The Bitcoin Halving is Over: What’s Next?

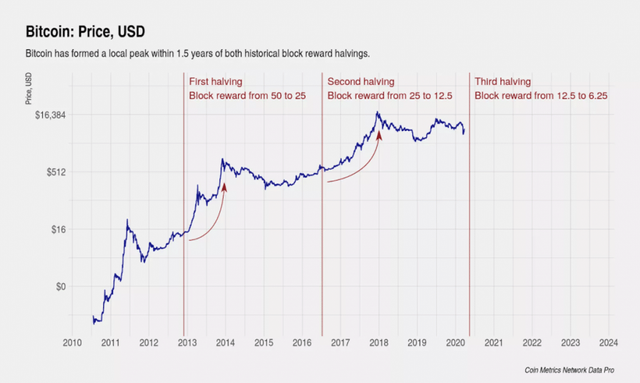

- In the past, halvings have preceded surging Bitcoin prices by 12-18 months. Will this time around be any different?

After weeks, months, or perhaps even years of anticipation, the Bitcoin halving is over. As of approximately 3:21 p.m EST, the Bitcoin mining reward was cut in half, falling from 12.5 BTC for every block of transaction data that was added to the network to 6.25 BTC; the number of BTC produced each day fell from 1800 to 900.

Despite the massive news cycle that surrounded the halving event, the price of Bitcoin has managed to stay relatively stable over the last 24 hours.

However, with all of the narrative buzz surrounding whether or not Bitcoin’s price will increase as a result of the halving, many are asking: what comes next?

BTC’s immediately pre- and post-halving price movements are par for the course.

For most of last week, BTC began a steady ascent from $9,000 to around $9,600. On Sunday, the price of Bitcoin suddenly dropped from roughly $9,640 to around $8,650, where it has more or less remained until press time; around the time that the halving occured, there was a brief push just about the $9,000 mark.

Jose Llisterri, co-founder and chief product officer at cryptocurrency derivatives exchange Interdax, explained the price movements this way:

“the price of bitcoin and the halving was a case of ‘buy the rumour, sell the news’, with the price increasing in anticipation of the event as optimism among investors grew,” he said.

“However, just prior to the halving, the price has fallen as the block subsidy is halved.”

Interdax co-founder and Chief Product Officer Jose Llisterri.

The “rumor” that Llisterri was referring too is likely the narrative that Bitcoin’s price will increase following the halving. After the two halvings that have taken place in the past, Bitcoin’s price has seen a sizable increase in the 12-18 months that follow; analysts who support this theory say that this happens because of increased BTC scarcity.

BTC’s post-halving price boost could take months (or years) to arrive–and when it comes, it might not stay.

However, if the post-halving price boost does eventually come, it will likely be at least a year before it begins. Therefore, the “news” that Llisterri is referring to is likely the halving in actuality: a significant event, certainly, but one with consequences that won’t be fully realized for months, even years.

It’s also important to note that historically speaking, the price increases that Bitcoin experiences in the time after halvings are not linear: in the past, the price of Bitcoin spikes somewhere between 12 and 18 months after halvings occur; after that point, the price of BTC steadily falls for months before eventually bottoming out and, finally, recovering.

The key, however, seems to be in where the bottom is–sure, the post-halving spikes in the price of 2017 are impressive (late 2017, anyone?), but they certainly don’t last; some could even argue that because of the damage they do to BTC’s reputation (and the unwitting investors that they inevitably burn), that these spikes do more harm than good.

But after the spikes are over–after Bitcoin has spent months falling, and falling, and falling–the post-halving price floor has been much higher than the pre-halving price ceiling.

In the past, this cycle seems to have taken somewhere between two and three years: the halving occurs, and then 12-18 months later, there is a massive spike in the price. After the spike passes, there’s a price decline that lasts another 12-18 months; then, in the remaining months before the next halving, an upward trend begins to form. The process then seems to repeat itself.

When will the post-halving price peak come?

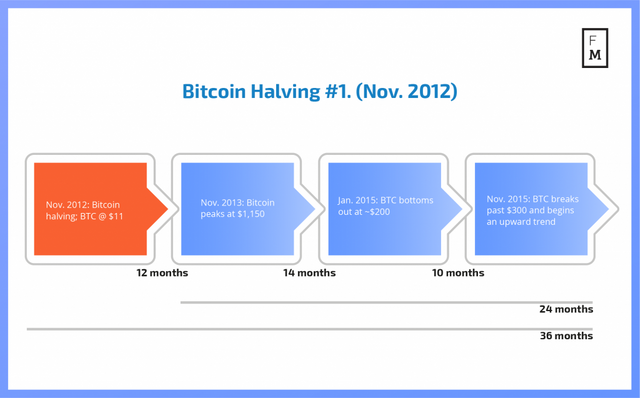

For example, the first Bitcoin halving, which occurred in November of 2012, resulted in an increase from about $11 to a peak of nearly $1,150, but it took 12 months–the second figure wasn’t reached until late November of 2013. Even then, the high was short-lived; by mid-December, the price had crashed down to nearly $500.

In fact, the price continued to fall throughout 2014 and into 2015; it bottomed out around $200 in January of 2015 (14 months later), and stayed between $200-$300 until late October of that year.

It wasn’t until early November of 2015 (24 months after the $1,150 peak, and 36 months after the halving) that Bitcoin was able to break past the $300 point; by the end of 2015, BTC had climbed to $430.

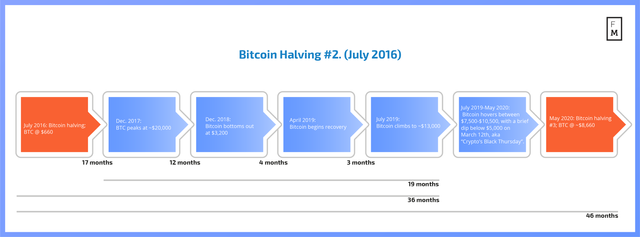

The second halving came in July of 2016. When the halving took place, Bitcoin was hovering around $660; by the end of the year (5 months later), Bitcoin had reached $957 (a price that still wasn’t as high as the post-halving spike in 2013).

This time around, it took about 17 months for the post-halving price peak to form: from July of 2016 to July of 2017, the price of Bitcoin had nearly quadrupled from roughly $660 to $2,550. Then, in mid-December of 2017, the price of Bitcoin peaked around $20,000.

However, just as in the previous halving, the peak was short-lived: by December 31st, the price of Bitcoin was $13,240.

And then, still in accordance with what happened during the first halving, the price began a long, slow decline: six months later, in June of 2018, the price of Bitcoin had fallen to $7,650; it finally bottomed out 12 months later, in December of 2018, around $3,200.

(Still, it’s important to note that in spite of this massive decline, the price of Bitcoin still showed a significant increase from its pre- to post-halving price points: as low as $3,200 is compared to $20,000, it’s still nearly 400% higher than Bitcoin’s pre-2016-halving price of $660.)

Bitcoin remained in the $3000-$4000 range until April of 2019 (16 months after the peak), when the price began to recover–it briefly climbed all the way to nearly $13,000 in early July of 2019. Since then, Bitcoin has largely stayed within the $7,500-$10,500 price range, with a brief dip below $5,000 in the wake of the coronavirus’s economic fallout.

How high will Bitcoin’s next price peak be?

Of course, there are myriad factors that affect the price of Bitcoin post-halving: scarcity is certainly one of them, but so too are the number of users on the network, the rate of BTC adoption in institutional settings, economic factors that exist outside of the cryptosphere (ie the coronavirus and the government stimulus that followed).

However, if history were to repeat itself unfettered, we’re likely to see a post-halving price peak somewhere between 18-24 months from yesterday (assuming that it takes progressively longer for the price peak to form each time a halving occurs.)

Additionally, we could expect a proportionately smaller post-halving price peak.

This is because the previous halvings had progressively smaller price peaks (in relation to the price at the time of the halving); from November 2012 (BTC at $11) to November 2013 (BTC at $1,1050), there was a 9400% price increase. From July 2016 (BTC at $660) to December 2017 (BTC at $20,000), there was a 2900% increase.

In other words, the percentage relationship between the Bitcoin price at the time of previous halvings compared to the post-halving Bitcoin price peak may be getting smaller: the growth rate from the 2016 halving price to the 2017 post-halving price peak was proportionally 3.24 times smaller than the growth rate from the 2012 halving price to the 2013 price peak.

Therefore, if this pattern continues uninterrupted by outside factors, the growth rate from the price peak could continue to get progressively smaller: if the same percentage decrease occurs between the 2020 halving price and the post-halving price peak, the next peak would be a 740% increase from the current price, or roughly $64,000.

Where will the new floor be?

But enough about price peaks–what of price floors?

There are a number of analysts who believe that BTC price floors are ultimately set by miners who refuse to sell their BTC at a loss.

Jeremy Britton, the chief financial officer at Boston Trading Co., explained to Finance Magnates earlier this year that before yesterday’s halving, it cost “around $3000 just in electricity to mine a single bitcoin (notwithstanding the cost of hardware, and internet access),” Britton explained. “This is why, when BTC ‘crashed’ earlier in 2019, the price did not go below $3000; miners did not wish to sell for a loss.”

Now, because miners’ profits have been cut in half, we can assume that it costs roughly $6000 in electricity to mine a single Bitcoin. Therefore, if miners continue to refuse to sell their BTC at a loss, the new price floor should theoretically be at least $6000.

Add the increased scarcity of Bitcoin into the market that the halving will allegedly bring about, and the price floor could go even hire: Interdax’s Jose Llisterri told Finance Magnates that “in the long term, the reduction of the daily issuance of bitcoin from 1,800 to 900 BTC will gradually influence the market and should in theory push prices higher in the long term.”

Other factors are also at play, particularly in a post-corona era: “the contrast between the traditional monetary system and the fixed supply schedule of bitcoin could also boost demand for the cryptocurrency,” Llisterri said.

“As inflation within the Bitcoin system is now 1.80% for the next four years, which is lower than the mandates of most central banks and almost lower than gold’s rate of inflation, this sets the stage for bitcoin to make its mark.”

- What do you think about the future of Bitcoin now that the halving has taken place? Let us know in the comments below.