Australian Banks Reportedly Freeze Accounts Of Bitcoin Users

Content adapted from this Zerohedge.com article : Source

Adding to the pressures on bitcoin early this morning, the Sydney Morning Herald reported that bitcoin users across Australia are reporting that their accounts have been abruptly frozen by the country's "Big Four" banks. And while the banks have remained largely tight-lipped about the closures, many angry account-holders are jumping to conclusions and blaming the banks for punishing them because of their involvement with bitcoin.

Bitcoin investors are claiming Australia's banks are freezing their accounts and transfers to cryptocurrency exchanges, with a viral tweet slamming the big four and an exchange platform putting a restriction on Australian deposits.

According to the Herald, cryptocurrency trader and Youtuber Alex Saunders called out National Australia Bank, ANZ, the Commonwealth Bank of Australia and Westpac Banking Corporation on Twitter for freezing customer accounts and transfers to four different bitcoin exchanges - CoinJar, CoinSpot, CoinBase and BTC Markets.

So @NAB @CommBank @WestpacNZ and @ANZ_AU are all freezing customer accounts and transfers to @BTCMarkets @coinspotau @GetCoinJar @coinbase . #Banks can fight it, but people want control of their money #ausbiz #auspol

— Nugget's News Australia (@nugget_alex) December 28, 2017

In response, some users complained that their activities with the cryptocurrency had still been described as a "security risk" by their financial institutions.

While not every bank had explicit policies governing their relationship with cryptocurrencies, according to the Morning Herald, Commonwealth Bank's June 2017 terms and conditions for CommBiz accounts specifically excludes this activity, saying it can refuse to process an international money transfer or an international cash management transaction "because the destination account previously has been connected to a fraud or an attempted fraudulent transaction or is an account used to facilitate payments to Bitcoins or similar virtual currency payment services".

A Commonwealth Bank spokesman said it was receptive to innovation in alternative currencies and payment systems "however, we do not currently use or recommend any existing virtual currencies as we do not believe they have yet met a minimum standard of regulation, reliability, and reputation compared to other currencies that we offer to our customers".

"Our customers can interact with these currencies as long as they comply with our terms and conditions and all relevant legal obligations," he said.

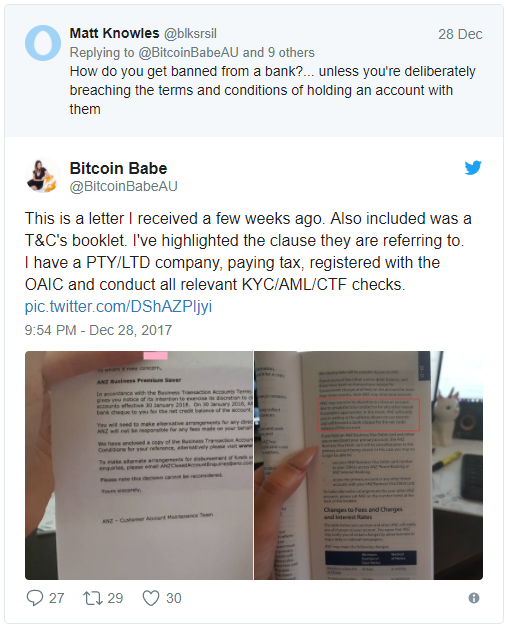

One Twitter user, Michaela Juric, who is known on twitter as Bitcoin Babe, said she had business accounts closed by 30 banks and posted a picture of a letter from ANZ, saying it was closing her accounts effective 30 January 2018 in accordance with its terms and conditions.

This is a letter I received a few weeks ago. Also included was a T&C's booklet. I've highlighted the clause they are referring to.

I have a PTY/LTD company, paying tax, registered with the OAIC and conduct all relevant KYC/AML/CTF checks. pic.twitter.com/DShAZPIjyi— Bitcoin Babe (@BitcoinBabeAU) December 29, 2017

The bank's sudden decision to close the accounts of digital currency investors was not totally without warning: CoinSpot said it was putting a "temporary restriction on all forms of AUD deposits" that would remain in place until at least the first week of 2018 as a result of issues with Australian banks.

"We assure you we are just as unhappy with the situation as you, but unfortunately Australian banks have been so far unwilling to work with the digital currency industry which leads to frequent account closures and strict limits on accounts whilst they remain operational, in effect debanking our industry," it said.

CoinSpot founder Russell Wilson said he was not aware of any new widespread issue, but was "monitoring" the situation.

"We are aware that on occasion banks will freeze payments while they clarify with their customers that the funds were not fraudulently sent from their account, this is standard best practice for the banks and protects everyone," Mr Wilson said.

Meanwhile, representatives at the major banks offered some version of "no comment" to the Herald.

A Westpac spokeswoman would not comment on specific instances, but said it had controls in place to "actively verify the identity of our customers and monitor the activities of those customers".

"Where we cannot verify the origin of transfers we may act to ensure we comply with Australia's anti money laundering obligations," she said.

A NAB spokeswoman said it was important to note the currencies are currently unregulated.

"While we don't support unregulated currencies, NAB does not deny the right of individual customers to buy virtual currencies," she said.

CoinBase, CoinJar and BTC Markets did not respond to request for comment.

While much of the carnage in bitcoin this morning could be attributed to the ongoing rotation into Ripple, it's important not to ignore the impact of this news. If more banks around the world start closing the bank accounts of bitcoin users and bitcoin-related businesses, it could negatively impact the price as marginal buyers, worried about being shut out of the banking system, go running for the hills.

The war is just beginning. This trend is already underway in the USA, where some bank managers are outright telling their clients not to use Coinbase.

The arrogance of these bankers is breathtaking: https://steemit.com/news/@techwizardry/banks-are-now-ordering-cleints-not-to-buy-bitcoin-from-coinbase-com

This is no surprise unfortunately.

The banksters are going to fight the idea of cryptocurrency at every turn. Actions like this only awaken some people to the power the banksters hold and the lengths they are willing to go to. For this reason, people need to seriously consider getting their money out of the traditional banking system.

What is ironic is the banksters might be shooting themselves in the foot. They think they are stopping the flood but they are actually opening it up.

In the US, with the fractional reserve system, every $1 that is withdrawal affects another $9 on the banks lending side. While crypto buyers dont make up a lot at this point, whatever the percentage is multiplied 10 fold.

I got most of my money out already but I still have a bit more in there...need to at least move it to a credit union.

"First they ignore you, then they laugh at you, then they fight you, then you win." Mahatma Gandhi

The banks don't want to allow us to cast off the shackles of financial oppression and free ourselves from wage slavery. We gave the banks their power, we have the ability to take away.

As for the Australian government being worried about or overseeing our spending. When you spend $49billion on a subpar National Broadband Network (complete by 2020), when you spend $250,000 per person per year imprisoning refugees, when you spend $122m on a same-sex marriage plebiscite when public sentiment is already clearly in favour of the "yes" vote. You lose the privilege of being able to tell me what to do with my money.

Fish

They still have the guns and you don't. So don't be over confident.

Watch Tehran over the next week if you want to see what happens when a critical mass of "we're pissed off and not going to take it any more" type of folks, by a large majority, go up against the guns and iron and prisons of the ruling government,

So we should give up? Besides, Australia and Iran are two vastly different countries.

You might want to. I've heard the local flora and fauna are very dangerous in your home country.

I am assuming that the banks involved have the 'legal' power that they need to freeze these accounts but I am also wondering what is going to happen when the accounts are unfrozen, can they refuse to do business with them ?

Whilst Bitcoin is not new it is also not as widely accepted as paper money be it dollars, euros or pounds, and most companies will not accept it as payment. Until such a time as the almighty dollar is not so mighty anymore we need banks as a way to pay bills, receive wages, buy goods - as much as we might fight the idea we do still need them at least for the moment and that is what they are holding onto - us needing them

If the Australian banks are freezing accounts how long will it be until other big banks decide to do the same, after all when Bitcoin becomes an everyday way to pay for things then there are going to be more than a few banks going under

I just hope that by the time they start cutting the crypto to fiat flow, the effect will be to push people further into crypto.

We could use some more time.

Awesome Post Everybody knows how much you like me so much that I can learn and learn many things every day looking at your post and I think your posts will be of great help to us and so I invite all my steemit friends. Thank you for posting the post

This is why we need to promote things like ATMs, Local Bitcoins, Bitshares etc. STEEM is also a great starting point for anyone as they don't really need a bank acount to get into STEEM. Hopefully these people would consider using mining rigs.

I'm sure the free market would be interested in setting up miners and selling those cryptos to Australians on a premium.

I've heard many great things about http://uphold.com/ and I think more people should start using these decentralized services. I'm not the biggest fan of Genesis Mining, but you could use it as an option too. I've written about it here. You can use the code __PL3Qx6 __ for a 3% discount if you like.

Here is another excellent link: https://www.dashous.com/?query=Australia

You can also spread the word about https://bisq.network/

This is a fight we can win. War against cryptos will make war against drugs look like a massive success. Spread the word about decentralization. We don't need banks even though the banks need us.

I heard this

A Commonwealth Bank spokesman said it was receptive to innovation in alternative currencies and payment systems "however, we do not currently use or recommend any existing virtual currencies as we do not believe they have yet met a minimum standard of regulation, reliability, and reputation compared to other currencies that we offer to our customers".

Bitcoin is still illegal in most countries in the world. Because of which every country is taking position against the government.

this post very nice..bitcoin is the best coin...thanks for sharing bitcoin news...best of luck...

Best coin by what standard? It is actually more of a dinosaur at this point than anything else. BTC is myspace.com; about 4 years before FB showed up.