Bitcoin Spikes Over $3800 As Institutional Investor Interest Soars

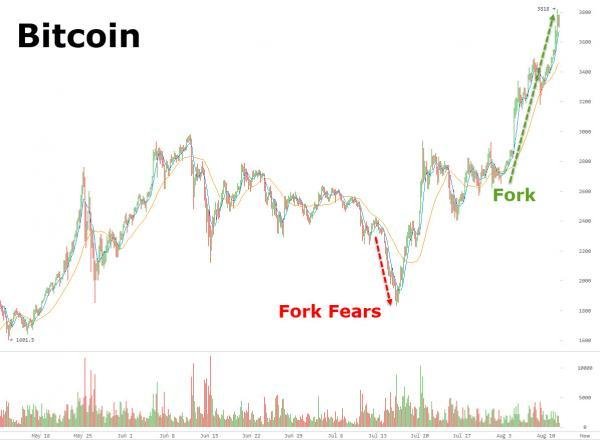

Bitcoin is now up over 45% since the fork on August 1st, notably spiking this week (to a record high over $3800) as US-North Korea tensions escalated and both Fidelity (retail) and Goldman (institutional) noted investor interest in cryptocurrencies is soaring.

Fidelity announced Wednesday that it started allowing clients to view bitcoin and other cryptocurrencies on its website, a rare move for an established institution.

Hadley Stern, senior vice president at Fidelity Labs, said "the big story is you can transfer value through software and software alone. This is a huge societal breakthrough."

And regardless of whether bitcoin will survive, it could be like the Napster of blockchain technology, Stern said, where it is the first of its kind but the next products, in this case Spotify and Apple Music, get better and better.

"I do think [cryptocurrencies] will make things, whether it's bitcoin or something else, faster and cheaper and create new products and services that we can't even imagine," Stern said.

While some critics are skeptical of how bitcoin is used, Stern said that banning the cryptocurrency would be like banning the web or open internet protocols.

"Whether governments like it or not, it's here to stay," he said.

And as we noted earlier in the week, Goldman Sachs wrote in a note that it is becoming more difficult for institutional investors to ignore Bitcoin and the cryptocurrency market.

The debate has shifted from the legitimacy of the ‘fiat of the internet’ to how fast new entrants are raising funds.

The hype cycle is in full effect with Bitcoin, the first, largest and most widely recognized cryptocurrency up almost 200% YTD (v 11% for the S&P 500) and a host of other emerging ‘altcoins’ growing in scope and presence (witness the growth of Ethereum).

Whether or not you believe in the merit of investing in cryptocurrencies (you know who you are) real dollars are at work here and warrant watching especially in light of the growing world of initial coin offerings (ICOs) and fundraising that now exceeds Internet Angel and Seed investing.

And with the fork out of the way, it seems that demand is having an impact...

Aditionally, as CoinTelegraph reports, Bitcoin could pass $100,000 by February 2021; a Harvard academic has said announcing Bitcoin is the first digital currency to follow Moore’s Law. In emailed comments, investor Dennis Porto said that after analyzing Bitcoin’s performance, it was the “first” currency to follow the digital technology rule.

“Moore's law specifically applied to the number of transistors on a circuit but can be applied to any digital technology," Porto wrote. "Any technology that is growing exponentially (i.e., 'following Moore's law') has a doubling time."

Porto makes the assertion that Bitcoin price has de facto doubled every eight months since its inception.

“This poses a unique opportunity for investors,” he added, something which was well-received in social media circles.

While multiple well-known commentators have contributed their opinions on how much one Bitcoin will cost in the next five or 10 years, $100,000 by 2021 is at the bolder end of the spectrum.

This week, Max Keiser repeated his faith in Bitcoin reaching $5,000 in the coming months.

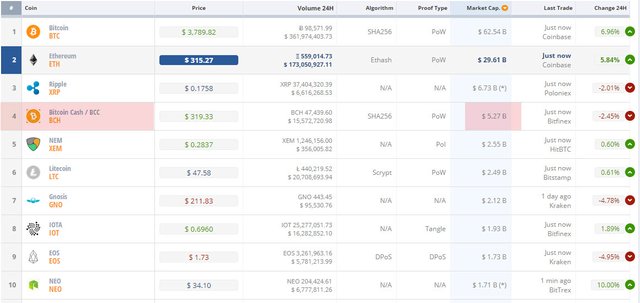

While Bitcoin is surging, Bitcoin Cash is sliding, falling to 4th largest virtual currency by market cap...

But Ethereum - which we noted previously appeared to be acting like a World War III indicator - continues to surge well above $300...

Source : http://www.zerohedge.com/news/2017-08-12/bitcoin-spikes-over-3800-institutional-investor-interest-soars

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you! Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

Can you please point a link to the above statement?

Bitcoin to the moon, as they say

My biggest fear right now is that there won't be a correction, that it'll keep rising and rising and leave me missing out on everything.

As I don't have the balls to buy in at a possible height.

Thank you for taking the time to create this article. Always great to get insight and help for newcomers like myself!

I am your follower and I will be thankful if you give your precious Upvote to me.!!