Bitcoin Battered On Report Bitfinex, Tether Were Subpoenaed Last Month

Content adapted from this Zerohedge.com article : Source

Update 1440ET: according to the NYT's Nathaniel Popper, while the CFTC did subpoena Bitfinex and Tether -- the subpoena was delivered on December 6, not last week. Still, it is unclear where in the process the CFTC may be, and what it means for Bitfinex and Tether.

I've confirmed that the CFTC did subpoena Bitfinex and Tether -- though the subpoena was delivered on December 6, not last week, a source familiar with the matter told me. https://t.co/7dWhKLTwg2

— Nathaniel Popper (@nathanielpopper) January 30, 2018

Update 1255ET: Bloomberg reports that U.S. regulators are scrutinizing one of the world's largest cryptocurrency exchanges as questions mount over a digital token linked to its backers. This follows reports of the company severing its relationship with its auditor.

As Bloomberg details, the U.S. Commodity Futures Trading Commission sent subpoenas last week to virtual-currency venue Bitfinex and Tether, a company that issues a widely traded coin and claims it's pegged to the dollar, according to a person familiar with the matter, who asked not to be identified discussing private information.

The firms share the same chief executive officer.

"We routinely receive legal process from law enforcement agents and regulators conducting investigations," Bitfinex and Tether said Tuesday in an emailed statement. "It is our policy not to comment on any such requests."

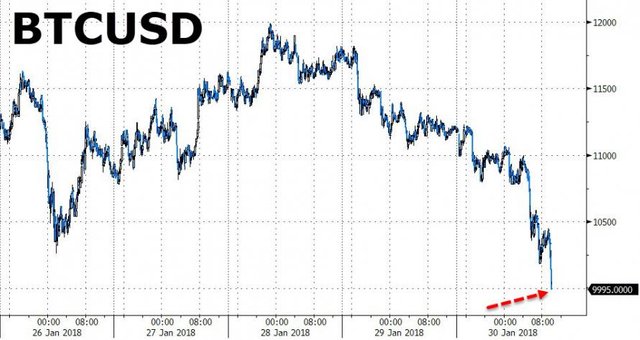

The reaction in cryptos was modest but lower as Bitcoin tumbled below $10k once again...

Could Bitfinex, the world's largest, Hong-Kong based cryptocurrency exchange, be headed for a Mt. Gox-style collapse? It's starting to look that way.

As we detailed here, when Mt. Gox first halted customer withdrawals in February 2014, it waited more than two weeks to admit the truth to its customers: that hackers had stolen more than $450 million of their assets, leaving the exchange bankrupt and them holding the bag. That hack effectively crippled the entire digital currency ecosystem, ushering in a two-year bear market that at one point carried the bitcoin price below $200, from what was then a record high north of $1,200 reached in November 2013.

So when another exchange engages in similarly shady behavior - withholding critical information about customer funds, or failing to produce audited financials despite promising to do so - it should prompt crypto traders to ask themselves why, with dozens, if not hundreds, of cryptocurrency exchanges operating around the world, they're choosing to do business with this one.

That's the question that customers of Bitfinex should be asking nearly two weeks after the exchange, once one of the world's largest, first revealed that it had been cut off from sending outbound dollar-denominated wires to its customers.

Of course, halting customer withdrawals isn't uncommon in the cryptocurrency world: All three of China's largest exchanges suspended customer withdrawals in February. And last year, Kraken, one of the biggest U.S.-based exchanges, suspended withdrawals temporarily because of a glitch in its trading software. But this freeze is particularly troubling because, like Mt. Gox, Bitfinex inexplicably decided to wait before informing customers of a critical problem. It also has implications that stretch beyond the bitcoin market, to another cryptotoken called tether that was launched by Bitfinex back in January 2015, and has since been dogged by allegations that it's a scam.

The halt is already costing Bitfinex's customers money. On Tuesday, bitcoins were going for $1,547 on Bitfinex's platform, a premium of more than $100 over most of the other popular exchanges. Investors, apparently, feel that eating a 7%-8% loss is preferable to leaving their assets in Bitfinex's care any longer.

Reddit users reported that wire transfers requested as early as March 9 were cancelled, and that the exchange offered only vague excuses as to why. It took the exchange until April 13, after it had filed a lawsuit against Wells Fargo & Co., whose correspondent banking division had effectively shut Bitfinex out of the global financial system, that the exchange disclosed the problem to its customers.

And while Bitfinex has repeatedly said it would make things right - it has promised to either establish a new banking relationship and to allow customers access to other fiat currencies - only a handful of customers have been able to get their assets out of the exchange.

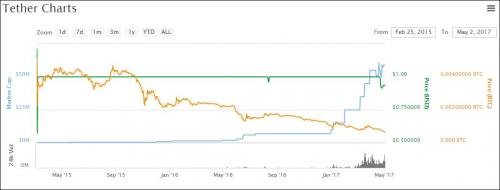

As part of the freeze, Bitfinex has established a moratorium on cashing in tether tokens held by its customers. These tokens were created by Bitfinex in 2015 to allow customers to exchange an asset that's pegged to the dollar at a one-to-one ratio, allowing them to avoid costly wire transfers that must be processed through the banking system.

But the withdrawal freeze has put pressure on the tether market; for only the second time since they were introduced, investors are selling these tokens at a discount. The price of a single token has been languishing below the $1 level for more than a week.

More troubling still is that Bitfinex has so far refused to provide an audit of the fiat funds that allegedly backstop the tether float, despite promising that it would be "fully transparent and audited to demonstrate 100% reserves at all times" when it first launched the token.

This has lead some to speculate that the exchange could be commingling tether funds with other customer assets.

While evidence of this could cause irreparable damage to Bitfinex's reputation, leading to a wave of withdrawals that could add further strain to its already thinning bitcoin reserves, as Twitter user @Bitfinexed points out, it's not technically a violation of the tether terms of service.

Here's an excerpt: "There is no contractual right or other right or legal claim against us to redeem or exchange your tethers for money. We do not guarantee any right of redemption or exchange of tethers by us for money. There is no guarantee against losses when you buy, trade, or redeem tethers."

Given the preponderance of scams in the cryptocurrency market, investors who haven't already, should probably take what's left of their money and run, if they can of course.

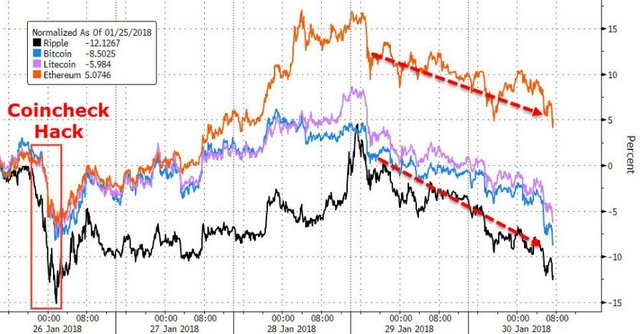

Having bounced back from the Coincheck-hack crash, cryptocurrencies are extending yesterday's ugliness today and accelerating to the downside...

Bitcoin is back below the Coincheck crash lows...

There are no clear catalysts for this drop.

Deutsche Bank executives have suggested that** "governance" that will legitimize crypto investments could exist in "five to ten years."**

Originally speaking in an interview with Bloomberg on Monday, Jan. 29, Mueller cautioned against current investment in cryptocurrency as only for those "who invest speculatively" while appealing for businesses in the sphere to work together with regulators.

"Once security and the corresponding trust have been created, cryptocurrencies can be assessed and evaluated like established asset classes," he forecast.

"It's possible that the required governance will be in existence in five to ten years."

Deutsche Bank has traditionally taken a bearish view on cryptocurrencies as prices rise, cautioning in December that a major fall in Bitcoin was being "discounted as a small issue" by financial markets.

The lack of volatility in traditional stocks was driving investor interest in more risky assets such as Bitcoin, fellow Deutsche Bank analyst Masao Muraki determined in a note mid-January.

"Now, a growing number of institutional investors are watching cryptocurrencies as the frontier of risk-taking to evaluate the sustainability of asset prices," he wrote.

Germany continues to fall behind in its treatment of cryptocurrencies at consumer level, providing a stark contrast to initiatives in other countries, such as neighboring Switzerland.

Earlier this month, the country's central bank director nonetheless precluded comments from UK and US lawmakers at the World Economic Forum 2018 that regulation of cryptocurrency should be a joint international effort.

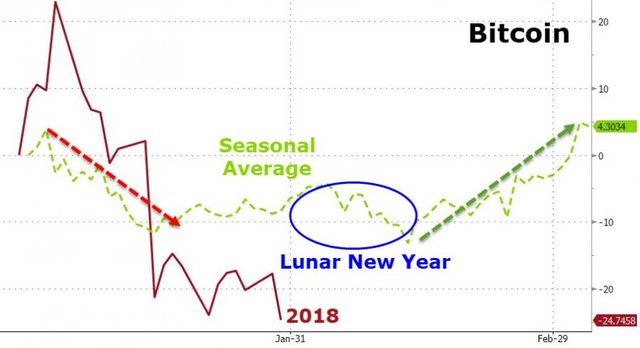

As a reminder this early-year weakness in crypto is not unusual...

_As CoinTelegraph notes, _the lead up to Chinese New Year is one of high spending as people book all sorts of travel and holidays, not to mention buy presents. Thus, just like Christmas and December is a time for spending in the West, January has a similar pattern in the east.

With Bitcoin's value almost halving from $20,000 in the middle of December to $10,000 at its worst in January, Wallin is both unperturbed or surprised.

_"The January drop is a recurring theme in cryptocurrencies as people celebrating the Chinese New Year, aka Lunar New Year, exchange their crypto for fiat currency," _explains Alexander Wallin, CEO of trading social network SprinkleBit, as quoted by Bloomberg.

"The timing is about four to six weeks before the lunar year when most people make their travel arrangements and start buying presents," he added.

The holiday takes place on Feb. 16; however, the build-up is where people start to spend their money. And with the Chinese population heavily vested in Bitcoin, it has a huge role to play on the movement of the market.

The thoughts are that people have been taking their profits into the build-up of the New Year, turning their Bitcoin into fiat currency to use for gift buying.

These centralized exchanges are turning out to be just as slimy as the banskters. Bitfinex and JPMorgan seem to have many similarities. I guess the currency can change but the game is still the same.

In the end, we will need to move this all to decentralization. There simply is too much theft and dishonesty when all this is centralized. Either the players are greedy/corrupt or the system itself is that way.

In the end, everything has to be moved to blockchain to avoid these situations. Imagine all the crypto trading done on decentralized exchanges. Then, nobody would have any questions....the accounts could be seen yet the keys were held by the individuals.

Let us hope this turns out for the best. We know the media is salivating at the prospects of really sticking it to the crypto world.

I hope bitfi is fine! Too much money there, this will be a mt. gox 1/2 crash - we dont need this.

lol, come on... these exchanges are ... wtf. I guess the transition to decentralzied exchanges will happen even faster than I thougt. Unfortunately if something happens to Bitfinex, it will be far more signifacnt than coincheck. Let's hope it will be fine, lol.

This news didnt help the price of bitshares any.

I guess we will have to see how many of these stories come out until people start to realize the value of decentralization in all things, especially exchanges.

To me, it appears they exchanges are acting like the banks do....no regard for anyone's money...as long as they get their cut, that is all that matters.

I, like you, and still wondering how coincheck plans on paying back $500M....who has that kind of cash laying around?

I certainly dont expexct coincheck to have it! I think people dont realize what exactly decentralized exchanges are. Maybe we should write an article or two on the matter for awareness.

Although Bitcoin experienced momentary fluctuations following the approach of 20 thousand dolars, there was a steady decline in overall picture. On the other hand, no one expected Bitcoin to rise so fast. Nevertheless, according to expert comments, after a rapid rise, Bitcoin's rapid decline was not foreseen. After declining today, the balloon expressions came to mind about Bitcoin, which dropped below 10 thousand dollars.

In general, as the investment made in Bitcoin grows, the value increases and vice versa, but the value starts decreasing. Tether and Bitfinex, the world's biggest cryptographic cryptography companies, are accused of causing all Bitcoin investors to turn around and lose value.

I think that Bitcoin will continue to lose value when considering living conditions. Nouriel Roubini, who has become the world's top economist with many guesses about the crisis, said that Bitcoin values are inflated and will experience 80% depreciation without this support.

I also think that the lawsuits and rumors going on will continue to depreciate as coward investors will move away from the favorite crypto currency. Well, do you think people who are waiting for your long-term investment will be profitable?

bitcoin is the future

Despite all this however decreased will rise again

Trading volumes fell sharply as investors became more cautious in trading encrypted digital currencies for a higher risk-to-return ratio

What are encrypted digital currencies like Bitcoin, and many other currencies? And why most traders chose

The digital currency market needs a strong push to continue rising prices

Continued selling in the digital currency market has led to lower prices for technical support levels, and investors who want to buy are still reluctant to enter or trade the digital currency market again. Despite the heavy losses last week, we are seeing a further decline and a decline for most of the digital currencies at a high rate, as this decline occurred in markets other than digital currencies, this became the news in most headlines. Volumes have fallen sharply after the negative news about the digital currencies in South Korea and China, indicating that most traders now stop trading the digital currency until more market prices stabilize and fluctuate, then a construction period will be renewed and traders will be optimistic but mostly will happen This construction is at lower levels than now.

Bitcoin price is stuck between two levels Fibonacci

Bitcoin is currently trading at 61.8% Fibonacci at $ 10,971 at the same level as bitcoin prices are rising strongly in mid November to mid December, so bitcoin will need continuous highs to reach its highest level and the next bullish move will start. On the downside, 78.6% Fibonacci correction at $ 8.523 will be the next low price level and will certainly affect investors' desire to trade now. A break of 78.6% Fibonacci will open the next level at $ 5406 The beginning of the recent bullish trend.

Do not fear me bitcoin the best and will stay as well. @zer0hedge

Qin Block Technology

Decentralization is inevitable

Are you still masquerading this news,

bitcoin Xapo and a board member at PayPal, provide compelling predictions regarding the value of the bitcoin currency over the next decade. Where he spoke at the 2017 Conciliation Conference in New York. He delivered a speech at a dinner organized by the bitcoin and blocin group pro-currency center, his speech was a lightning strike.

Since the dinner was not attended, and no video was found to speak, some snippets were taken from his online commentary. He highlighted the currency of bitcoin, where Casares saw that "the Internet has no currency and is in desperate need of one", drawing attention to the most popular encrypted currency in the world.

He also told the audience: "[The biggest mistake will be buying more bitcoin currency than you can afford to lose. But the biggest mistake [too] is not owning any bitcoin currency. "

"Put 1% of your net income into the bitcoin coin and forget it for 10 years," Casares said.

His speech also included the prediction of the encoded currency, that one of the bitcoin currencies would be worth $ 1 million by the next ten years.

As long as Casares was a pioneer in the technology business. He was the first founder of the ISP in Argentina, as well as one of the first promoters of the bitcoin currency. He also launched the retail bank in Brazil before the recent launch of the bitcoin Xapo portfolio. In early 2016, Casares joined the board of PayPal, where he was described as "the next generation leader of payment methods and currency coding ideas."

However, the Casares forecast has sparked controversy among the most bullish forecasts for bitcoin currency prices so far. He was also predicted by both financier Chat Jeremy Liu and Plucheen CEO Peter Smith that bitcoin currency prices would reach $ 500,000 by 2030.

My future traders. @zer0hedge

Any report that can show cryptocurrancies as being unstable and prone to hacks or scams is going to make big news - it's going to make people worried about the safety of their money and whether it's a good thing or just someone trying to take what they have worked hard for.

Moving everything to decentralised exchanges and having transparency can only be a good thing, it would help alleviate some of the fear that cryptos hold for so many

Germany continues to fall behind in its treatment of cryptocurrencies at consumer level, providing a stark contrast to initiatives in other countries, such as neighboring Switzerland.

very sad to see

The digital currency market needs a strong push

The world's most popular electronic currency, Petcown, continued its downward spiral last Friday, losing about 5 percent of its value on Wednesday morning, losing more than 16 percent of its total value over the past few days amid fears that China A decision to ban the circulation or dealing with them, which constitutes a severe blow to them.

The currency of the "Petcoin" to less than four thousand dollars during the trading Wednesday for the first time in weeks, after the price of last Thursday had exceeded the $ 4700 dollars in the markets, thus losing more than 16% of its value within four days of Trading only.

A good kick in the nuts will be good long term for cryptos. The hype from say, November till now was like taking the entire dot com hype, boiling down to condense it, then shooting that right in your arm. BTC was jumping $1k per day, $2k per day. People were giddy. Everything got a bid. Supermodels and Evander Holyfield started pimping tokens. ICOs were the daily thing. It was like wonderland.

That is not sustainable nor healthy for something that many hope would come to compete with the current fiat system.

So a drop down to $5k for BTC, a shakeout of weak hands, and the implosion of many of the shady shops will help cryptos in the long run. Much healthier to have that then keep up with the current moonshot trajectory, which would guarantee a spectacular explosion, thus ending the cryptocurrency experiment.

pods @zer0hedge