The Great ICO Debate Carries On (With Bonus Media Frustration!)

Just finished reading this interesting /r/ethereum thread called "There is a war going on. (on crowdfunding and ICO-phobia)"

Since I joined the Augur Project in January of 2015, the topic of crowdsales has been something that's been very hard to avoid in my life. In October, Augur's REP crowdsale concluded and we raised $5.3 Million, a great amount considering it was the first token sale on Ethereum and there was an extremely bear market at the time for ETH and BTC. At the time of the sale, I expected an onslaught of trolls accompanied by the occasional genuine skeptic who had legitimate questions (we love these people, even managed to win a few over too). My expectations were way off as we did receive some criticism, but not as much as other projects had in the past. Unfortunately, this period of calm only happened until the launch (and subsequent hack) of The DAO.

The final total funds raised in Augur's 2015 Crowdsale:

Since that event occurred earlier this year, pundits seem to come from every angle to pontificate the evils (or values) of the ICO model for funding. Subsequently, my job of communicating with the public became a lot less fun and a lot more frustrating.

Bonus Media Frustration (AKA The Great ICO Debate Part 2):

Last week on October 4th, Augur's REP tokens were distributed and the full Augur network went live! In the days preceding the distribution, the two largest crypto exchanges by volume (Poloniex and Kraken) both announced that they would support REP at launch. This was something unprecedented as I'm not aware of any exchanges pre-announcing their support of a token upon distribution. In the first day of trading on Kraken and Poloniex, the volume of REP trades was three times higher than Ethereum had at it's launch.

Both MyEtherWallet and Jaxx Wallet offered integration of REP almost immediately, with a slight delay of getting Augur approved for Jaxx by the Apple App Store. The token distribution went insanely smooth and there were no major issues and very few minor ones that occurred. As the launch week winded down, the price dipped and became a bit more stable from the rush of day 1 traders, something I personally expected as it's happened in other similar situations. An email by a colleague included this quote regarding their perception of the crowdsale (a comment echoed by other team members as well):

"This was the cleanest token launch I've ever heard about -- the support inquiries I've seen are almost entirely about user errors." - Augur Co-Worker

My perspective changed a bit earlier today when a Coindesk piece was published that focused on the REP distribution. The author was put in touch with me last week by his editor to talk about the distribution, getting our perspective for a possible piece. After multiple attempts to contact the author after the intro....I received no reply and thought they decided not to cover this and focused my time on other outlets. These preceding events made seeing the name Charles Bovaird as the writer of a completely negative piece on Coindesk earlier today even more frustrating. The negative perspective didn't bother me as much as the lack of interaction with the author, who was introduced to me but didn't bother to contact us to get our perspective/statement on the launch.

A Predictible Click-Bait Headline Followed By The Pastest Tense:

The piece seemed designed to take a stance against "appcoins" (and crowdsales), going even so far as to call them "snake oil". They spoke to people like Whaleclub’s Petar Zivkovski and Crypto fund manager Jacob Eliosoff, two individuals I know little about. Something I do know is that the Augur team has more data and information about the REP launch than either of those individuals, which begs the question of why Charles Bovaird refused to get a statement from us....or even acknowledge that he was in contact with our team about this exact topic. The piece had some investor-focused content that focused on the drop in REP price from launch day, to be clear I have no issues at all with this as it's obviously true and not something that is too concerning at this point, it was pretty much everything else that bothered me. No surprise that Mr. Bovaird also failed to mention the project update and UI preview screenshots we posted this morning on the Augur Blog.

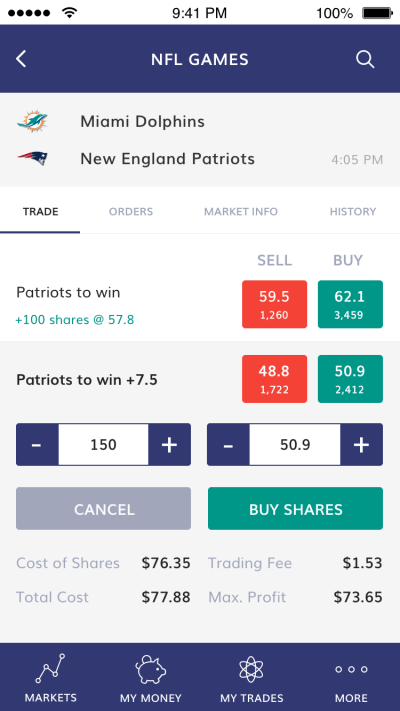

Preview of Augur's New Mobile UI:

This has lead me to right now, thinking about the different sides of this issue and trying to understand the perspectives that I vehemently disagree with. So I've been reviewing the views of some various respected folks in the space to try and gain some insight. There's Preston J. Byrne's piece who seems like an old man yelling at clouds, telling ICO supporters to "grow up" and going on and on about future regulation (inevitable, eventually) to spread FUD on the concept (interesting since CFTC members have made multiple statements advocating for a "do no harm" approach that will allow the technology and related innovations to grow before handling regulation. Byrne seems like the kind of guy who absolutely loves authority and regularly uses quotes like "well the law is the law" and "rules are rules". To summarize, the guy comes across as the type of person who I have no respect for as it's clear he has no respect for the topic he is covering.

On a completely opposite note would be Tuur Demeester with a piece titled "Why I’m short Ethereum (and long Bitcoin)" that was published last week. The piece is more Ethereum-centric, but it is still relevant to this topic as most crowdsales are for Ethereum-based tokens. Tuur seems like the type of person that many folks on the "Anti-ICO" side could learn from when it comes to clear and respectful messaging. I love Ethereum, but what he wrote actually caused me to research some of the issues he illustrated and his points were logical and his bias seems remarkably low. Reading this brought my spirits up and I'm now making his Medium page a regular visit and something I recommend all to check out.

So are crowdsales bad? The answer is that many are, but some aren't. Any argument that doesn't illustrate that is something to immediately disregard. My pro-crowdsale bias was likely partially caused by my work with Augur, something I will readily admit. Augur is a project that would have a very hard time finding VC funding for a variety of reasons, including the fact that it's open source. The crowdsale model gave us the resources to build a decentralized prediction market platform, a radical idea that's time has come to attempt. Like anything, there were issues in the process and bumps along the road, but those should be expected when attempting a project like Augur.

I'll wrap this up by sharing two quotes that I gave to Michael del Castillo of Coindesk (Note: Michael does great work) back at the Exponential Finance Conference on June 9th, 8 days before The DAO hack:

"I’m hoping that developers don’t hear all this about The DAO and stop there and think that’s their only way to get an Ethereum project done,"

"To have a strong ecosystem in Ethereum you need projects outside of The DAO and there needs to be as many projects as possible."

As malicious attackers continue to hammer the Ethereum network itself, pundits and trolls both anonymous and known will continue this "war" against the ICO model. My belief is that the "Anti-ICO" sentiment is what's used publicly, but the real motivation is to create a situation similar to what's happened with Bitcoin in the past 1 to 2 years. Imagine if all of that effort was put into improving Bitcoin, it's easy if you try.....

Tony on Twitter @TonySwish

Learn about Augur: Augur.net

Disclaimer: I am just a bot trying to be helpful.