This Could Be Bitcoin's "Netscape Moment"

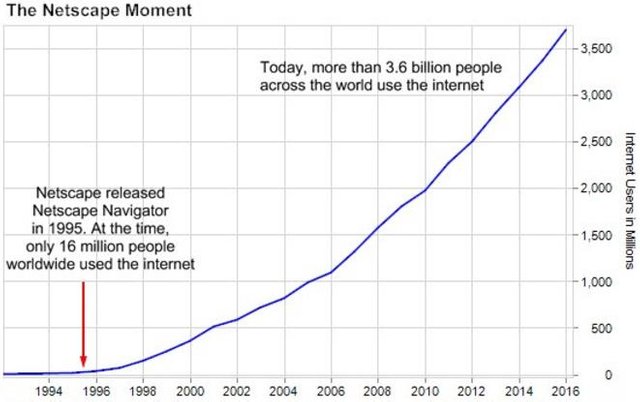

On August 9, 1995, the internet had its “mainstream” moment.

That’s when Netscape held its initial public offering (IPO) and released its web browser, Netscape Navigator, to the world. At that point, the internet had already been around for 15 years. Yet despite being one of the greatest inventions in history, the world was slow to adopt. In 1995, only 0.3% of the world’s population used the internet.

The internet needed a catalyst. And looking back, it was Netscape. The numbers back it up. In 1995, there were 16 million internet users. Then Netscape Navigator came along. By the end of 1996, the number of internet users had more than doubled to 36 million. And five years later, we reached over a half-billion users.

That’s growth of over 100% annually.

The success of the IPO inspired the term “Netscape moment.”

Today, we use the term to describe an event that signals the dawn of a new industry. I believe we’ve already had our Netscape moment for another technology: bitcoin.

Now, it’s incredibly difficult to make predictions, especially without the benefit of hindsight. And I might be wrong. Nevertheless, today I’ll tell you which key event over the past two years was bitcoin’s Netscape moment.

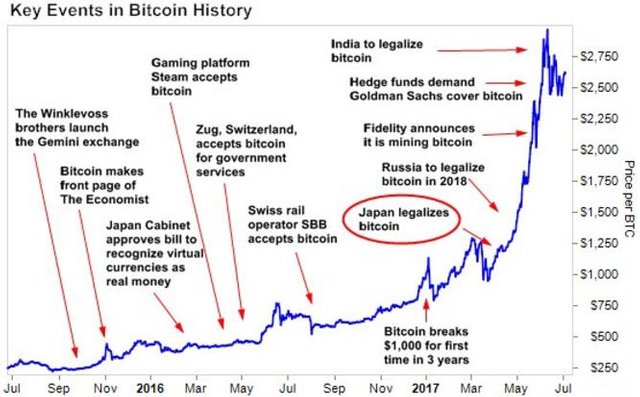

Bitcoin Is Like the Internet in 1995

Today, the number of bitcoin users is estimated to be between 15 million–35 million. We’ll split it in the middle and call it 25 million. That’s 0.3% of the population… similar to the number of internet users before its Netscape moment. Like the internet in 1995, bitcoin continues to gain popularity. The chart below highlights the key events of the last two years.

To me, one event stands out as bitcoin’s Netscape moment.

That’s when Japan legalized bitcoin.

Bitcoin’s Moment

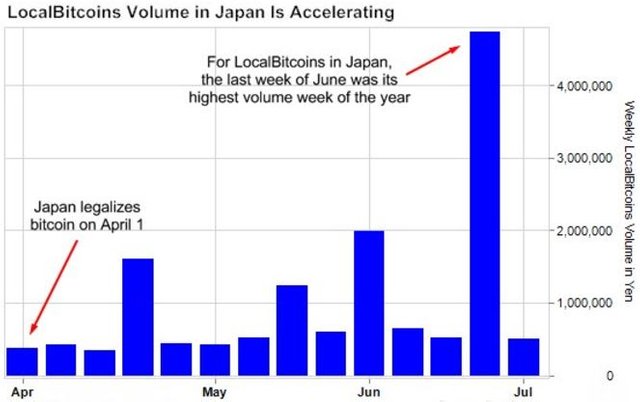

Since bitcoin was legalized, here’s what has happened in Japan:

- More than 260,000 stores in Japan are rolling out bitcoin as a payment method.

- Stores at famed electronics marketplace Akihabara have started accepting bitcoin.

- Japan is setting up a bitcoin “testing hub” for fintech companies.

- Leading Japanese bitcoin exchanges have unveiled plans to accelerate adoption.

It’s all leading to increased usage of bitcoin in Japan. Volume on LocalBitcoins has accelerated since the law went into effect. And it had its highest volume week of the year the last week of June, topping 4.7 million yen (about $42,000).

Tokyo’s Sushi-Bar Numazuko Ginza 1st is an example of the growing popularity of bitcoin in Japan. The restaurant was one of the first to accept bitcoin payments.

The restaurant’s manager said there were only a few bitcoin payments per month two years ago. By March 2017, that number increased to about 70.

This quote from the restaurant manager sums it up best: “Japanese customers are using bitcoin more than we expected.”

How to Profit From the “Bitcoin Moment”

I think we’ll look back at Japan’s legalization of bitcoin as its Netscape moment.

Every day, millions of people are working on bitcoin to make it better. And its acceptance will only rise from here.

And just recently, South Korea announced it will regulate and legalize bitcoin. The trend that started in Japan continues unabated. The best way to profit from this trend is simply to buy bitcoin.

Best Regards

from Palm Beach Group

Good article. It just shows that whatever people thinknof the Alts, at present they have no real application, purpose or prescience. If people are aware of any crypto its bitcoin and anyone accepting crypto as payment will be accepting bitcoin.

I agree that BTC is the "known" crypto at the moment but I disagree with your comment that the alts have no real application. When you have things like the EEA in action, you know there is serious money behind ETH's application(s). The ICO'ed companies of recent, there we have agreement about real application.

I agree ethereum has real application as does steem but the vast majority of Alts do not. There are around 900 Alts at present and most are just clones with a few variables adjusted. Ultimately they need real world applications otherwise they will remain vehicles of speculation and effectively betting tokens.

Totally agree with this. Its similar to IPO companies in the equity market. 10% will survive long term (maybe less). The 900 will grow but the top 10 are relevant as those are the Blue Chips.

As I continue to read and re-read this article I cant help but continue to nod in agreement btw.