Why I Sold All of My Bitcoin This Week

For the second time in my Crypto trading career, I don’t own any Bitcoin. The last time I sold out was when I got sucked into the Ethereum narrative during the ‘flippening’, where the scaling arguments were going crazy on Reddit. The trade proved successful though in hindsight naive.

On Wednesday evening (US time) I and sold all of my Bitcoin. Six days previous I had sold all of my altcoins apart from Komodo, Maid, Monero, Steem and my tiny free bags of ETC and OMG into Bitcoin. I should have made this move way before, and it proved to be a missed opportunity. I had suggested before the Bitcoin Gold fork that it would be a good time to be all in Bitcoin as altcoins were ending a market cycle and BTC dominance was increasing, the myth of ‘free coins’ a contributing factor.

After BTC had hit $7.6k on November 5th, it bounced back down and was trading between $7k and $7.2k, testing support. The war of words over the Segwit2x fork was intensifying with key opposition posting to Twitter, Reddit and Medium attacking the lack of replay protection.

I had started to become nervous and feared a price crash. The more I researched the fork and possible scenarios, the more bearish I had become about the price of Bitcoin. The tech arguments are sometimes hard to follow and understand, but the possible scenarios concerning me were as follows:

- B2X would take 85% of mining support from Bitcoin, increasing block times for Bitcoin and reducing confidence

- B2X could attack the Bitcoin chain to become the new Bitcoin

- Lack of replay protection could cause chaos across both chains

- Lack of agreement across exchanges, wallets on which coin would keep the Bitcoin name would create confusion

It had become increasingly evident that Segwit2x was a hostile attack for control of Bitcoin. There was absolutely no way of predicting the outcome and holding 83% of my portfolio in Bitcoin had become a considerable risk. I had written a couple of posts previous, one about why I thought the futures market would kill B2X before launch, another covering what Segwit2x is, why I wasn’t supporting it and how I would trade it, and lastly a more detailed approach to how I would trade the fork.

As the fork approached, I was reading more and more about the potential outcomes for both Bitcoin and B2X and I felt like my strategy was flawed. Flawed because it was risky. Flawed because the total value of both coins post fork would likely be less than the current Bitcoin price. Flawed because I was gambling.

I did not want to risk my earnings for the year through this unprecedented fork, it was an unnecessary move. Further, when looking at the likely scenarios for price action, I felt that almost every scenario would lead to a fall in the price of Bitcoin:

If B2X was successful then the BTC price would fall and B2X would rise, but the total price of the two coins would be less than the current BTC price

- If B2X fails then the BTC price temporarily rises and then falls due to a natural correction

- If there is no clear winner — panic and BTC price falls

Bitcoin was undoubtedly overbought, the price rally this year has been insane, and I was fully expecting some correction as investors looked to take money off the table. The tricky thing for any of us is knowing where the tops and the bottoms are.

On Wednesday afternoon I was glued to the price of Bitcoin, following the 5-minute chart and not enjoying my break in Vegas. As it bounced around $7k, I was nervous about a crash, and the fall from $7.6k to $7k was a near 10% drop already. Being so heavily leveraged to Bitcoin meant that a 10% fall in Bitcoin would lead to a near 10% fall in my portfolio. When it spiked back up to $7.3k on Wednesday afternoon, I decided to start selling my Bitcoin. I initially pulled 45% out then very quickly the rest.

Outside of Segwit2x, there are other things which have been spooking me too, the ongoing debate around Bitfinex and Tether and the clear BitConnect Ponzi scheme. Either capable of crashing the market if and when they are exposed.

The price was still rising after my exit, but there was no way of knowing if this was a temporary jump or a new rally. Also, I was meant to be out with friends. I was was not prepared to spend all evening watching and waiting, being stuck away from my laptop.

After I completed the sale, I posted up on Reddit to a mixed response, some saying well done and others laughing at me.

Even though the price continued to rise after I had sold, I felt relaxed and happy to be out for a while, then something unexpected happened.

I went to bed and woke up to a couple of alerts on my phone to approved posts in my Facebook group. They were both the same, “Segwit2x had been cancelled”.

Oh shit!

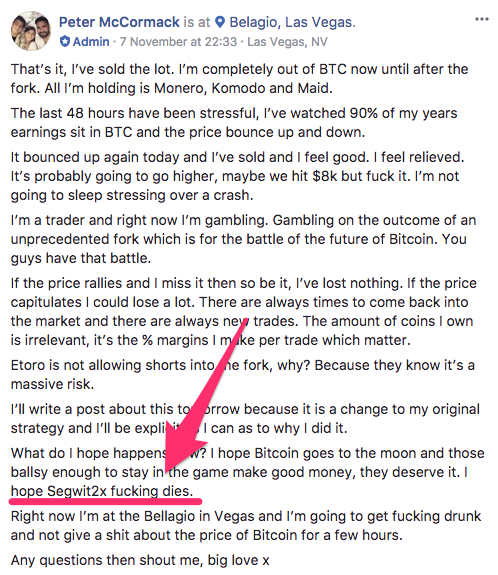

I had posted the previous evening on my Facebook group announcing that I had sold all my Bitcoin and that I wanted Segwit2x to burn to the ground and it fucking happened.

Obviously, the first thing I did was recheck the price and BTC had shot up to $7.8k, but there was no way I was going to buy. People had commented on my Reddit post, some saying right decision and others laughing. I had no confidence in this rally, and it was not surprising that the news led to an immediate spike but traditionally “Buy the rumour, sell the news” holds true. After the quick pump, the price dropped back down to my exit price where it stayed most of the day. Still, I was not going to buy. The price has continued to fall, and I feel lucky with my timing. Very lucky.

So what now? I missed the alt rally due to the cancellation of Segwit2x, and I am sitting on the sidelines for now. My fear is as follows, I think BTC will continue to fall, and I won’t enter again until we find support and a change in trend. While altcoins have bounced, this may be just a strategic swing play like with Bitcoin Gold. Down pressure could continue.

I am currently 89% fiat and holding the following crypto:

- Monero

- Komodo

- Maid

- Steem

- ETC (small free bag)

- OMG (small free bag)

I believe in Bitcoin and think we will hit $10k, maybe even this year, crazy right? Perhaps it is next year. The CME futures market could drive the price up but my entry is going to be careful, and I will likely scale my entry back in as the price falls. I am looking for under $6.5k and ideally under $5k. I have a target number of coins I want to purchase and will be buying these at each support line.

With hindsight, beautiful hindsight, I should have flipped my altcoins into BTC way back, and even though the flip proved a profitable trade, it may have been more beneficial to have kept my altcoins for the natural post Segwit2x bounce.

The market is very different from how it was at the start of the year, and I am careful with my investments. I have a lot to do and think about:

- Review my strategy

- Review my portfolio

- Work on my website

Anyway thanks for all the support, expect more updates soon.

Long live Bitcoin!