Market Musing, 5/1/2018, Sell in May (Dollar Rising and Bonds Selloff), Crypto's stabilizing

1. High Volatility!: VIX > 16, Sell in May and Go Away.!

Strong Dollar Rise and 10 Year US Treasury Interest Rate near 3% are not good for the US Markets. (Read the next two paragraphs and charts to see this). AAPL Earnings, FOMC Meeting and Jobs Report are all volatility events for the week. Downside Target for /ES Futures could be the 200 Day Moving Average, 2613. If this does not hold, then the March Lows, 2580 or even February Lows, 2530 in play. Keep your hedges on please: Risk Twist Spreads for the Quarterly Hedge, Dr Ted Nukes SPX Put Ratio for a 3 week hedge and 2v4 Week RUT calendar for 6-10 day hedge, and SPY, IWM, QQQ Long Puts for a few days hedge.

2. E-currencies vs US Dollar:

Bitcoin has bounced off the $6000 low and has stalled around $9000. The other cryptos Litecoin, Ethereum and Steem are following suit. This is a trader’s environment, where you can buy or sell a small positions and take profits quickly. Are you mining cryptos in private wallets yet? US Dollar finally broke through the 91 and exploded above the 200DMA. US Dollar is up 9 of the last 11 trading days. My upside target is 95 but there is potential resistance at 92.62 the high for the Dollar in 2018.

https://www.coinbase.com/charts?locale=en-US

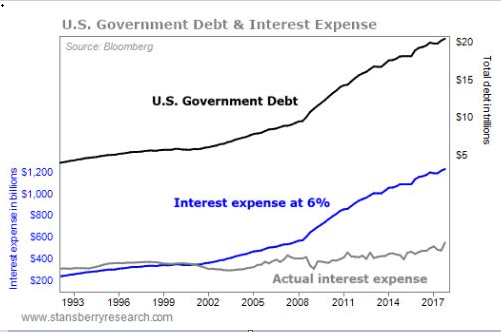

3. US 10 Year Treasuries Interest Rate approaching 3% again:

A week ago Tuesday, the touch of 3% caused a 80 handle drop in /ES Future intraday. With US Treasuries selling off again, what do you think happens to US Markets and US Government Interest Payments? Look at chart to see the impact if interests normalize t 6%. The yield curve is flattening and could go inverted. In the past, this has been an early sign for recession. Perhaps this time will be different…...

4. Cherry Picks Newsletters:

Tasty Trade Researchers publish an awesome weekly newsletter every Tuesday. Check out the link below. If this blog sounds like gibberish, watch "Where do I start 101" free education series on Tastytrade.

https://s3.amazonaws.com/cherry-picks-s3-bucket-newsletter/live/18_05_01_tastytrade_Research.pdf?mc_cid=b1c14c6f61&mc_eid=e9e24bad07

5. TRADE Log: VIX > 16 High Volatility Trades

- Long GOLD, BITCOIN

- Jade Lizards, Broken Wing Butterfly, Dynamic Iron Condors

- Jade Lizard Adjustment Case Study (Watch last Video please)

6. Videos:

Theotrade:Can AAPL Save A Sinking Market?

Coins mentioned in post: