Bitcoin Crashes 35% In China: Beijing To Shut All Local Exchanges By End Of September

Update: Confirming the other speculation, that China would halt all cryptocurrency exchange, Yicai reports that it is not just BTC China:

- CHINA MAY SHUT ALL LOCAL BITCOIN EXCHANGES BY SEPT. END: YICAI

To which the response from the Bitcoin Association of Hong Kong is: "if China restricts growth in bitcoin" it will drive business to us"

Yuan-denominated Bitcoin has crashed as much as 25% 35% in Chinese trading, plunging from 25,000 yuan to as a low of 16,000 on local exchanges BTCChina (and as low as 20,000 on OKCoin), following confirmation of last week's Caixin report that Beijing would stop cryptocurrency exchange trading. China's second largest exchange, BTC China, said that it would halt all trading on the platform beginning September 30, launching a liquidation panic.

In a statement released on Weibo, BTC China said that it would immediately stops accepting new account registrations on BTCChina Exchange. The decision was made after “carefully considering” Chinese regulatory bodies’ Sept. 4 announcement on preventing risks associated with token fundraising. A google-translated version of the statement:

China will stop all trading business on September 30th

Dear Bitcoal Chinese users: According to the September 4 issue of the "People's Bank of China Central Office of the Ministry of Industry and Information Technology Ministry of Industry and Commerce, China Banking Regulatory Commission, China Securities Regulatory Commission on the prevention and treatment of the risk of the issuance of the currency," the spirit of the document, adhering to the protection of investment risks, the maximum protection of users

The principle of interest, Bit Coin Chinese team by careful discussion, is to make the following decision:

1. Bit currency China's digital asset trading platform today to stop the registration of new users;

2. September 30, 2017 Digital asset trading platform will stop all trading business.

Beitou China's pool (pool) and other business will not be affected, continue to normal operation.We apologize for the inconvenience. If you have any questions, please contact [email protected].

And on Twitter:

1/ After carefully considering the announcement published by Chinese regulators on 09/04, BTCChina Exchange will stop all trading on 09/30.

2/ BTCC products, including BTCC Pool, are not affected by this change. Please contact us at [email protected] if you have any questions.

The immediate result was a sharp plunge in the CNY-denominated price of bitcoin on exchanges like BTC China and OKCoin:

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2017/09/05/btcchina%20yuan.

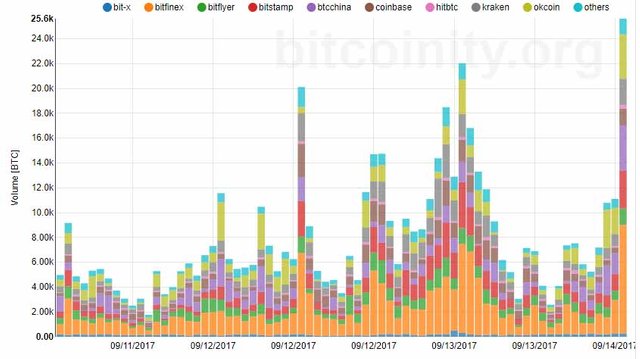

While China no longer dominates cryptocurrency trading - it accounted for nearly 90% of all trading in late 2016 before Beijing launched a series of measures to limit participaton - and is now responsible for less than 40% of global volumes, the Chinese selloff has spooked global markets, pushing bitcoin sharply lower on international exchanges as well like Coinbase, where it was trading at approximately $3,600 last.

A breakdown of global bitcoin exchanges by volume is shown below:

Also notable: as of this moment, China-denominated bitcoin is trading at about 17,000 yuan or just under US$2,500, indicating there is a nearly 30% arb between Chinese and offshore trading.

This isn’t the first time the bitcoin market in China has come under regulatory scrutiny. In early February, major exchanges suspended withdrawals of bitcoin and stepped up their scrutiny of clients after meeting with the central bank.

Emil Chan, vice-president of the Hong Kong Blockchain Society, said it would be difficult for regulators to outlaw bitcoin trading altogether. “There is no option to restrict cross-border sales of bitcoin. It is a smarter move to maintain the operation of the local exchanges if the central bank’s goal is to minimise the outflow of yuan.”

Still, the virtual currency is up more than six times from a year ago, with some participants convinced the bitcoin market is in a bubble. “In fact, the market was too hot. The action taken is an effective action to cool down the global cryptocurrency market,” said Chan.

Meanwhile, Leonhard Weese, president of the Bitcoin Association of Hong Kong, said if China continues to toughen up on regulations to restrict growth in bitcoin, it may drive the business to the city.

“People in China will be more careful about marketing these events, and a lot of that marketing activity will come to Hong Kong in the form of conferences and communities,” said Weese.

It remains to be seen if Chinese bitcoin fans will simply switch to other OTC/bilateral forms of trading, or simply take their trading to neighboring Japan and South Korea which remain eager advocates of trading in the crypto space.

Source : http://www.zerohedge.com/news/2017-09-14/bitcoin-crashes-chinese-trading-second-largest-exchange-halt-all-trading

The FUD is simply shaking out the weak hands. BTC and crypto does not need China. All they did was help expedite the price movement earlier. This is what I've been waiting for to pick up some cheap crypto. BTW, this isn't the first time China has pulled a stunt like this.

The buying will take place somewhere.

There are only so many coins available...banning the sale of them will only open up the selling elsewhere. There is no way for the government to stop it totally, especially with many Chinese having access to Hong Kong.

Besides, many of the elites/big money people in China have their money outside the country...for the last 5 years they were moving funds out expanding a collapse of the currency. Many of the single family homes sold in the US in the 2013-2015 time period were with Chinese money.

At the moment people are scared and will natural sell out. This is just a great time for the rest of us to buy on a dip.

Prepare to buy more. I just bought some. This type of price may not come again.

This news are really great for people who want to buy bitcoin cheaper. I would advise to buy as many bitcoins as you possibly can, it can be 1 $, 10$, 100$ or 10,000 $, it does not matter how much, just start buying and hodl your bitcoins, as prices will definitely hit higher highs then what we have yet to see.

btc diving in deep sea for a short period

HODL!

First you short, then you HODL.

Hold tight guys the market will bounce back.... Fuck China

I talked about this in my post as well and I think the trading will just move to other foreign exchanges or new exchanges that open up and meet the Chinese regulatory requirements. If you want to hear more check it out here.

Prepare to buy?