Valuating the Bitcoin Part 1: International Trade

My exposure to international trade (and payments for international shipments) is (minimal, but) enough that I understand some of the difficulties involved. Using banks to make these payments is expensive and time consuming (both in that it takes a long time for the money to move and there is a good deal of labor involved for the customer and the merchant). Worse, companies often rely on banks to provide currency exchange rates which is where the banks make a somewhat concealed profit.

As part of a multi-entry series on valuing the Bitcoin, I intend to tackle International Trade as an important use case for the digital currency. The goal is not to convince companies to adopt BTC as the currency of international trade; I am confident that they will figure this out on their own. My goal here is to use the size of international trade as a way to value the Bitcoin.

I envision that companies engaging in trade across borders will hold a certain amount of their wealth in the Bitcoin at all times ready for fast, convenient, permissionless, inexpensive international payments. In order to have this BTC on hand, companies will likely be required to convert their fiat into the Bitcoin on exchanges meaning the amount of institutional investing in BTC will mirror the amount of BTC that will be used in trade. So, what effect will that have on the capitalization of the Bitcoin?

Let's start with a basic statistic: $11T. This is the approximate value of the international shipments of goods occurring in 1 year. But understanding the movement of funds in order to accomplish this is difficult. So I will assume that $11T worth of transactions can be accomplished with just half that amount of money: about $5.5T (likely a conservative figure since according to this Market Watch there is around $200Q worth of state-backed currency (depending on your definition of currency) in existence today.

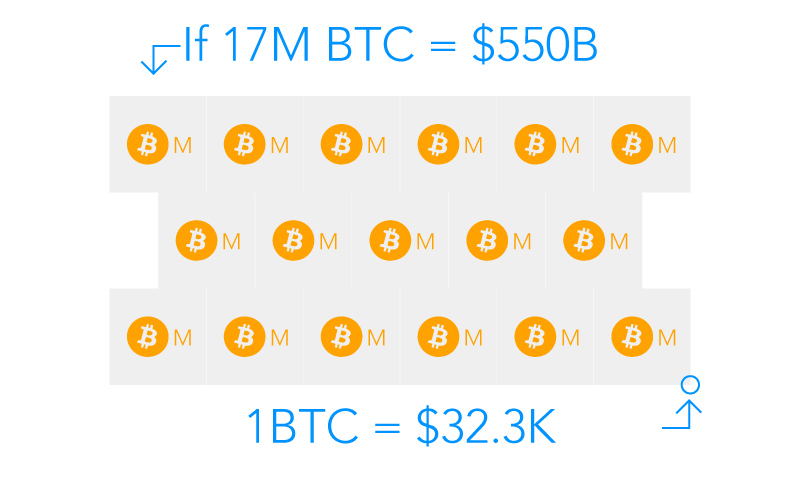

If we imagine a moment in the near future where about 10% of int'l trade is transacted in BTC then the market capitalization of the Bitcoin would need to grow to about $550B.

What matters to most speculators in the BTC is not the total cap though. So to take this one step further, we'll make one more safe assumption: let's say there are 17M BTC in existence at the moment we hit this 10% adoption rate.

$32,300 Bitcoin. This valuation completely ignores all other use cases of the Bitcoin. So adding other use cases will cause my opinion of the value of BTC to go up. However, other cryptocurrencies could also be used for this purpose. While standardizing the currency will be valuable, steep competition for the role of international trade currency could easily cut this number in half (still roughy 3 times the current value of the Bitcoin).

Thanks for reading. If I got anything wrong, please sure to let me know. Also, what do you think is the #1 best use case for the Bitcoin? Do you have a method or formula for determining the right price for a cryptocurrency?

I've long thought it would be useful to find a valuation formula that could be applied to cryptocurrencies. Especially, I'd like to know the right value of the Bitcoin. (Much in the same way investors value a company.) So far as I can tell, the world of cryptocurrency speculation is for technical traders only. (A fact, as a skeptic, I find troubling.) This entry on the value of BTC as an international trade currency is part 1 or a series on my attempt to find such a formula. Please follow me to continue to read my posts.