An in depth analysis of why bitcoin COULD reach $1,000,000!!

I have come to the conclusion that bitcoin is going to $1,000,000. This number, which you will see tossed out into the crypto narrative, comes from the idea that there are 100 million subunits of bitcoin and if each was worth the quantum unit of 1 U.S. cent, then a bitcoin would be worth $1 million. This is a non sequitur argument as there is no causal link why this should be so. In fact, you can fractionalize a bitcoin satoshi in to as many sub-satoshis as you like. It does have plenty of sizzle as an idea and while it has seemed extremely unlikely to me until now I suddenly see that mirage as being a possibility.

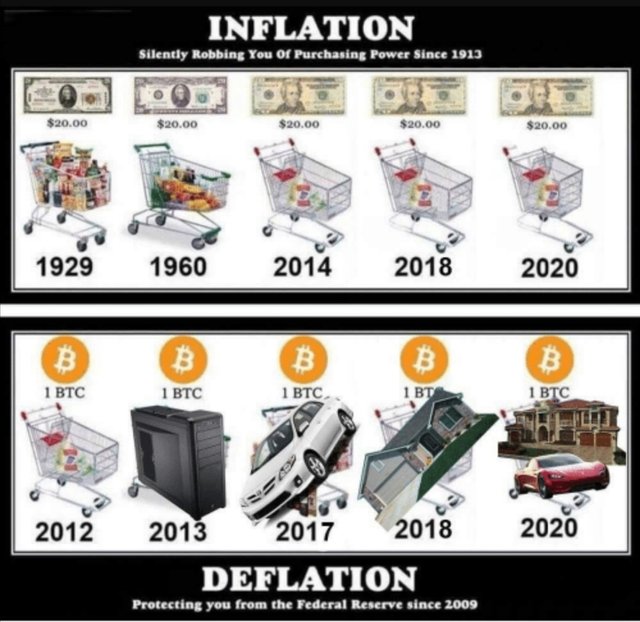

I now believe this is a possibility not because the value of bitcoin will go up, though I believe it will, but because the value of money is about to fall heavily and quite possibly into the depths of monetary hell.

If there is not a startling recovery in the global economy this year, then government budgets will collapse and those governments will be forced to print cash and monetize bonds. You might say this is QE, but QE isn’t the same thing at all, because it doesn’t print new money and hand it out. It prints new money and swaps it for not so acceptable assets that are a step or two and a haircut or two away from being swapped by others for lovely cash. QE is a generous swap with a kindly pawnshop that is happy to take a view on the creditworthiness of a lot of dodgy assets. Handing out to the general public money still almost wet from the presses because they might get sad and uppity or simply because they need money to pay their mobile bill to keep the phone company solvent to keep their employees working to pay taxes to the government, is another thing entirely. Printing money to spend in that state’s economy is straight South American-style inflationary fiat creation.

If tax budgets crater, this is exactly what is going to happen, because “austerity” on the scale necessary to claw back broken budgets is not going to happen and perhaps even shouldn’t. Like it or not, the lockdown has made everyone poorer, in what are highly leveraged economies. The trouble with leverage—as anyone with a nice life style, a pile of debt and sudden unemployment knows—is that leverage is great on the upswing but awful on the downswing. Any trader will tell you, leverage kills and like any leveraged trader caught with the markets in reverse, we must hope for a sudden semi-miraculous reversal in direction to save us from being irreversibly crushed by the mathematics.

Right now, there are plenty of firebrands wanting to smash the capitalist system or what passes for one in these mixed economic times. It may be proven ironic that it has already been smashed. Who owns the aftermath is yet to be established and we can hope the outcome will not be worthy of a record in the history books. Either way the outcome of sovereign budget collapses is not going to be resolved by deflation and the only solution to such a situation will be to print and to flush the system with money at every level without recourse to caring about inflation.

So I can imagine a scenario where recovery comes quite quickly and governments print hard but not so hard as to hit the sort of inflation made famous in Argentina, Turkey or even in history Japan, Hungary and Germany. A strong recovery means rebasing currencies by 100% over say 6 or 7 years, which would do the trick of crawling back to a new normal. You would see inflation around 7%-9% a year and the rest of the dilution would be magicked away with statistical tweaks to help the optics of it all. That would be a fine accomplishment by those holding the bag of the next few excremental years. It would be like a plane crash where there were only concussions and broken limbs. But this “soft landing” is by no means a certainty.

The second virus wave is already apparently shaping up and countries are unlocking at a pace that might go on into the autumn and perhaps will take even a year or two to revert to a status where economic activity can fully recover, the damage is still building. Is the timetable for a return to normal levels of economic activity going to allow state expenditures to continue at anywhere near old levels?

It’s hard to imagine it will while it is easy to imagine a biblical outcome.

Doling out millions of new money is the classic answer to such chronic straits so bitcoin to $1,000,000 could happen in short order in such circumstances and in real terms that might be only a few multiples higher in purchasing power.

Right now there are only about 18 million bitcoins (with a maximum of 21 million) and if any major economy or group of minor countries melted down into hyperinflation that alone would drive crypto into orbit in dollars.

So while the halvening chips away towards high prices for bitcoin, there is an inflation bomb ticking away that in short months will quickly resolve its probabilities.

So what is an investor to do? Simply watch prices at your local supermarket and watch the pace of stimulus and government deficits. This will help you gauge if the wheels are coming off and if they do, as is becoming increasingly possible, bitcoin will go vertical.

That inflation is already baked into U.S. equities and bonds care of QE, and if there is another round of U.S. stimulus and it’s the kind that goes straight into the pockets of people, then that will be the starting gun for a financial reset that will see everyone with plenty of zeros added onto their net wealth but sadly with significantly less ability to buy the things they want.

This post has received a 25.8 % upvote from @boomerang.

This post has received a 25.8 % upvote from @boomerang.

You got a 76.86% upvote from @minnowvotes courtesy of @ukprepper!

You got a 1.47% upvote from @votemypost Send any amount of Steem to @votemypost with your post link in the memo for a proportional upvote. Earn a passive income by delegating Steem Power to @votemypost

If you are looking to earn a passive no hassle return on your Steem Power, delegate your SP to @votemypost by clicking on one of the ready to

delegate links:

25SP | 50SP | 75SP | 100SP | 250SP | 500SP | 1000SP | 2500SP | 5000SP

Another Amount

You will earn 85% of the voting bot's earnings based on your delegated SP's prorated share of the bot's SP each day! You can also undelegate at anytime.