My Strategy for Trading the B2X Fork (Now to the End of November)

With the upcoming Bitcoin2x (B2X) fork, estimated around November 16th, I thought it might be useful to share how I am going to be trading leading up to the fork, during and after it.

Note: my experience of trading both the Bitcoin Cash and Bitcoin Gold forks are leading my B2X strategy, but I have some specific warnings:

- The previous behaviour of the market is no guarantee of future behaviour

- The market can be controlled and manipulated by whales, and they can play the market how they want

- You should not just copy me

These are all critical points because the markets are not always predictable, the best trades are those in advance of market expectation.

I have previously written a couple of articles about the upcoming fork. Firstly I wrote an article explaining why I think the futures market might kill B2X before it launches; this hasn’t yet happened, and the futures price of B2X is bouncing between 0.1 BTC and 0.15 BTC. I don’t want or believe in B2X, which I wrote about here, but I am happy with the price being as high as possible. B2X may pump on launch but will likely be dumped by investors wanting to cash in on their ‘free coins’ and either increase their BTC position or swap for fiat and altcoins.

I am almost certain that the futures price is being artificially held up by those parties with a vested interest because whenever it sinks towards 0.1 BTC, the price then pumps back up. These pumps are ignoring the BTC price, holding above 0.1 BTC as a psychological support level. The good news is that as the Bitcoin price increases then the value of B2X also increases. As an example, the B2X price is currently 0.15BTC and thus at $920.56 based on Bitcoin currently being at $6,137.01 (Coindesk). If the Bitcoin price goes up to $7,500 by the time of the fork and B2X holds the same exchange rate, then a B2X coin will be worth $1,125. As such, I am hoping the BTC price keeps rising, and the B2X price holds or even goes up.

What Did We Learn From the Bitcoin Gold Fork?

Firstly, I believe Bitcoin Gold is a shitcoin. The official press releases from some of the major exchanges highlight many of the concerns people have with it. For example, take a look at this Bittrex post, specifically:

- “At this time, the information and codebase presented by the Bitcoin Gold team is not in a functional state and Bittrex will not commit to opening a Bitcoin Gold trading market.”

And:

- “Bitcoin Gold codebase also contains a private premine of 8,000 blocks (100,000 BTG). Please be aware that if a market does open there is a possibility of the developers selling their premined BTG on the open market.

- When considering adding tokens to Bittrex exchange we look at the risks involved. Bitcoin Gold does not satisfy our criteria for safety for our users. Taking a snapshot of the Bittrex exchange Bitcoin wallet is also a large disruptive undertaking that requires over 24 hours of preparation (Bitcoin deposits and withdrawals are also suspended during this time) and should not be taken lightly.”

Add to the pre-mine, a lack of replay protection and no access to the code in advance; this is an embarrassment of a fork which does not deserve to have had such an impact on crypto trading. But it did, and as such, provided some signals for how we can prepare for the Bitcoin2x fork, whether you call it B2X, S2X, etc…

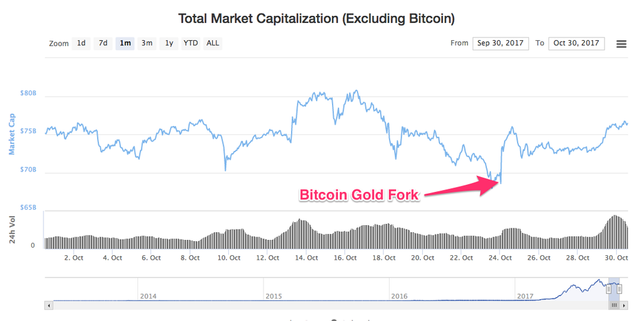

Firstly let’s take a look at the charts for the total market for altcoins.

As you can see above:

- In the week before the fork, the market for altcoins started to drop, seeing a fall in market cap of 15.9%. Within this, note that the larger cap, more resilient coins fell less, for example, Litecoin dropped 11%, and smaller coins fell more, for example, Iconomi fell 24%.

- As soon as the Bitcoin Gold snapshot of the Bitcoin blockchain was complete, the prices for altcoins jumped, seeing a rise in market cap of 14.5% in 13 hours, this dropped again before resuming regular trading. Note again; conversely, the more resilient coins bounced less than the smaller cap coins.

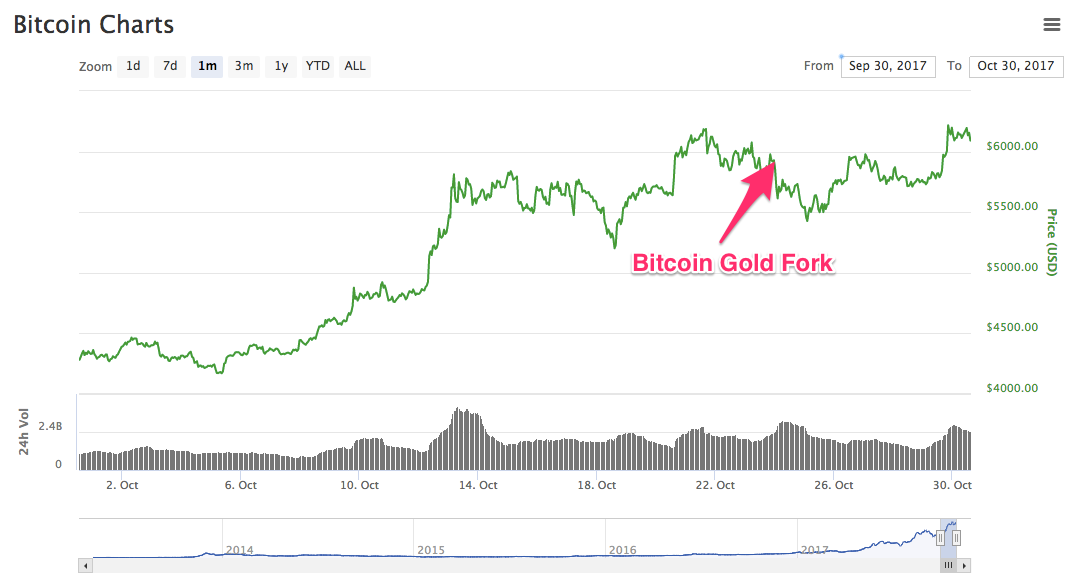

Now if we look at the chart for Bitcoin below, we can see the price was rising in the build-up to the fork and fell after the fork, though we must note a few things:

- The price of Bitcoin was rising anyway, pushing back through the $5k market on October 13th.

- The price started to fall away a couple of days before the fork.

The charts appear to quite clearly shows investors selling-off their altcoins in the build-up to the fork to receive the ‘free coins’, quickly followed by a reversal once the snapshot was complete, where people sold off Bitcoin and bought back into altcoins. The altcoin pattern for this is much more obvious than with Bitcoin; I believe this to be because Bitcoin is much more stable than altcoins and there are many other trading influences over the price.

I am of the firm belief that people were selling altcoins for free Bitcoin Gold coins. If this pattern is correct then it would appear that the strategy for how to trade B2X would be quite simple:

- Sell altcoins to accumulate Bitcoin before the fork

- Keep some fiat money on the side

- Before the fork snapshot buy a bunch of the smaller altcoins which have sold off massively ahead of the fork

Then once the fork snapshot is complete:

- Immediately reduce your Bitcoin position to your regular holding volume

- Buy more altcoins

- Watch the inevitable pump of altcoins and sell at the top in the first 12 hours

- Rebalance your portfolio once everything has calmed down

Easy right?

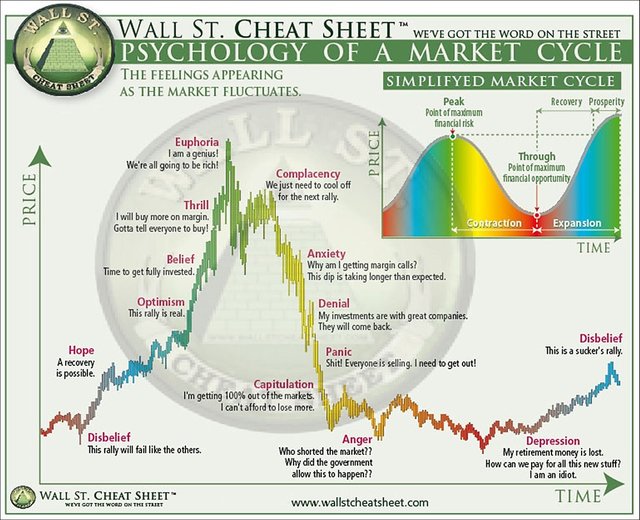

Yes, if it plays out like this, which it might, but there is something which is holding me back. Many altcoins appear to have reached the bottom of their market cycle, in that they have retraced as much as they will and are now starting to increase in price. If you don’t know what the emotional market cycle is, then take a look at the chart below.

Now if you want to see this cycle in play then take a look at the chart for Iconomi below, pretty similar right?

The difficulty I am having here is selling off altcoins which are at the bottom of their market cycle for free B2X Bitcoins when it feels like they won’t sink much further. If they start a new market cycle, they will likely outperform Bitcoin. This was especially evident on Sunday when we saw a big jump in the price of Bitcoin alongside significant increases in the prices of altcoins. They are moving together, which is what we want with a hedged investment strategy.

So how should this be traded then?

Personally, I want to avoid too much risk, and there is an awful lot of unknowns coming. Yes, Bitcoin seems to be racing towards $10k, but what does this mean? Will it fly through and go to new heights? Will it see a sell-off at this price as Bitcoin itself has reached the peak of its current cycle? Will we see a massive correction? Is more institutional money coming in which will keep things going up?

It is hard to know, but forks do lead to volatility, and I have been expecting a correction for a while. Even if institutional money is coming, it may not be in time to prevent a correction.

I do not like surprises, and I do not like risk. As such my strategy is as follows: I expect the pattern for people selling altcoins to get ‘free Bitcoins’ to repeat. The question is when this will start? With Bitcoin Gold, this arguably started around a week before the fork. Still, I want to give myself a bit more time to prepare. The fork is estimated to happen on November 16th, as such I am going to do the following

- November 2nd (two weeks before the fork): I will start exiting altcoin positions to accumulate both fiat and Bitcoin. I will be primarily exiting smaller cap coins as they will be most volatile around the fork. I won’t exit all altcoins because the market may not react to the fork as I expect. I expect my BTC to altcoin ratio to be around 75/25, predominantly holding the likes of Dash, Monero, Litecoin, and Ethereum as these have all traded sideways during the recent forks and are being suppressed by Bitcoin price action.

- November 13th (3 days before the fork): I will start monitoring solid smaller cap altcoins which have dropped the most. These will be the projects I believe in most.

- November 14th (2 days before the fork): I will transfer all my Bitcoins to Coinbase before they disable deposits and withdrawals for Bitcoin. The reason I will be moving to Coinbase is they will be instantly crediting accounts with B2X coins at block 494,784 and allowing for trading of both Bitcoin and B2X within 24 hours of the fork.

- November 15th (1 day before the fork): I will start buying those smaller altcoins which I believe will have the best swings and will also form part of my long-term investment portfolio.

- November 17th (1 day after the fork, first hour): I will immediately sell half of my B2X coins, I won’t be selling all as I think there may be those with a vested interest who will pump the coin. Realistically though, I expect a lot of downward pressure on B2X. I will monitor this for 24–48 hours, if the price appears just to be falling I will sell all of it. I will also be looking to sell quite a lot of my BTC, but I will be looking at whether the price holds first. The selling of B2X coins may spike BTC in the short term.

- November 17th (1 day after the fork, after 12 hours): I will sell off a bunch of my altcoin swing trades as I expect a short price spike.

- November 18th — November 30th: I will monitor the market for both Bitcoin, B2X, and altcoins and will likely start rebuilding my portfolio based on what I expect from the market.

There are other things I am nervous about outside of the Bitcoin fork:

- Issues relating to Tether and wash trading at Bitfinex.

- I have a feeling that Bitcoin will enter some form of correction which could bring the whole market down.

I don’t mind missing gains, especially after such a good year. I don’t like random drops. At this point, I will be happy to mainly hold fiat and slowly watch the market, preparing my summary of 2017 and preparing my strategy for 2018. If I time it wrong it doesn’t matter, FOMO doesn’t bother me as I am in this market for % gains.

The key to playing this strategy is as follows:

- Identifying when investors start selling altcoins to accumulate BTC

- What the top price of BTC will be pre-fork

- Which altcoins to purchase pre-fork

- Whether and at what price to sell B2X

- Whether and how much BTC to sell off post fork

I will be keeping close to the market over the next few weeks to ensure I can play this out well. I have already sold off two Dash positions into Bitcoin to grow my BTC pot, which has proved successful as the new BTC pot is already up +5% while Dash is still slowly dropping.

Any questions then please give me a shout.

Thanks for the post. Really appreciate the transparency and reasoning for your trading strategy.

Do you have a long term view? Would a "buy and hold" strategy work at this time or is it too risky with the folk?