The Curious Case Of Tether

Traders are experiencing the most choppy month of the year as the Bitcoin scaling debate nears a possible end. To understand some of the big moves that are taking place we will look at a seven day period covering July 7 to July 14.

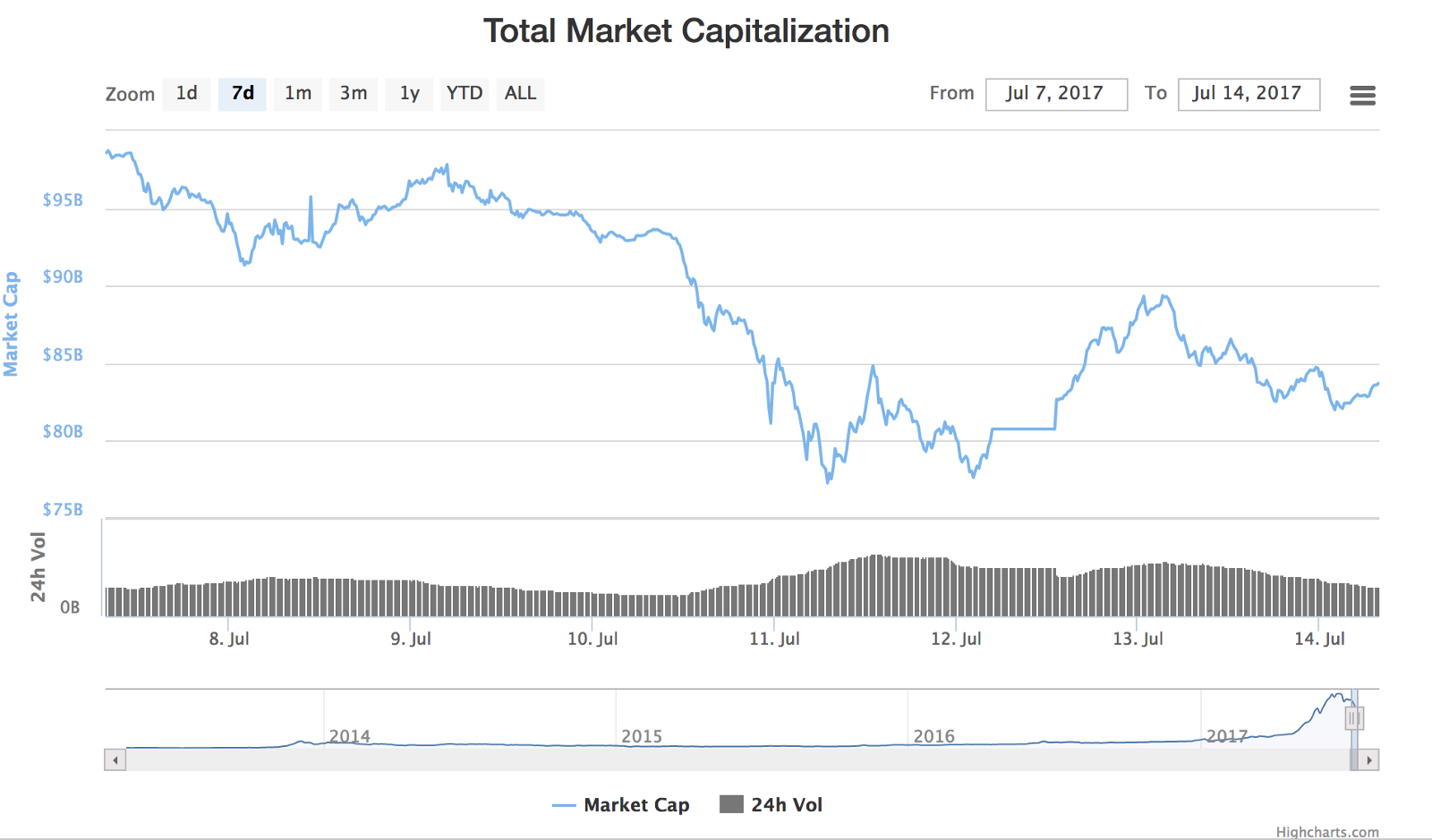

Market cap as a whole began the period at a substantial $98bn, before and closed at just over $83bn at the end of the period with the lowest volume in the period being testing at $77bn — this was tested twice on successive days — July 11 and 12, forming a double bottom if you view the market as a whole.

To put this into perspective, the percentage change from highest to lowest point is at 21% on July 11 and closing the period on July 14 with a slight recovery to 15% change. These corrections are important, but not substantial for the volatility in cryptocurrency.

Many traders are preparing for ways to hedge the August 1st event. The day represents a possible user activated soft fork to Bitcoin Improvement Proposal 148 — but also a possible fork splitting Bitcoin into two seperate chains. Strategies range from cashing out fully into fiat to moving into resilient and similar technology coins to Bitcoin — the most notable of which is Litecoin, experiencing a $56 all time high in the first week of July.

While it would be interesting to analyse the flows of currency into alts and back, traders can learn a lot by paying attention to the growth Tether has experienced in the same period. The $USDT currency which is pegged to the dollar almost completely with a minor fluctuation of 1–2%.

Tether started the same seven day window at just $223mn market cap and and closed the window at $291mn. The substantial 30% uptick in a trading period of one week is only part of the picture. The largest increments taking place between 11 and 14 July.