Cryptoasset Valuations

Recently, an increasing number of crypto market participants and observers have become interested in a framework for valuing cryptoassets. Over the years many a dinosaur has proclaimed bitcoin valueless, an asset worse than tulips (at least with tulips you got a flower). Now they’re trying to figure out how valuable these assets really are. That’s a big win for the magic internet money community.

In this piece I share some early attempts at crypto valuations to give perspective on how early we still are, then discuss the theory I’m currently using and why, before walking through a fictional bandwidth coin valuation that includes a link to the actual model. Each section operates as a standalone, so feel free to skip amongst them.

Early Days of Cryptoasset Valuation

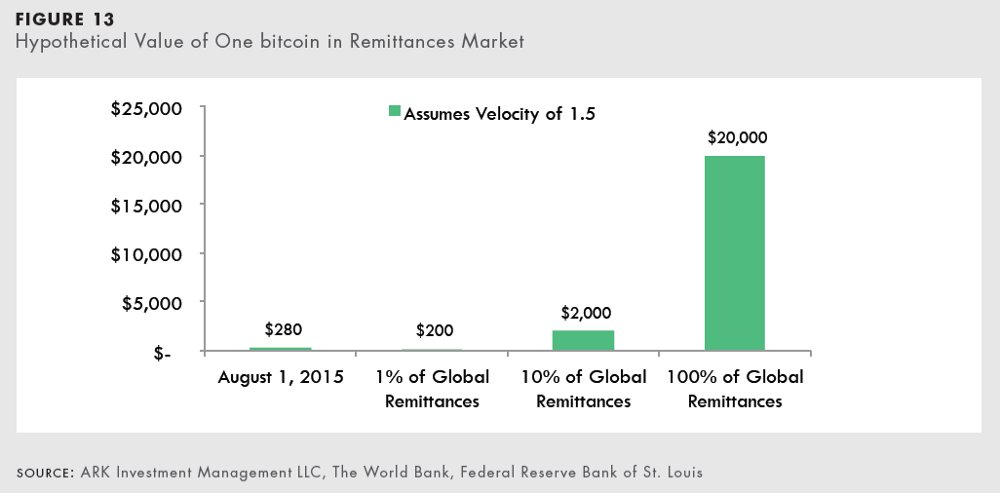

The first time I attempted to value bitcoin was at ARK Invest, where I started as a buy-side analyst in 2014. ARK became the first public fund manager to invest in bitcoin in September of 2015, and to do so we had to have some basis to justify current prices ($200's), or at least quantify the potential for significant asset appreciation. Other asset managers will have to do the same as part of their fiduciary duty, which is one reason everyone’s become so interested in cryptoasset valuations. Below is an example valuation from a paper I wrote with Dr. Arthur B. Laffer to complement ARK’s 2015 investment, which serves as a nice starting point.

While an overly simplified assessment of value, this graph gets across a few key concepts, mainly total addressable market (TAM), percent penetration of that market, velocity, and number of coins outstanding.

The thinking was as follows (with notes where my thinking was flawed):

The TAM for remittances in 2014 was $436 billion (using a present TAM for future adoption was a mistake).

Potential percent penetration of that market could be 10%, meaning Bitcoin’s blockchain would have to transact 10% x $436 billion, or $43.6 billion, to satisfy this demand (not providing a time frame for adoption makes it impossible to deduce percent return each year).

The “same bitcoin” could be used multiple times in the transmission of value for remittances — in this case 1.5 times per year. Hence, $43.6B / 1.5 = $30 billion in value that bitcoin would need to store (more on velocity later; 1.5 was too low).

At the time of publication, there were 14.7 million coins outstanding, so $30B / 14.7M = $2,000 per bitcoin (using the present number of coins for future adoption was another mental error).

The above valuation could be stacked with bitcoin’s use in another target market, with another percent penetration and velocity. The values for each target market would then be additive; dual demands on a single supply. Clearly I was still struggling with all the variables — Spencer Bogart and Gil Luria were doing better work than myself at the time, putting out reports on Grayscale’s GBTC, which I recommend looking at.

I’ve thought about cryptoasset valuations a lot more since then.

Theory Behind Cryptoasset Valuations

The first thing to note with crypto valuations is these aren’t companies; they don’t have cash flows. Hence, using a discounted cash flow (DCF) analysis is not suitable. Instead, valuing cryptoassets requires setting up models structurally similar to what a DCF would look like, with a projection for each year, but instead of revenues, margins and profits, the equation of exchange is used to derive each year’s current utility value (CUV). Then, since markets price assets based on future expectations, one must discount a future utility value back to the present to derive a rational market price for any given year.

I believe in a taxonomy of cryptoassets that goes far beyond currencies. That said, within its native protocol a cryptoasset serves as a means of exchange, store of value, and unit of account. By definition, then, each cryptoasset serves as a currency in the protocol economy it supports. Since the equation of exchange is used to understand the flow of money needed to support an economy, it becomes a cornerstone to cryptoasset valuations.

The equation of exchange is MV = PQ, and when applied to crypto my interpretation is:

M = size of the asset base

V = velocity of the asset

P = price of the digital resource being provisioned

Q = quantity of the digital resource being provisioned

A cryptoasset valuation is largely comprised of solving for M, where M = PQ / V. M is the size of the monetary base necessary to support a cryptoeconomy of size PQ, at velocity V.

Let’s start with P and Q, as those seem to trip people up the most. The first thing to note is P does not represent the price of the cryptoasset, but instead the price of the resource being provisioned by the cryptonetwork. For example, in the case of Filecoin it would be the price per gigabyte (GB) of storage provisioned, represented as $/GB. Q represents the quantity of that resource provisioned, in the case of Filecoin the GBs of storage. Multiplying $/GB x GB = $.

This dollar amount represents the exchange of value in the Filecoin economy to provision cloud storage (and whatever other utilities Filecoin may provide over time). In other words, it is the GDP of the Filecoin economy, which fits with classical monetarism where PQ is the gross domestic product (GDP) of a country. Fortunately for crypto folks, we have transparent and immutable ledgers to track this GDP — they’re called blockchains.

Hence, the GDP of a cryptonetwork is represented by the on-chain transaction volume of its cryptoasset.

A sidenote: While I believe on-chain transaction volume nicely represents a cryptonetwork’s GDP, it is imperfect because often 30%+ of a cryptoasset’s on-chain transaction volume can be shuttling the asset between exchanges. Doing so is not an exchange of value for the digital resource of the network, but instead a means of speculation, which is excluded from GDP metrics. For example, FX volume is not incorporated into the GDPs of nation states. Additionally, second-layer scaling solutions will make this assessment of GDP conservative, though I would likely consider the assets used in second layers as bonded, falling into the “bonding bucket” that I later discuss.

Turning now to V, velocity shows the number of times an asset changes hands in a given time period. Re-arranging MV = PQ, we can calculate V = PQ / M. Taking bitcoin in 2016 as an example, that year the network processed an average of $160 million in estimated USD transaction value per day, for a total of $58 billion in the year (PQ). The average size of bitcoin’s asset base through 2016 was $8.9 billion (M). Hence, V = $58B / $8.9B, or 6.5.

A velocity of 6.5 means that in 2016 each bitcoin changed hands 6.5 times. In reality, a small percentage of bitcoin in the float likely exchanged hands a lot more than that, while a larger percentage sat locked in hodlers’ hands, but more on that later. For perspective, the velocity of the USD M1 money stock is 5.5 right now, though this has declined precipitously since the Financial Crisis of 2008 (increase M significantly, while PQ squeaks along, and V is bound to decline).

Lastly, the asset base, M. Note that I have used an average size of bitcoin’s asset base through the year, which is necessary due to the inflationary nature of the asset. Accounting for an expanding monetary base is particularly important for younger cryptoassets that could be classified as hyper-inflationary with annual rates of supply increase that clock in north of 20%.

Now that we’ve covered the variables of the equation of exchange, and touched upon the idea of a total addressable market and percent penetration of that market, there’s one more key concept to cover: discount rates. We’ll do that in the context of an actual model.

Valuing a Bandwidth Token: INET

Before attempting to value a fictional bandwidth token, let me make clear that I don’t use these models as price targets the way equity analysts create price targets for the stocks they cover. The granularity of our understanding of cryptoeconomics is not there yet, and nor are the crypto markets efficient enough to base asset management on rational market pricing (yet).

Instead, I use these models to help me understand the levers of value within a token’s cryptoeconomic model. Models help me ask the right questions, and they also allow me understand what kind of adoption a cryptonetwork will have to achieve to justify certain asset prices. As of now, I’ve found the people that get the most out of these models are developers, as it helps them think through the monetary policies of their soon-to-be-launched networks.

Here’s the model I’ll be referencing: https://docs.google.com/spreadsheets/d/1ng4vv3TUE0DoB12diyc8nRfZuAN13k3aRR30gmuKM2Y/edit?usp=sharing.

If you’d like to fiddle with the assumptions, download it so that you can get out of “Comment Only” mode. As mentioned above, this model attempts to understand the cryptoeconomy of a fictional token called INET, as it works to take share in the provisioning of bandwidth via its decentralized virtual private network (VPN).

Broadly speaking, there are four sections to most of the crypto models I’ve been building. Section A calculates the number of tokens in the float, Section B quantifies the economy of the protocol using the equation of exchange, Section C projects the percentage adoption of the cryptoasset within its target market (which feeds into Section B), and Section D discounts future utility values back to the present.

The tables to the left of A, B, and C are all my input tables: INET Supply Schedule Inputs, INET Economy Inputs, and Adoption Curve Inputs. Inputs are composed of assumptions and your assumptions can be different from my assumptions — that’s what makes a market. If you want to test different assumptions, all the inputs in blue are particularly subjective.

To the right of the input tables are the output tables, which show the results of the calculations based on my inputs. I’m going to focus on the output tables, which will include a discussion of some key inputs. You can easily follow the formulas if you’d like a deeper understanding of all the math.

Starting with Section A, Rows 2–11 are used to determine how many tokens will be in the float and therefore available to the INET economy, with Row 11 the particularly important output row: Number of Tokens in Float after Bonders & Hodlers.

Here’s the basic thinking: there’s a certain amount of INET tokens issued in the ICO, in this case 75% of the total that will ever be in existence, or 75M. There’s instant liquidity for those tokens, though of course you can change that if you like. The remaining 25M tokens are locked up by early private investors, the foundation and the founders, vesting over different periods depending on how the monetary policy is structured.

The most important inputs, and ones that I imagine will be controversial, are the percentage of tokens locked by bonders and hodlers (inputs C12 & C13). With Proof-of-Stake and other consensus algorithm experimentation, I think we will see an increasing amount of bonding necessary by the nodes (human or machine) that support a network. Such a bond incentivizes these nodes to act properly, or lose their lunch.

Furthermore, second-layer scaling solutions like Lightning or Raiden will also effectively bond the cryptoasset, facilitating a secondary economy off-chain. Whether or not the assets used in these secondary layers have a velocity will depend on how frequently they settle onto the main chain. Beyond these bonders, there’s the percent being hodl’d by those that expect the token’s purchasing power to go up, and therefore use it as a store of value to cash in on at a future date.

Together, the bonders and hodlers take tokens out of the float, meaning these tokens have a velocity of 0. Hence, they’re not in circulation and are pulled out of Section B, my exploration of the INET economy. I imagine this will spark some debate, and rightfully so.

Two notes: Since the supply is not inflating via organic mining, the nodes in this economy make money off transaction fees. If you want to include mining that’s easy enough, it’s just another row. Lastly, one of my favorite inputs is Lifetime of Foundation (C9), and I’ve been using this to help teams think through the sustainability of funding for their foundations.

Turning to Section B, let’s dig into the INET economy. Recall that a cryptoasset valuation is largely comprised of solving for M, where M = PQ / V. In the table, INET Economy and Utility Value Output, we are solving for M, the solution of which shows up in Row 25.

To solve for M, we need P, Q, and V.

P can be seen in Row 19, with the cost per GB for a user of INET’s VPN network. Note that after 2018, P incorporates an annual cost decline of 16% (C20). Cost declines are a necessary part of most cryptoasset models given the deflationary nature of the resources they provision. Cryptoassets that provision non-deflationary assets are of particular interest to me. Onward.

Q can be seen in Row 23, though it takes a few steps to deduce. To get Q, I’ve always had to start with understanding the total addressable market (TAM) of the cryptonetwork. Often others have done this industry analysis and it can be found by hunting around online, as I did with annual global IP traffic reports from Cisco. To project the TAM of future years, you also need a reasonable assumption about the unit growth of this market going forward (C23).

Q also requires a projection of the percent penetration that the cryptonetwork will take of its target market. To estimate such adoption, I use a simple S-curve formula that allows me to dictate a few key inputs, shown below.

Inputs include:

When the cryptonetwork will launch and adoption will start (Base Year)

Maximum share the network will take of its target market (Saturation Percentage)

When the network will hit 10% of its Saturation Percentage (Start of Fast Growth — this can be thought of as the inflection point)

Amount of time it takes for the network to go from 10% to 90% of its Saturation Percentage (Take Over Time).

These variables allow you to tinker with cryptonetwork’s adoption profile. Note that “Blue represents a particularly subjective assumption,” and all of these inputs are in blue. I’ve also included a small hack adjustment so that the cryptonetwork starts off at minimal adoption in year 1.

Since the TAM is typically a massive number, the choice of “Saturation Percentage” has a large impact on the model. One could argue that the winning protocols of these digital resources will become global standards, and global standards are typically “winner takes most” scenarios. I’ve chosen 2% here to be conservative.

Your choice of “Take Over Time” will dictate the steepness of the S-curve, as shown in the graph I have included. For example, a take over time of 20 years with the above inputs yields the following S-curve:

Meanwhile, if the “Take Over Time” is shifted to 10 years, the S-curve steepens considerably.

I recommend modulating “Take Over Time” to fit how difficult you believe it will be to get the mainstream to switch from their centralized providers to these decentralized networks.

Now that we have P and Q, we can multiply them together to see the GDP of INET in any given year (Row 24). In 2018, INET’s GDP would be roughly $43.2M, represented in on-chain transaction volume. This number seems conservative considering bitcoin does 10x that on-chain transaction volume in a single day, but then again it’s also ~10x the age if INET launches in 2018.

To get the monetary base, M, necessary to support this GDP we need to bring in velocity. Velocity is an assumption listed in the input table (C26), and the most important assumption in the entire model. For INET I have chosen a velocity of 20, which is about 3x bitcoin’s 2016 velocity of 6.5.

However, bitcoin’s velocity of 6.5 was a hybrid velocity, which lumped together the hodlers with the people using bitcoin as a means of exchange. My velocity of 20 only references the velocity of the tokens in the float (i.e., means of exchange velocity), because I have pulled the hodlers out of consideration, which will factor back in shortly. I deduced a means of exchange velocity of 20 from research I did with Coinbase on how their users interact with bitcoin (shown below)

We can see in 2016 that 54% of Coinbase users approached bitcoin “Strictly as an Investment,” meaning they hodl’d with a velocity of 0. The remaining 46% actually used bitcoin as a “Transactional Medium,” resulting in some velocity that we have to infer.

Fortunately, we have the hybrid velocity of bitcoin in 2016 at 6.5, and thus can solve for its constituents using a weighted average formula.

Hybrid Velocity = (% Token for Use 1) x (V1) + (% Token for Use 2) x (V2)

Use 1 is “Strictly as an Investment” with velocity = 0

Use 2 is “Transactional Medium” with velocity = V2

6.5 = (.54) x (0) + (.46) x (V2)

V2 = 6.5 / .46 = 14

As my input for INET I’ve used a velocity of 20, which is about 40% higher than bitcoin’s means of exchange velocity. Why? I think cryptocommodities like bandwidth coins will have higher velocities than the cryptocurrencies that are used as a currency on a macro basis. More on that another day.

Now, we can divide PQ by V to get M. Recall that PQ in 2018 is $43.2M, and with a velocity of 20, that means only $2.2M is necessary in the monetary base to serve this economy. One step then remains to get the current utility value per token, and that is to divide the required monetary base by the number of tokens in the float. From Row 11 we have 15.8M tokens in the float in 2018, and so $2.2M / 15.8M = $0.14 current utility value per INET token.

I don’t include the tokens that are bonded or hodl’d in my calculation of current utility value because in any given year they’re not in circulation, and thus are unavailable to the cryptoeconomy. They’re not flowing back and forth as a means of exchange for the digital resource, and hence not part of my MV = PQ calculation. Feel free to debate me on this; I’ve debated myself, and only recently added this line of thinking to my models.

We’re not done yet, because current utility value does not equal the market price of a cryptoasset. The market price of a cryptoasset is based on predictions of the future size of a cryptoeconomy, and the utility value each token in the float will require to support that economy in the future. Such pricing is done in the off-chain liquidity pools that we call exchanges, performed by our beloved friends called speculators. Which takes us to Section D of my model: discounting future utility value back to the present.

Assets are priced based on future expectations, and to deduce a present value from future expectations one needs discounting.

If you’re not sure what discounting is in the context of valuations, start here. Typically, discounting is used to determine what a future cash flow is worth today, but remember cryptoassets (or at least what I consider cryptoassets) don’t have cash flows. Instead, we are discounting back a single future utility value to the present, using a discount rate suitable to account for the risk of an early stage network. Since you use a cryptoasset once, and then it’s in someone else’s hands, this discounting methodology is not accumulative over each year the way it is with a DCF.

For these models I first choose my holding period (typically 10 years), which in this case pulls the future utility value of INET in 2028, which is $7.45 (P26). At risk of being redundant, this means in 2028 each INET token in the float will need to have $7.45 worth of value to support the INET bandwidth economy at that point in time.

I then choose a discount rate, often in the 30–50%+ range, which is 3–5x the discount rate used for risky equities that have high WACC’s. Taking the value of $7.45 and discounting it back 10 years at a rate of 40% yields a rational market value of $0.26. The calculation is $7.45 / (1.40¹⁰).

With 78.9M tokens released, INET would have a network value of $20.5M, as network value is based on the total number of tokens released as opposed to the ones simply in the float. All assets are priced at the margin, and it is the speculators that price the asset based on future expectations. This pricing is not restricted to the tokens in the float, but instead carries over to pricing the network as a whole. Be careful not to confuse this pricing with P, the pricing of the digital resource being provisioned in MV = PQ. As with Ethereum’s gas model, there are ways to dissociate how a market prices an asset from the cost to use the resource of the network.

Based on the above assumptions, if I wanted to earn a return of 40% for the next 10 years, which will nearly 30x my money, then I don’t want to buy this asset for over $0.26. In traditional finance, people would say that anything over $0.26 is overvalued. Anything under $0.26 is undervalued.

The discount rate is commonly referred to as the expected rate of return, as it shows what you expect to be compensated for holding this risky asset over time. If you decrease your expected rate of return, because you deem the asset less risky and thus need to be compensated less, then you’re okay buying the asset for a slightly higher price. For example, using a discount rate of 30% yields a rational market price of $0.54. If this is confusing to you, don’t worry, it’s somewhat counterintuitive and takes time to sink in.

Now for a curveball: What this model doesn’t account for is that in 2028 the market price of the asset will likely not be $7.45. Instead, just as with 2018, the rational market price in 2028 will be based on future expectations looking out from 2028. This is what Brett Winton has described as second-order valuations for cryptoassets. More work on that later, I suppose.

Eventually, in an equilibrium state where the cryptonetwork has fully saturated its potential and there is no prospect for future growth, the asset’s price should converge upon its current utility value that year. In other words, the current utility value could be thought of as a natural price floor driven by the demands of the cryptonetwork’s economy.

What gets tricky, however, is there will be fewer and fewer hodlers as we approach equilibrium, because there is much less potential for value accretion. Hence, the number of tokens in the float will increase. You’ll note I have an input, Decrease in percent of INET that is hodl’d each year (C14), to account for this phenomenon. One hidden fear of mine is that as these cryptoassets approach saturation of their target markets the decrease in hodlers will lead to vicious unwinds in asset prices. Fortunately, things rarely reach equilibrium given humanity’s capacity for imagination and growth.

Lastly, rows 46 & 47 look at the percent of the cryptoasset’s market price that is composed of current utility value vs expectations of utility. Since I have discounted back from a future utility value to the present, there’s a certain percentage of that price that is supported by current reality ($0.14), while the remainder is supported by future expectations ($0.12).

While some people are quick to pejoratively point out that a large percentage of these assets’ prices are based on future expectations — which can be thought of as speculative value — this phenomenon is not all that different from how stocks trade above their book value due to future expectations. In INET’s case the asset’s market value is supported by 53% current utility value, which is significantly better than most cryptoassets in the market right now.

Still Early Days

To wrap up, it’s early days for cryptoasset valuations. I’m sure I’ve made tons of mistakes, and look forward to others tinkering with these models. Given we have a whole new asset class on our hands, we a fantastic opportunity to craft the theory that people will use to price these assets for decade to come. People win Nobel Prizes for that kind of thing.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Much of my thinking here has been inspired from years of work under the guidance of Brett Winton and Cathie Wood. Thank you also to Steve McKeon, Matt Fong, Joel Monegro, Brad Burnham and Fred Ehrsam for conversations that pushed my thinking in the pursuit to better value cryptoassets.