Bitcoin: a clear path to $50,000 in 2018

I expect Bitcoin (BTC) to hit $50,000 by the end of 2018, which would represent a return of 3.4x from the closing price of $14,595 on January 9, 2018 (per www.coinmarketcap.com).

Some of the primary factors driving this increase will be as follows:

Continued flow of M2 money from fiat currencies into cryptocurrencies from residents of countries where political and monetary policy instability create an unfavorable environment for holding the local fiat currency.

Flow of investment capital from Chinese investors seeking a higher-yielding and easier-to-execute store of value compared to real estate investments outside of China. Investors from other countries with similar capital control dynamics and political/monetary policy friction will also re-direct capital into cryptocurrencies that otherwise would have been earmarked for commercial and residential real estate investment in countries with more favorable investment dynamics.

Re-allocation of invested capital from stocks and private equity into cryptocurrencies based on more attractive return potential, in addition to investment portfolio diversification benefits from cryptocurrencies’ low correlation with other asset classes.

Additional potential upside from cryptocurrency adoption from the 1 billion people in the world who have mobile phones but do not have bank accounts.

Additional potential upside from investment in gold, silver, and other precious metals re-allocated to BTC as a store of value.

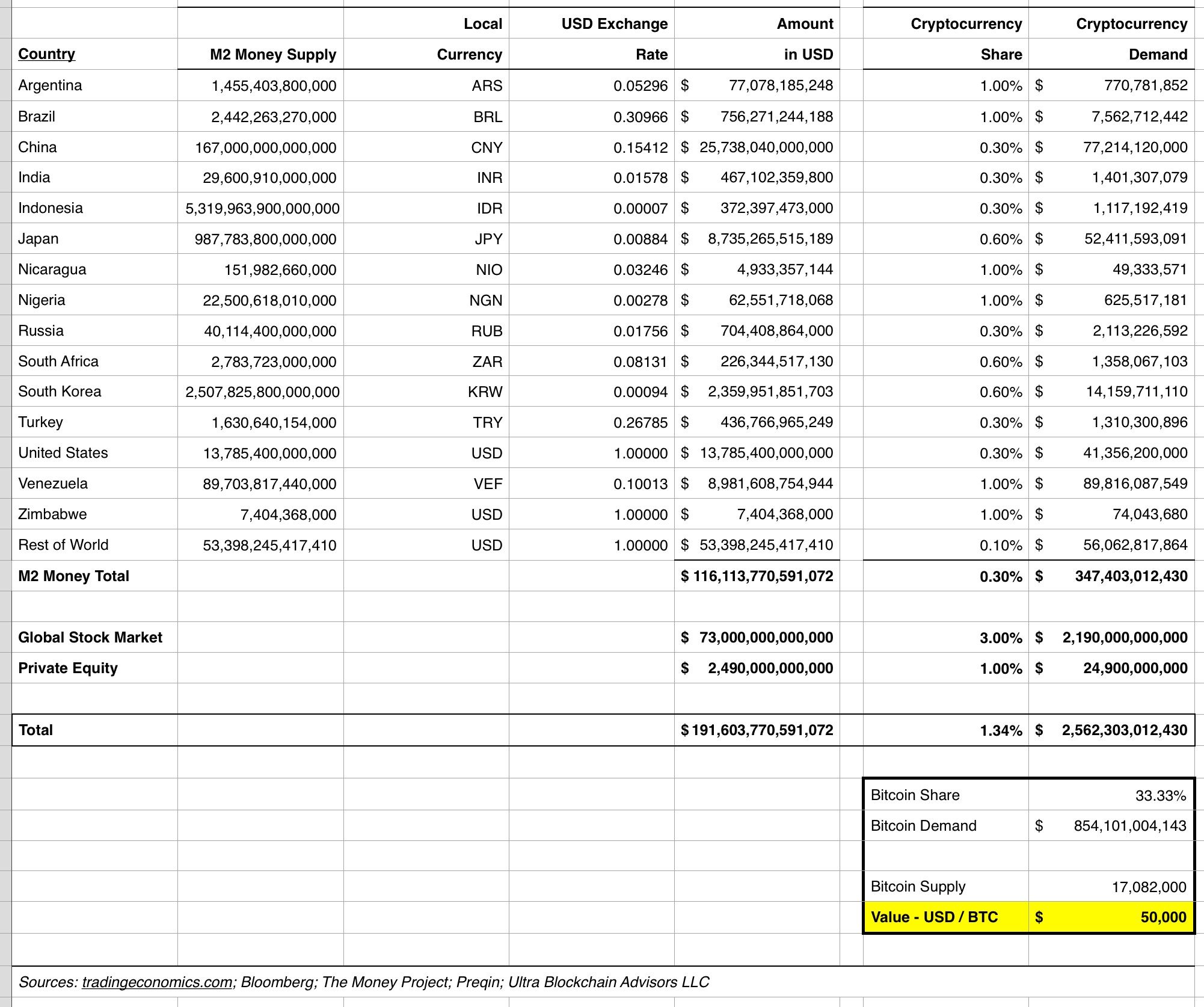

There does not have to be a major shift in any of these factors in order for the overall cryptocurrency market to hit $2.6 trillion in market capitalization within the next 12 months (or sooner). Assuming BTC maintains a 1/3 share of this market (vs. current share at 33.5% as of the time of this writing on 1/9/18), then total demand for BTC would reach $854 billion, or roughly $50,000 per BTC.

The chart below outlines the projected demand for cryptocurrencies - and, specifically, BTC - based on the factors discussed above. A detailed explanation of the assumptions behind these numbers is discussed in the sections of this blog post following the chart.

Shift from M2 Money to Cryptocurrencies

I estimate that 0.30% of the global M2 money supply (cash, checking deposits, savings deposits, money market funds, and other time deposits) will be allocated to cryptocurrencies in 2018. This will generate $347.4 billion in demand for these assets. The major countries driving this growth will be as follows:

- Venezuela (1.00% of country’s M2, or $90 billion)

- China (0.30% of country’s M2, or $77 billion)

- Japan (0.60% of country’s M2, or $52 billion)

- United States (0.30% of country’s M2, or $41 billion)

The demand for cryptocurrencies among Venezuela’s population has been well documented and driven by major instability in the fiat currency and political corruption in the country (1). Therefore, it does not seem unreasonable to assume that at least 1% of Venezuela’s M2 moves into cryptocurrencies such as BTC.

In my analysis, I assume that countries that rank high on the Bitcoin Market Potential Index score, which measures the potential for Bitcoin/cryptocurrency adoption (see footnote 2), will also have approximately 1% of M2 move into cryptocurrencies from the riskier fiat currency of those countries. Venezuela carries a BMPI ranking of #2. I assume that Argentina (BMPI ranking #1), Brazil (#17), Nicaragua (#29), Nigeria (#7), and Zimbabwe (#3) will also have roughly 1% of M2 move into cryptocurrencies.

The United States carries a BMPI ranking of #5; however, since the political and monetary policy of this country is (presumably) stronger than the countries listed above, I assume that only 0.30% of United States M2 money moves to cryptocurrencies. This would lead to $41.4 billion in demand for cryptocurrencies from US holders (or “hodlers" as the case may be). This number seems to correspond to the fact that, based on a recent survey, approximately 25% of US millennials favor cryptocurrencies over other investments (3), along with the fact that there are over 13 million accounts opened on Coinbase (4).

There are 75.4 million millennials living in the US (5). If we assume that 25% of these individuals buy cryptocurrencies, with an average investment of $1,825, then this would lead to total demand of $34.4 billion for cryptocurrencies (83.2% of my estimate for the entire US cited above, which is likely conservative). In addition, if we look at the 13 million Coinbase accounts and assume that each account buys an average of 0.143 Bitcoins, then that would lead to approximately $26 billion in demand. Each of these figures supports the total cryptocurrency demand in the US included in my analysis of M2 movement in the United States.

I estimate that China (BMPI ranking #27), India (#22), Indonesia (#152), Russia (#11), and Turkey (#35) also see 0.30% of M2 money shift into cryptocurrencies. In fact, there is likely a higher incentive for residents of these countries to move into Bitcoin as a store of value vs. the fiat currency, given political and/or monetary policy instability in each respective country.

A recent report from Nomura Securities estimates that there are 1,000,000 people in Japan holding an estimated 3,700,000 Bitcoins (6). This corresponds to around $51.8 billion in cryptocurrency demand. I use this as the basis for my estimate that 0.60% of M2 money in Japan will continue to move into cryptocurrencies, which would create $52.4 billion in demand. I believe that South Korea will have a similar share as Japan, despite recent FUD about regulators cracking down on exchanges in that country.

For the “rest of the world,” I assume that 0.10% of M2 money moves into cryptocurrencies. In total, I estimate that 0.30% of global M2 moves into cryptocurrencies, which contributes $347 billion in demand.

Capital re-directed from real estate investments to cryptocurrencies

Another factor supporting my demand estimates is the fact that real estate investments, which have been popular with the Chinese and South Americans, appear less attractive as a store of value compared to Bitcoin for future investments. Therefore, money that would have been invested in real estate could be re-directed to cryptocurrencies such as Bitcoin instead.

Individuals and corporations in China invest in excess of $20 billion annually in real estate abroad, and estimates indicate there is an additional $200 billion available to invest (7). However, it is getting much more difficult for Chinese investors to move money out of China, due to steps that Chinese authorities have taken to constrict capital flight in an effort to stabilize the local fiat currency, the yuan. Even with the restrictions that Chinese authorities recently have placed on local cryptocurrency exchanges, it still is much easier for investors to acquire cryptocurrencies than real estate abroad, especially for individuals.

Therefore, as the $200 billion or more in capital is set to be invested by the Chinese, I believe cryptocurrencies will take a growing share of this in 2018. In my analysis above, I assume that 0.30% of China’s M2 money supply will be allocated to cryptocurrencies. This accounts for just over $77 billion of demand for cryptocurrencies, a portion of which will be driven by capital previously allocated to real estate investments.

There are other countries that share this dynamic, including Brazil, Venezuela, and Russia (8); and I believe investors in these countries will continue to shift at least a portion of their investment capital from real estate into cryptocurrencies. This provides further support to my demand estimates above.

Re-allocation of capital from stocks and private equity to cryptocurrencies

The value of investments in the global stock markets totals approximately $73 trillion (9), and total capital invested in private equity is roughly $2.5 trillion (10). I expect there to be continued re-allocation of capital from stocks and private equity into cryptocurrencies in 2018.

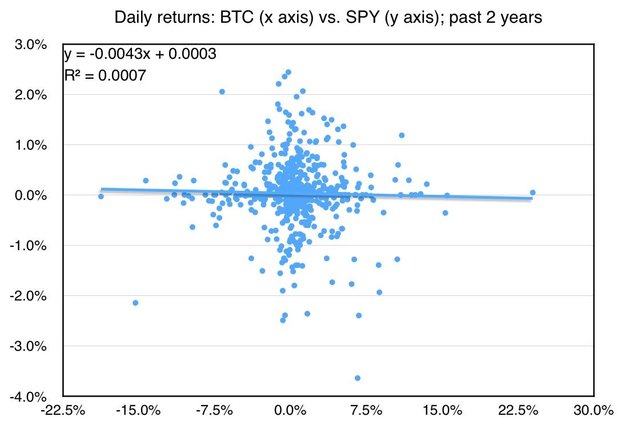

The S&P 500 returned 17.4% (excluding dividends) in 2017, which is a solid return for the stock market overall. However, this pales in comparison to BTC’s 1,300%+ return over the same timeframe. As investors seek better returns, and as exchanges develop more user-friendly applications that make it easier to acquire cryptocurrencies, I believe investors will re-allocate at least 3% of their stock market investments into cryptocurrencies in 2018. In addition, a recent survey indicates that a large portion of millennials actually favor investing in cryptocurrencies instead of stocks (see footnote 3). Further, as illustrated in the regression analysis below, cryptocurrencies exhibit no correlation to the stock market, which should enhance diversification in the context of an overall investment portfolio.

In my opinion, these factors make a 3% re-allocation from stocks to cryptocurrencies an achievable target in 2018. This re-allocation would add close to $2.2 trillion in demand for cryptocurrencies.

The median annual return for private equity funds was 12-13% (source: Preqin; see footnote 10). Given the illiquidity of private equity investments, along with lagging returns due to an over-supply of capital chasing the same limited number of deals, it would make sense for investors to move some money into cryptocurrencies from this asset class. I estimate that 1% of the capital invested in private equity will be re-allocated to cryptocurrencies in 2018, as the low-quality deal flow and lackluster returns drive investors to seek a more attractive investment. This would add almost $25 billion in demand for cryptocurrencies.

There has also been much discussion of Bitcoin as “Gold 2.0.” Private investment in precious metals, such as gold and silver, could potentially be re-allocated to cryptocurrencies as a store of value; however, that is likely something that will have a greater impact beyond the 2018 timeframe. While the amount of mined gold exceeds $7 trillion, the actual amount of this that represents this asset held as an investment is closer to $1 trillion to $2 trillion. Therefore, this might not be as massive a factor driving Bitcoin higher - albeit still a solid source of upside if capital does get re-allocated from gold to Bitcoin.

Other potential upside

I believe the 3 themes discussed above will be the key drivers of the value proposition for investment in and adoption of cryptocurrencies in 2018. There are other factors that could support upside for the cryptocurrency market but are more difficult to quantify - at least as it relates to impacting the value of the market in 2018 - and they include the following:

Cryptocurrency adoption among the 1 billion people in the world who own a mobile phone but do not have a bank account (11)

Cryptocurrencies, such as BTC, being used in place of fiat currencies for a portion of the $5.1 trillion in daily foreign exchange transactions (12)

Conclusion

There will be continued demand for Bitcoin coming from a number of countries, as this asset represents an attractive alternative as a store of value compared to the local fiat currency. However, the big mover for Bitcoin and other cryptocurrencies, as illustrated in the chart in the earlier section of this post, will be capital re-allocation from global stocks and private equity. Overall, I expect approximately $2.6 trillion in demand for cryptocurrencies in 2018, with BTC taking a 1/3 share. At this share, the demand for BTC would be $854 billion, which corresponds to a price of $50,000 per BTC.

Footnotes:

(1) https://www.bloomberg.com/news/articles/2017-06-15/venezuelans-are-seeking-a-haven-in-crypto-coins-as-crisis-rages

(2) http://fc15.ifca.ai/preproceedings/bitcoin/paper_14.pdf

(3) https://www.prnewswire.com/news-releases/blockchain-capital-survey-finds-over-one-in-four-millennials-would-prefer-investing-in-bitcoin-over-stocks-and-bonds-300551422.html

(4) https://www.cnbc.com/2017/11/27/bitcoin-exchange-coinbase-has-more-users-than-stock-brokerage-schwab.html

(5) http://www.pewresearch.org/fact-tank/2016/04/25/millennials-overtake-baby-boomers/

(6) http://www.businessinsider.fr/uk/bitcoin-could-be-adding-03-to-japanese-gdp-2017-12/

(7) https://www.cnbc.com/2017/06/16/chinas-real-estate-investors-on-a-200b-global-spending-spree.html

(8) https://www.buildium.com/blog/why-foreign-investors-buy-property-in-usa/

(9) http://money.visualcapitalist.com/worlds-money-markets-one-visualization-2017/

(10) http://docs.preqin.com/samples/2017-Preqin-Global-Private_Equity-and-Venture-Capital-Report-Sample-Pages.pdf

(11) https://www.theverge.com/2015/2/4/7966043/bill-gates-future-of-banking-and-mobile-money

(12) https://www.bis.org/publ/rpfx16fx.pdf

Enjoy the vote and reward!

Great study! Hopefully you are right!