Pipe Down Jamie Dimon — Bitcoin Can’t Be a Fraud

Jamie Dimon, the CEO of the repeatedly convicted fraudulent banking and financial services organisation, JP Morgan, came out this week to publicly call Bitcoin a fraud, stating that:

- "The currency isn’t going to work. You can’t have a business where people can invent a currency out of thin air."

But it is working, people are using it, and they are buying things with it. It is because it is working that China has banned it. You can see the interview on Bloomberg: Jamie Dimon Slams Bitcoin as a ‘Fraud.’

He also patronised his daughter who has invested in Bitcoin, by saying:

- "It went up, and she thinks she’s a genius now."

Well, maybe she is more than a genius than you Jamie.

Let’s break down why Bitcoin can’t be a fraud. The Collins Dictionary defines fraud as “the crime of gaining money or financial benefits by a trick or by lying.” So where is the trick and who is lying? Who is this criminal mastermind ripping us all off? Satoshi? Really? If it isn’t him/her/them, then who is? Or is this a free market with a currency protected from all the scams of government-controlled fiat.

Everyone trading Bitcoin knows what it is and knows its inherent risks; they also know that they are investing in a new global currency, free from control, inflation, and theft.

By definition, Bitcoin can’t be a fraud. It is a free, decentralised economy where the people have spoken and voted with their fiat.

We do have some better examples of fraud available which sit within the Collins definition:

JPMorgan Agrees To Pay $264 Million Fine For ‘Sons And Daughters’ Hiring Program In China

Where at the request of Chinese government officials entered into a hiring programme “dubbed internally as a “Sons & Daughters Program,” enabled JPMorgan to win business that generated $100 million in revenues for the bank.” Certainly sounds like criminal activity and fraud.

JPMorgan Hit Hardest as EU Fines Euribor Trio $521 Million

Where alongside HSBC Holdings Plc and Credit Agricole SA. “The trio colluded to rig the Euribor rate and exchanged sensitive information to suit their trading positions in correlated derivatives markets, in breach of EU antitrust rules.” Sure sounds like fraud again.

JPMorgan Chase pays fine for discriminating against minority borrowers

Where they were “Accused of charging at least 53,000 African-American and Hispanic borrowers higher rates and fees on home mortgage loans between 2006 and at least 2009.” Yep, sounds like fraud again.

JPMorgan Chase Fines Exceed $2 Billion

Where they were fined “for violations of the Bank Secrecy Act tied to failure to report suspicious activity related to Bernie Madoff’s decades-long, multi-billion dollar Ponzi scheme.” Wow, massive fine for what looks like more fraud.

JP Morgan in record $13bn settlement with US authorities

And let’s not forget the record fine they faced for “misleading investors during the housing crisis.” Where “The bank acknowledged it made “serious misrepresentations to the public,” but said it did not violate US laws.” Well, that is a massive fraud which nearly collapsed the global economy. The fine accepted was to end a criminal investigation.

Need anymore? Try reading Blair Erickson’s excellent post on Medium: How is a corrupt criminal like Jamie Dimon, not in prison for fraud? Blair points out that:

- “Since 2010, the year Bitcoin first began to circulate, under the leadership of Jamie Dimon JP Morgan Chase has been charged with 48 different violations of banking and securities fraud. $28,675,456,874.00 is the total they’ve paid out just in the past 7 years in slap-on-the-wrist fines by politicians who’s coffers they’ve filled with money.”

Blair also points out that:

- “in 2013 JP Morgan Chase was denied a patent for a Bitcoin clone over 175 times.”

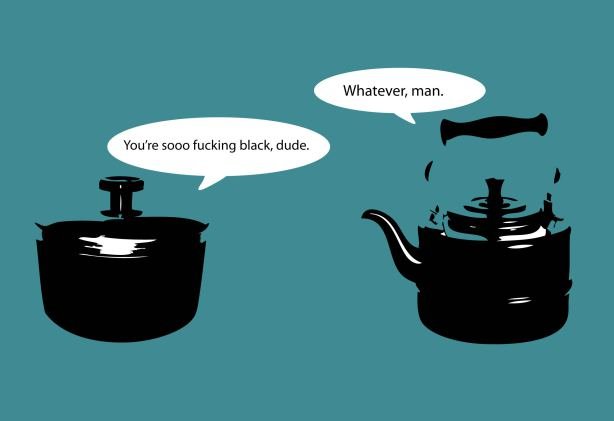

So the CEO of one of the most fined organisations in the world, who has repeatedly tried to patent technologies similar to Bitcoin, is calling Bitcoin a fraud.

Hmmmm…

The Dollar Vigilante covered this in his article about Jamie Dimon explaining that actually, the Dollar is more of a fraud because:

No max cap. In other words, it can be inflated to infinity… As opposed to bitcoin which has a hard limit of 21 million bitcoins that will ever be created.

- Pre-mined. One of the death knells of a cryptocurrency is that it is pre-mined. In general, this means that the creators of the currency create the currency and give it to themselves before allowing others to purchase it. This is the height of fraud in the cryptocurrency space but this how all US dollars are created. They are pre-mined by the Federal Reserve before they are allowed to “trickle down” to the rest of us poor slaves.

- No transparency. Unlike bitcoin, the US dollar has very little transparency as to where it came from and which potentially criminal organization, like the US federal government, IRS or any of the other three letter agencies it has flowed through.

- Not backed by cryptography. While bitcoin and all cryptocurrencies have proof of ownership through very secure cryptography the owner of “dollars” can be anyone who is friends with the Federal Reserve.

- Not open source. Unlike bitcoin, which anyone in the world can review their code, the dollar is not open source and therefore all manner of fraud can be perpetrated in the system.

- You don’t control your private keys. With Bitcoin and other cryptocurrencies, you hold complete control of your currency by holding your private keys. With dollars, any criminal government agency or the central bank can take control of your dollars at any time.

- Not voluntary. While using and owning bitcoin is completely voluntary, usage and acceptance of US dollars are backed by violence. If you do not accept dollars you can and will be kidnapped and thrown in a cage. Should you try to escape you most likely will be killed.

If you haven’t signed up for the Dollar Vigilante’s daily email, I suggest you do.

Jamie Dimon is scared, as are the banks, as are the governments, as is China. They are afraid of a monetary system which they can’t control, manipulate and steal. The louder they become, the stronger Bitcoin becomes.

Erik Vorhees from Shapeshift, summed it up perfectly, “Jamie Dimon has every interest in the world in disparaging Bitcoin and working with his friends in government to regulate and suffocate it.”

People in glass houses shouldn’t throw stones, Jamie!

This is great research. And I think you are absolutely right. When banksters tell you something is shit it must be pure gold.