Buckle Up Buttercup Because the Bitcoin Price is in Uncharted Territory

Get a comfortable seat and strap in because this is going to be one heck of a ride!

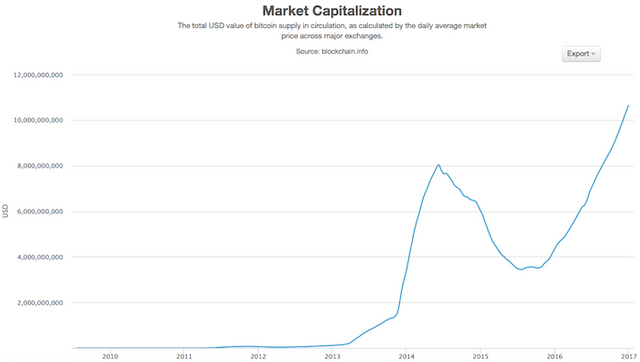

The underlying Bitcoin economy is incredibly strong and the price is rallying towards all-time highs. What is driving all of this? Do transactions fees play a role?

As I tweeted earlier, the best performing currencies over the past six years have been:

2011 - Bitcoin, +1,500%

2012 - Bitcoin, +299%

2013 - Bitcoin, +5,400%

2014 - USD, +13%

2015 - Bitcoin, +37%

2016 - Bitcoin, +130%

The 200 day moving average is a great metric because it filters out all the daily noise to reveal the long-term trend in the price of an asset. The 200 DMA for Bitcoin has been powering along in a fourth great bull run and adding nearly $25m per day to the 200 DMA market cap. 2013's bull run by comparision added about $1m per day to the 200 DMA market cap.

The underlying Bitcoin economy is doing great with hundreds of exchanges, thousands of businesses and millions of users. There are a myriad of services ranging from buying bitcoins, to Bitcoin debit cards to Bitcoin mining equipment and so much more.

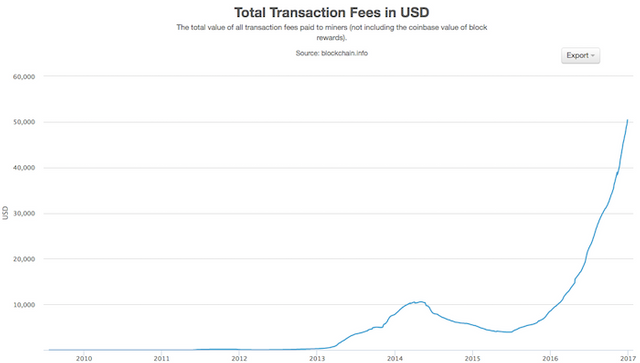

And all this daily use results in Bitcoin transactions. To send Bitcoin transactions requires fees to be paid. So an excellent way to see how much value the Bitcoin network adds to society is to gauge how much people are willing to pay to use it. How much? It has gone from about $5,000 per day to around $50,000 per day!

And what does the 200 day moving average of transaction fees in USD reveal? All time record amounts being paid to use Bitcoin. This means people find Bitcoin incredibly valuable and are willing to pay to use it.

So, what do you think? Are transactions fees important to the price of Bitcoin? The higher the better? Or is actually chasing the rabbit too much more fun than thinking about why?

I'm of the opinion that the higher transaction fees go the worse it will be for Bitcoin in the long run. The reason being, it will become (if not already becoming) a problem for merchants, who will then choose a less expensive solution.

I recommend SBD's ;), but the likely winner will be their old reliable merchant bank and credit cards.

As fees increase it could also become a problem for anyone simply wanting to send money domestically.

Disclaimer : I sometimes channel Roger Ver. ;)

Bitcoin's price is determined by 2 aspects:

(1) its utility (normally as a payments network, but other uses too)

(2) its hoarding component (similar to gold)

I agree fees are a good indication of price component (1). The ratio between the (1) and (2) is ultimately measured by monetary velocity. Currently the hoarding aspect is quite a large component of Bitcoin's valuation, similar to gold, so I suspect the fees is a secondary valuation indicator.

FWIW, the mooning of the fees market has been a result of a very recent demand driven fees market emerging since March 2016. I posted this on my Twitter and is part of a larger study I'm doing on the fees market right now.

https://twitter.com/dangermouse117/status/814406103647649792

Disclaimer: I am just a bot trying to be helpful.

Disclaimer: I am just a bot trying to be helpful.

Great analysis and perspective. Thankyou.

I happen to like rabbits. But seriously, great analysis, thank you for sharing!

Good information thanks for sharing