Frontrunning the S2F model

The breakout out of the correction seems confirmed.

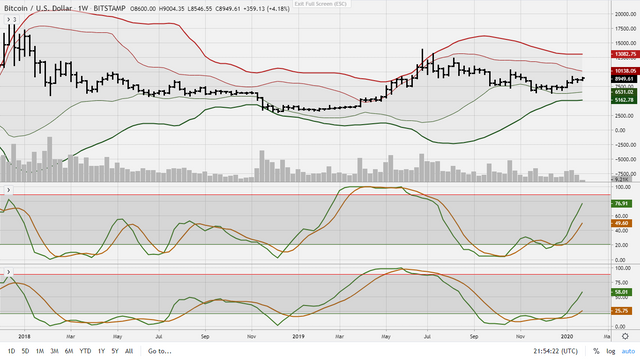

Please note that we are above the weekly 21 SMA, 21 EMA and 21 WMA, which tend to contain the weekly trend; as can be easily seen in the above chart.

Currently, my preferred count looks like above which would lead to a wave 2 finishing end of March, beginning of April, when also in 2019 and 2017 we saw the start of a solid uptrend. Maybe there is a seasonal effect in crypto.

The OBV looks strong, both on the weekly and the daily chart: money is flowing into bitcoin.

Both the weekly and daily stochastics have enough space to the upside. There does seem to be serious resistance around $10k, where also an important previous resistance level rests.

I managed to close half of my put options for a 50% loss and I'm going to let my futures run until we get something of a pull back; when it'll be time to add to the position. It's looking very good and - quite comforting also - we still seem to be following the S2F model which predicts significantly higher prices after the coming halving in May. Prices are frontrunning this affair.

Great analysis, thank you 👍

I'm with you with the preferred count.

I know, I've seen your count. They're more or less the same.

But usually something else happens