3 coins to keep an eye on!

Bitcoin is off to the races again after a month-long consolidation period.

The break of resistance at $8800 could trigger another wave of euphoria, with the area around $9800 posing a reasonable target.

The altcoin marketcap also continues to trend upward gently. The news of Binance restrictions for US customers destroyed some promising charts, but more opportunities are available.

Keep an eye on these three of the top 100 coins listed on CoinMarketCal with events during the next two weeks.

Chainlink (LINK)

After a retest of the lows in early May, LINK went parabolic with an over 300% gain. The current retrace is testing the previous highs near 0.00017, which is also the .618 Fibonacci retrace. If this pullback continues, another possible support zone lies around 0.000145. This zone is formed by a daily orderblock that overlaps a weekly orderblock from mid-March. It also provided the source for the last dramatic spike upward.

If all else fails, a third confirmed support zone can be found at the overlap of two weekly orderblocks and two daily orderblocks between 0.00012 and 0.00013.

Bullish action seems likely with Oracle demonstrating LINK at the CloudEXPO 2019.

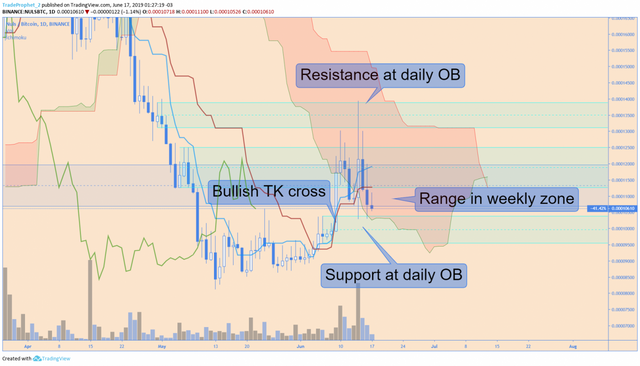

NULS (NULS)

NULS began a short accumulation phase in early May that was followed by a breakout through resistance. Price discovered the next confirmed resistance near at a daily orderblock near 0.000135.

A range is forming inside a weekly orderblock. Attempts to dive lower were countered by the bulls. This can be seen by the wicks touching support in the daily orderblock near the previous resistance around 0.0001.

It remains to be seen whether the old resistance around 0.0001 will hold as support. However, the new website launch today may provide some catalyst for this level to hold, making it a promising entry for the next leg upward.

Waves (WAVES)

WAVES is drifting toward a low set in early August 2018 after a horrific downtrend beginning in April.

Volume has been gradually dropping off as price entered the weekly orderblock marking the bottom of the last market cycle. This suggests that panicking bears are becoming exhausted – as bulls silently accumulate.

Price is hovering around the orderblock’s EQ at 0.00028. It’s unclear whether this will be the bottom, or if 2018’s lows will be broken.

However, the current zone does provide a probable support area. This could form the bottom of a range during an accumulation phase.

The upcoming node release increases the chances that bull create a bottom soon, which could offer an excellent entry for a forthcoming range spawning a new market cycle.

This is not financial advice. I don’t take into account of your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation. Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of any information or analysis supplied.

Posted using Partiko Android