to derail it. The FUD narrative will continue to be played to reign in BTC and the crypto market as much as possible. It's only a matter of time before lending will make it's way into the crypto hemisphere and when it does, all hell will break loose with the banking sector. Cutting into their ability to extract fees for being a financial medium of exchange is one thing, but cutting into their fractional reserve banking money machine is quite another thing.

Dimon epitomizes Wall Street and the bankster mentality. Anything, and I mean anything, that is a threat to them gets destroyed. The central banks have killed people to ensure they have control over the money supply. No one is safe from the thieves. Dimon is at the top of the list.

Dollars enslave people. Bitcoin along with the other cryptos offer a people a way out. Personally, this pullback is very much to my liking since I am seeking to add more. However, make no mistake, the banksters will belittle it to start and, when that doesnt work, put the pressure on their government lackeys (politicians) to regulate the hell out of it. Ultimately, they will look to manipulate the market just like they do gold and other commodities.

He's pretty much just full of it. JP Morgan Chase is deep in their own blockchain project, and ultimately a cryptocurrency for internal bank settlements. The banks are waiting for regulation to put capital into crypto, some rumor it is conservatively at $100b in institutional money.

I am convinced that bitcoin price = exchanges health and credibility.

He is angry at himself for not investing earlier :)

time to buy !! no panic sell!! PANIC BUUUUY!

@zer0hedge Sharing to have this witnessed far more (and perhaps open up the eyes of some)! Thanks for the properly put up and documented report! Resteemed.

@zer0hedge Excellent submit and very insightful. Have learnt a whole lot from it..

very strange position bitcoin