Bitcoin Bloodbath Leads Tech Stock Tumble; Gold Gouged As Credit Curve Crushed To New Lows

hmmm....

We started the day with a gold flash-crash...

Then Durable Goods data and The Chicago Fed's National Activity Index both tumbled and massively missed expectations -smashing the Citi Macro Surprise Index to its weakest since August 2011...

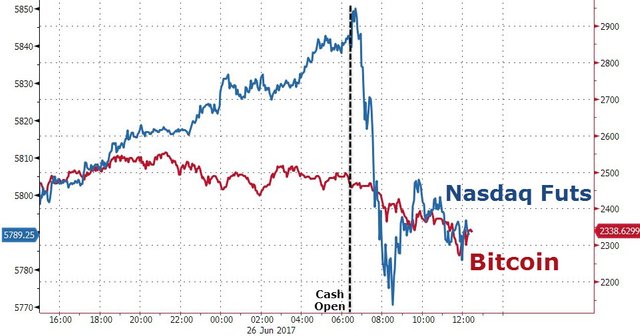

Then Nasdaq (led by FANGs) tumbled at the cash open after levitating overnight - oddly reactive to the tumble in Bitcoin...

Bitcoin was clubbed like a baby seal - down over 15% - the biggest drop since Jan 2015...

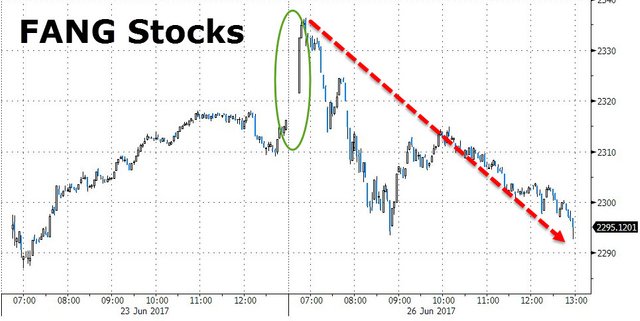

On the day, only Nasdaq closed red...markets closed weak (NOTE, the European close saw a buying panic reappear in Nasdaq briefly)

FANG Stocks fell most since the day after the tech-wreck closing NOT "off the lows"...

VIX was smashed back to a 9 handle...But as the chart below shows, it didn't help push stocks back up...

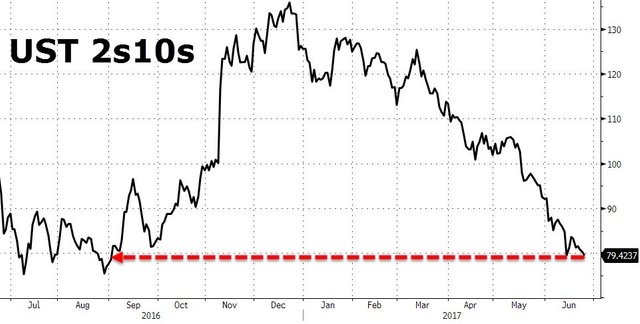

Treasury yields all fell on the day - even the short-end was bid in a very strong auction. The drop started on the dismal data early...

The Treasury yield curve slumped flatter once again with 2s10s dropping to a 78bps handle - lowest since Aug 2016

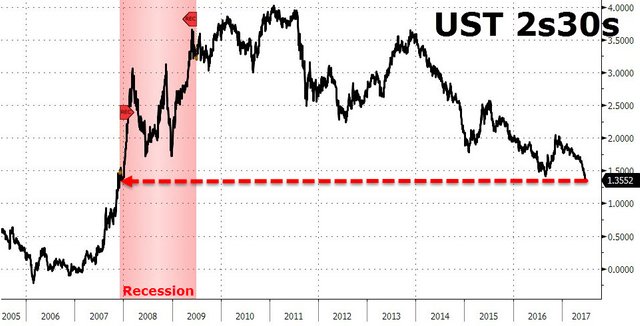

2s30s tumbled again to 134bps - the flattest since the last recession begain...

The Dollar Index roller-coastered to end the day slightly higher...

Yen was sold hard today (and Yuan weakened)...

Both Gold and Silver flash-crashed overnight but rallied on the weak US data...

On the bright side, WTI Crude saw a modest bounce today... testing below $3 briefly...

We note that while Bitcoin was battered today, it found support at its exponential trendline off March lows...

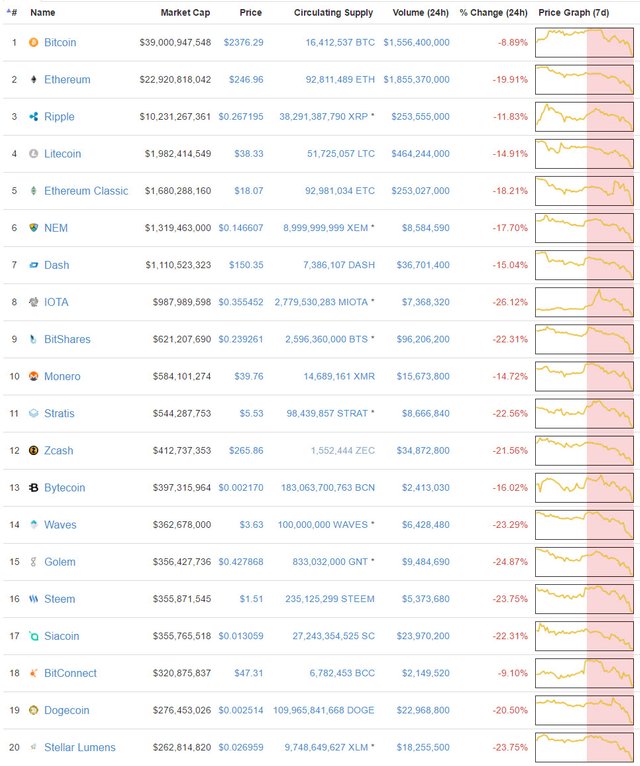

All 20 of the largest cryptocurrencies were deep in the red...

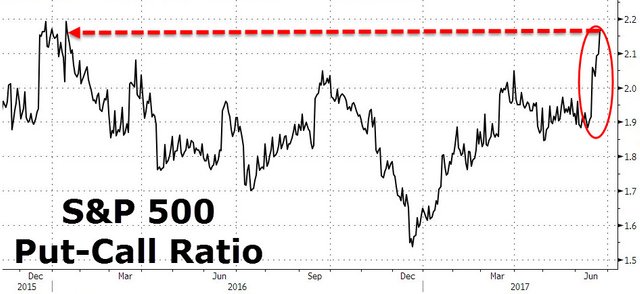

Finally, we note that at least one corner of the equity market might be getting nervous about the S&P 500 Index hovering near all-time highs. Options contracts that pay off with a drop in the benchmark gauge outnumber those betting on a gain by a rate of more than 2-to-1, the most since January 2016, according to data compiled by Bloomberg.

Since the start of the bull market, the S&P 500 has lost 0.3 percent in the 10 days following put-to-call ratios at or above the current level, compared with a 0.6 percent gain in all 10-day stretches during that period.

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

Its not the cryptos doing it, the monetary system is fucked and its going to fail

BTFD they say.

https://www.google.ca/search?q=btfd&oq=btfd&aqs=chrome..69i57j0l5.1223j0j1&sourceid=chrome&ie=UTF-8

buy the blood.

Thanks for your in depth Techincal Analysis, I don't wanna see BTC go bearish for the rest of summer. I am still pretty bullish and I would like to see a bounce on my chart here

Wait for autumn or if the bond bubble lets go... this is just noise in my eyes.... I blogged about this today...

Will take a look!

Very Easy !!!

Sideway cat-bounce formation, that's advanced TA right there.

Perfect video for whats happening today.....love it!!!

One person's bloodbath is another's party pool, if that person is a vampire or in this case using that opportunity to buy more Ether!

Much appreciated for bringing zerohedge to steemit, one less stop on my surfing journey.

You've been followed, upvoted and resteemed.

@zer0hedge you just got a new follower!!!

I like all the update for the day trading but how do you feel about the market long term? I would use the recent pull back as a buying opportunity in the crypto industry.

^^^UPVOTED^^^

Thanks for the info, i will buy as usual

Zero is the cat he doesn't give a..... hahaha

all i am seeing is buy buy buy :)

Thanks for depth Techincal Analysis.