COSS.IO - Playing with Charts

COSS.IO — Playing with Charts

Some of you may have heard already about COSS.IO, a cryptocurrency exchange based in Singapore. COSS was founded in 2017 and financed through an ICO.

The tokens issued, COSS tokens, come with a nice feat: they pay dividend or, as COSS names it, they provide a fee split distribution. The fee split consists of 50% of the trading fees and are accumulated in (fractions of) the tokens traded. In short: a revenue paying token.

COSS had a tremendous runup during the December 2017/January 2018 bull run. The token reached 2.99 US Dollars and was loved in the scene.

Then came the crash.

And live was hard again.

The purpose of this post is to look at some charts to see where COSS (the token) is going and whether we can see signs of better times. Of course, COSS price action is mainly influenced by the core feature: dividend (and as such: VOLUME).

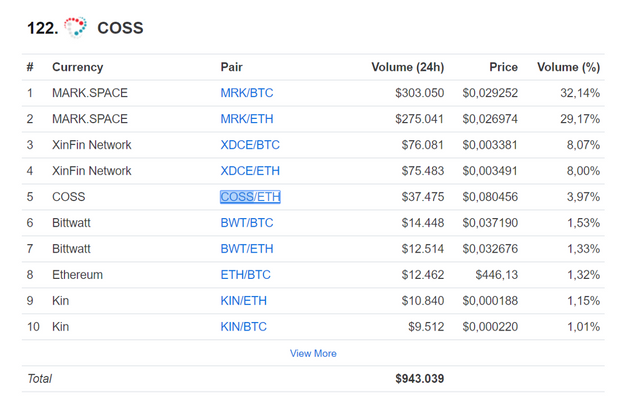

Volume is slow and there are no signs yet that this is about to turn a corner. With a daily volume of about $1M, COSS is barely able not to drop off the chart of 122 top exchanges (volume based).

Coinmarketcap: COSS in 122th place

As a comparison, Cryptopia is in 89th place with about $4M daily volume.

But on the other hand, that is still the enormous potential. If COSS can benefit from a pickup in crypto trading volumes and rise on a big wave of cryptocurrency adoption, COSS price could again rise tremendously up to $10 and beyond. Check some calculators on COSS-stats.com and COSScalc.com.

But for now, things are not looking rosy in terms of immediate improvement of the general cryptocurrency markets and thus trading volumes.

The good part is that COSS has started with an immediate focus on 100% KYC compliance and implementation of a FIAT gateway (meanwhile implemented). They are working on a new trading engine (COSS 2.0) and (much anticipated) an API. These slow times are not passing without building the exchange further.

But I digress.

We start the chart analysis with the daily charts followed by a shorter time frame; the 4hr chart.

I mainly focus on the COSS/ETH pair because it has the highest trading volume.

As a spoiler: things are not yet looking very good, but I see signs of reaching a (final) accumulation zone. Let’s dig in further…

Chart 1

Figure 1: COSS /ETH 1D with RSI and MACD (COSS.IO)

One thing is immediately clear: the COSS(/ETH) price is in a relentless down trend. MACD remains in the negative zone (below 0). RSI is firmly oversold but as appears from the charts, that does not indicate a sure_thing_rally although price may bounce a little.

From previous bottoms I derive some comfort that the zone between 0.000115 and 0.000135 acts as an accumulation zone.

Chart 2

Figure 2: COSS USD chart (coinmarketcap.com)

The COSS/USD chart does not lie either. Price wise, COSS is a hot potato continuing tumbling down. Relentlessly. COSS participated in the February and April rallies but the current rally in BTC developing has not stirred COSS to do the same.

Chart 3

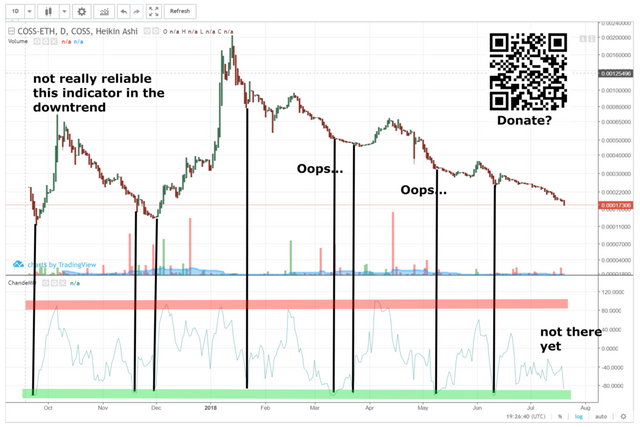

Figure 3: COSS /ETH 1D with ChandeMO (COSS.IO)

Again, the COSS daily chart but this time with the Chande Momentum Oscillator. I indicated an overbought zone with red marking and an oversold zone with green marking. While the oversold signal does not prove 100% reliable, it may help indicate spots of potential reversal.

And from this indicator, no such reversal is apparent. We are close to reaching oversold, but it is not in the green zone yet. So I count this one as inconclusive.

Chart 4

Figure 4: ETH/USD 1D vs COSS/ETH (Tradingview with COSS.IO overlayed)

To get a better handle on the correlation between COSS/ETH and the USD value, I made a chart comparing ETH/USD to COSS/ETH.

Although there seems to be some connection between ETH rallying and COSS experiencing snap-back rallies, the current ETH/USD price action does not support the expectation of a COSS rally soon. ETH may still rise in the next few weeks which could lead to COSS price stabilising or even rallying, but the situation for COSS still seems delicate.

But it could be a signal that dumping COSS right now could be a mistake.

A story that is developing…

Chart 5

Figure 5: COSS /ETH 1D with RVI (COSS.IO)

A final daily COSS chart. This time with the Relative Vigor Index (RVI). If not taken too tight, it seems to be a reasonable indication of a (short or longer term) bottom. Given that we are in a firm downtrend, I would tend to say a possible indication of a short term bottom.

I once again marked the accumulation zone between 0.000115 and 0.000135 which proved historically to be a bottom area.

Chart 6

Figure 6: COSS /ETH 4HR with RSI and MAC (COSS.IO)

Zooming in, we see the downtrend in play without RSI showing a violent sell off bottom yet. But price seems to be hitting some early resistance at 0.000175 and MAC seems to attempt to put in higher lows. I consider this a weak signal but it may indicate a potential price reversal developing.

Closing thoughts

Looking at the charts, I do not have the feeling that the worst is over for COSS. Fundamentally, there is no news indicating that trading volume is about to pick up in a meaningful way and the markets are still generally in a slump. The BTC (and, to a much lesser degree, ETH) rally have not induced a COSS rally, and the signs of bottoming are not conclusive (yet).

Given the available information, I am thinking of a trading setup consisting of the following:

- an ETH/USD rally towards $600

- upon signs of topping of this short term rally (into August): sell COSS/ETH -> convert to USD -> wait

- resumption of the bear market AKA a new wave down

- pickup COSS again (hopefully way within the accumulation zone) by buying ETH with USD and converting to COSS

I note that the conversion of ETH->USD->ETH should be done outside of COSS as the liquidity in the ETH/USD pairs is still abysmal.

Remember, bear markets are excruciating but also a big opportunity to increase your existing bag of coins with 50–100% if timing your trades right.

I hope the current BTC rally persists and that the trading setup may become viable. Until then, enjoy your weekly COSS fee split distributions.

Very useful thanks https://9blz.com/rvi-indicator-explained/