RE: Bitcoin Booms Above $10k as Next Wave Starts

Regarding Tether - I'm wondering why everyone seems to judge Tether based on whether each Tether in circulation is backed by an actual dollar. The US dollar value of any cryptocurrency is based on its circulating supply and the demand for the token, no?

With this in mind, does Tether not adjust its total supply based on the demand for Tether in order to keep the price of Tether at 1 USD - in effect tracking the US dollar?

How does being backed by physical US dollars affect this in any way? Even if people started massively selling off Tether, couldn't Tether developers "burn" excess supply to make it more scarce and keep the value at $1 regardless?

Being that you have discussed this issue in the past, I was curious to know your response to this. I welcome any other readers thoughts as well. Thanks.

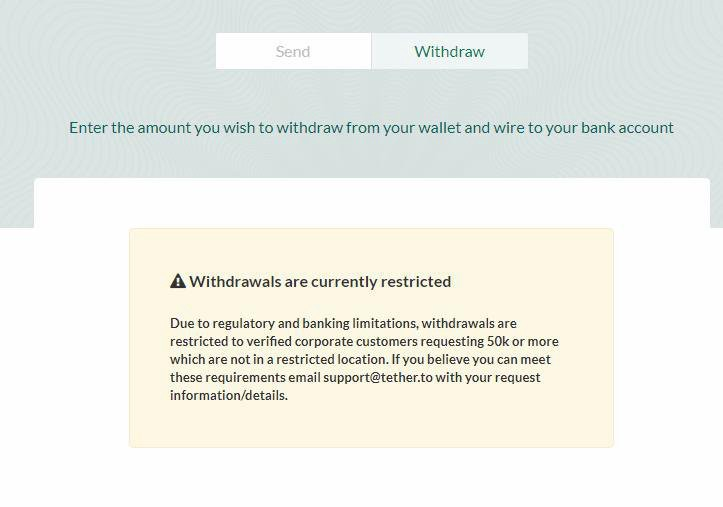

A normal bank would maintain fractional reserves, and is insured and backed by the U.S. government. But Tether has a problem, the backbone of Tether's business is to exchange one USD for one USD₮. Now Tether must prove it has that money, in case people people would like to withdraw. It is possible to "burn" Tether to maintain the price, unfortunately that is not the case. Since Bitfinex lost it's ability to bank, no one has been able to withdraw Tether, therefor maintaining the price within 10 American Pennies.

Of course Tether might have the money, and is stuck with incompetent auditors, OR Tether has essentially created fake money propping the price of Bitcoin up.

Thanks for the response, but again - what relevance does a bank have to do with the Tether token? If Tether the company is making this their business model, then I certainly see your point. Clearly the Bitfinex exchange has problems.

I'm more referring to the concept of a stable coin in general. If you have a stable coin, whether or not you have fractional reserves in a centralized entity is irrelevant to the dynamics of supply and demand for the token itself. Whether or not people can cash out their crypto is the responsibility of the exchange you are using, or other type of selling/exchange method used by the holder.

So, if Bitfinex screwed something up, and can't give people their money - is that not an exchange issue? Theoretically a "flex-supply" stable coin should be able to have its value stabilized without regard to fiat backing in any way, no? And accordingly - regardless of the condition of the company Tether, the Tether token should have value relative to its usage and its ability to stabilize the price at 1 USD.

The whole premise of Tether is that it's backed 1:1 by fiat USD so if they're not then they're lying to Tether users, quote from their website

"Every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USD₮ is always equivalent to 1 USD."

I see. That is important then. I wonder if another stable currency could upend this requirement though in the manner that I described above.