Bitcoin in a tradebot bubble since Nov 29, what's going to happen next?

If you don't already know, the Chinese government is the largest purchaser of Bitcoin in the world, and the Chinese also run the biggest Bitcoin and Bitcoin Cash mining pools.

It wouldn't surprise me if it's the Chinese that also let this AI / trade-bot loose on the major exchanges, in order to capitalise on the crypto hype (such as witnessed in South Korea when IOTA was added to their largest exchange on the back of some news that they made a business deal with Microsoft and Samsung).

However, they have a much more cunning strategy here. The end goal is to transfer all the (crypto) wealth from the West to the East.

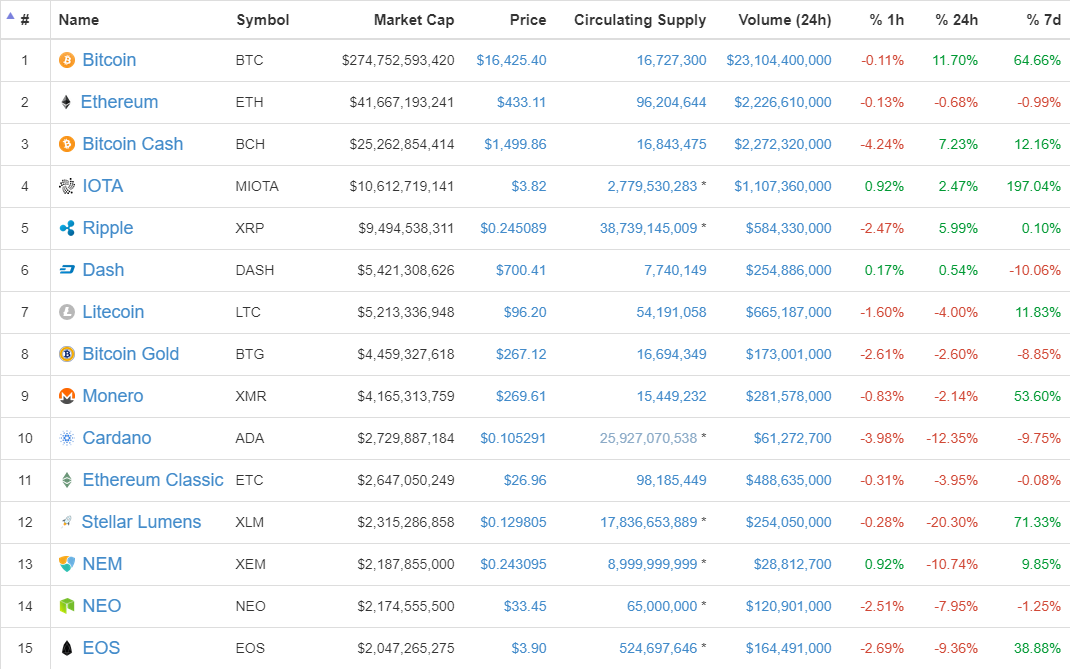

If you watch the Coinmarketcap graphs throughout the day, you will see massive fluctuations in the Altcoins, some getting bought up and shooting up 28%, while others get the opposite treatment and fall 28%. This happens over and over again. All the trading is coordinated and the Altcoins are selected in such a way as to play on people's sentiments. FOMO - fear of missing out, as well as selling short an investment when the bars turn red are some of the games this AI is playing with people. Even experienced traders are having a hard time trying to keep up with the flip trades.

This is why South Koreans continued to buy IOTA at USD$5 a piece... just to see it fall to USD$3 a day later. Many decent people lost their money, while the trade-bot raged on converting Bitcoin to Altcoins and then back again. Bitcoin has been growing exponentially ever since, and will continue to do so until one of 3 scenarios play out:

- Exchanges throttle API usage, forcing trade bots to wait 5 seconds between orders, or ban bot accounts altogether.

- Government steps in and says Bitcoin usage is prohibited, citing tax fraud and large penalties. Exchanges that are not decentralised are shut down.

- The AI gets what it wants - own the whole Altcoin market, and then just stop trading.

I predict that scenario 3 is the most likely to play out.

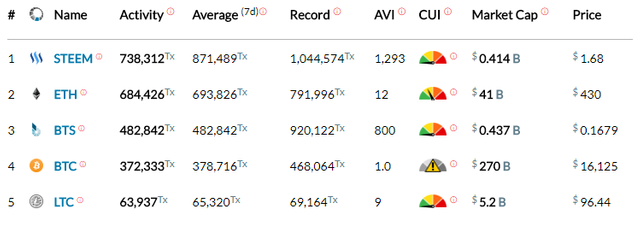

There are already 218,140 unconfirmed Bitcoin transactions, sized around 470Mb sitting in the backlog waiting to be validated. At 10 minutes per block, the blockchain miners may never catch up to finalise all the transactions filling up the mempool. And don't forget, miners will always add the transactions with the highest fee first, meaning there could be thousands of transactions that will never get confirmed because their fee was set too low... Bitcoins in the void...

You can see in the above graph that Bitcoin is over 100% capacity and if the current trade-bot activity continues, I don't see this actually resolving itself. Bitcoin will be unspendable for anyone that owns it. In fact, you couldn't even send it to your wallet from an exchange if you wanted to. You might get lucky if you set your transaction fee to $500,000 !!

At this rate, Bitcoin doesn't have much longer to live (it's death will be defined by loss of confidence and loss of value). The trade bot will pump Bitcoin to $50,000 maybe even $100,000 US Dollars before it triggers the last phase of the takeover. Since you can't get Bitcoin out of the exchange anyway, the bots will just buy everything they can get their hands on, at any price, and move it off the exchange. This will effectively drown Bitcoin's price, perhaps setting it back all the way to $9,800. But now all the Altcoins will be worth BILLIONS, and the AI will own them all!

While this whole scenario plays out, regular people are falling victim to the emotional pain of watching their investments sway uncontrollably, and usually in the negative direction.

HOLD on to whatever cryptos you got. When this all ends, the Altcoins will be the big winners (after all, most of these are well-funded businesses with technical expertise and a marketing plan). Bitcoin is just a clever piece of software, and there is always someone cleverer who knows how to take advantage of it.

If I was to pick one Altcoin winner from this whole charade, I would put my money on Litecoin. Besides an expected dip in January, Litecoin is expected to reach almost $1000 by mid next year. This could be due to the release of MAST (a smart contract platform for the Litecoin and Bitcoin blockchains), or it could just be due to Litecoin being Bitcoin's little brother, but with a blockchain that you could still transact on! Yesterday, Ethereum was at 100% capacity too... better hurry up with the sharding fix, Vitalik!

Personally, I'm waiting for the Chinese or the Russians to finally release a gold-backed cryptocurrency (most likely to use something similar to Distributed Proof of Stake). Because when they do so, all the Altcoins will be reevaluated in relation to this CryptoGold, and not Bitcoin (which could be valued at $1,000,000 schizedollars by then for all I know).

Where do you guys think this is all going? - please leave comments below.

Disclaimer: None of the above is intended to be investment or trading advice. Do your own research and make your own conclusions.

Please upvote if you want to hear more (I'm only new on steemit).

Congratulations @whatstrue! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP