Some stunning longer term Fibonacci projections

The bitcoin monthly chart shows a clear impulse up and we've not even completed the longer term wave III with, of course, waves IV and V to follow. We are simply in a wave 4 triangle-like correction, within that larger bull market, that has many years to go. Seeing the longer term picture it becomes obvious that the current correction is really nothing out of the ordinary and in time we'll look back on it with a smile on our faces.

However, not all coins will move up equally fast. Some will disappear all together. Many of the older coins for instance, the ones that had a spectacular rise already, display an almost perfect Elliott Wave impulse pattern that, in contrast to bitcoin, has already completed. In addition, they have by now corrected back to wave 4 of the previous motive wave, which is the textbook target for a correction in an impulse move; promising therefore another impulse up - in fact that will then be a larger time frame wave III with dizzying target levels.

The standard target for a wave III move is 1.618 times wave I.

Let´s look at a couple of them.

ETH

Ethereum 1.618 wave III target hovers around 1750$ for a percentage rise of 775%.

ETC

Ethereum classic, now at $9.154 can go to $85 for a rise over 800%.

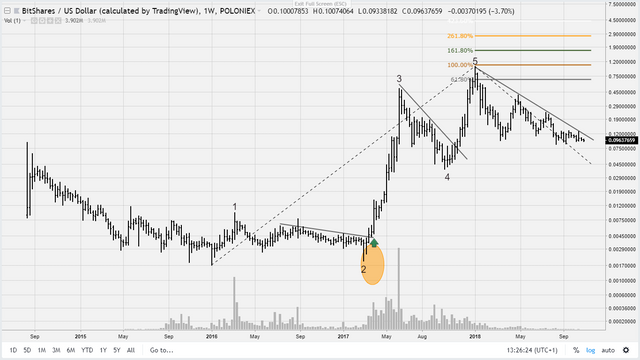

BTS

Bitshares has a 1.618 target of around $1.75 for another 800% profit from the current level.

But we don't have to stay so modest as there are more promising ones.

OMG

Omisego is now at $3.21 and can go to $48 for a 1390% profit

WAVES

Waves has a 1.618 target of $33 for a 1678% rise.

WTC

Walton coin: target $78 for a 2290% rise.

STRAT

Stratis has target of $40 for a 2400% rise.

BURST

Burst should go down a bit more after which the 1.618 target will be around $0.24 from the current $0.008 scoring a plus of 2900%.

XEM

Nem Economy Money, following the standard 1.618 Fibonacci target for a wave 3, should go in an extended wave III to ca $3.5. From the current level of slightly over $0.09, that is a meteoric rise of 3788%.

That's a lot of profit.

How about Steem and EOS?

Thanks!

Steem, if the impulse runs as below, has a 1.618 target of $15.50

For EOS we're looking at a 1.618 target of $34, again, if the impulse is as below

Good charts let's hope that this corection ends soon and so we will enjoy profits again.

Posted using Partiko Android

Congratulations @youp! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

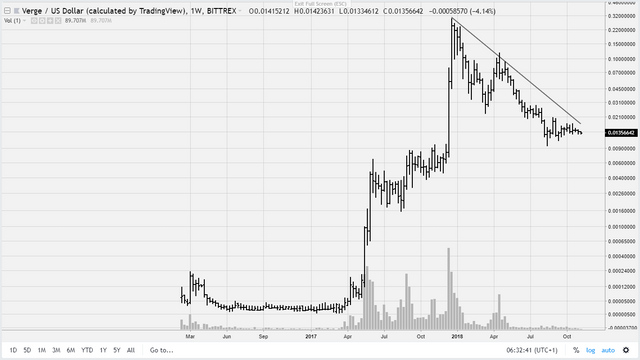

Any thoughts on XVG & TRX?

For Verge I cannot count a five wave but it does look impulsive with a correction now.

Tron doesn't have enough data. The most I have is on Bitfinex which started January 2018 - so, during the correction. As said before, if the rest goes up this will too. Tron missed the strong move into December/January. Therefore no Elliott count can be made.

Very interesting thank you!

I’ve seen other EW analysts do Trx & Xvg.

Not experienced enough to understand how they see enough info & perhaps you disagree..

In those examples they see very impressive looking price predictions ahead, somewhat similar to your other ones here.

Great analysis!

What about XRP and TRX?

Ripple is interesting. I found I have the most data on Poloniex and while the start in 2016 is wobbly to say the least, I can distill a five wave, a correction and breakout from that correction. I personally added to my position on that breakout; today was a good day ;)

1.618 target around 5.5$. But I'm not sure to what extent a regular target for stocks, ccy & bonds can be trusted for crypto. In other words: could go much higher. But then, with a total amount of coins in circulation of 100 billion, that would mean an enormous market cap. To be continued...

Many thanks!!

Thanks for this! really help for keeping faith in cryto =]

How about Neo?

NEO is also a bit short on data, but they all move in tandem: a strong move up in 2017 with a correction in 2018. Depending when the coin was introduced they either corrected back to the starting point or somewhere halfway the previous rise. What is very important is that the correction is a sideways pattern, meaning it is a correction within a larger uptrend. Therefore another impulse up has to be expected and that impulse will make new highs. That is presuming the Elliott Wave theory has some value to it, which, certainly in hindsight, it usually has.

Thanks for that! =]

Congratulations @youp! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: