Is Decred (DCR) A Good Investment? In-depth Analysis and Near to Longer-Term Expectations

Being at such an early stage in its lifecycle, many cryptocurrency projects are still working on the best path towards a decentralized system - for whatever it purposes. Ironing out the kinks, so to speak.

Sure, we have commercially viable platforms that perform a serviceable job when it comes to their use case, but these teams themselves acknowledge the room for growth and improvement, via the fact that they have extensive roadmaps.

Projects are tentatively working on solutions that are subject to change, dipping their feet into the water and trying to figure out the best possible solution to achieve the optimal performance for their use case.

Even with the oldest of cryptocurrency use cases, i.e. a digital currency, projects have taken their own approach to creating the best possible network. Whether it’s security or transaction performance, these projects implement their own consensus algorithms, governance models and protocols to make that best possible network.

Many of those projects see Bitcoin as a great starting point into the world of digital currencies, but also feel that it could be improved upon in many ways. You’ve probably heard this story a few times before, but how many of these projects actually have substance to back these ambitions up?

Well, one of these projects is Decred (DCR), a project building a digital currency that emphasizes its governance protocol strongly.

`I’ll quickly explain what Decred is, before going over its technology and unique selling points. After that, I’ll talk about how the DCR token has done in the markets and the potential it has as an investment.

What is Decred (DCR)?

Decred is a digital currency through and through, though it really does a lot to promote the key feature of the network, the governance protocol and it’s hybrid use of Proof-of-Work and Proof-of-Stake (which I will talk about further below.)

Decred launched in 2016, with no ICO. Only 8% of DCR tokens were pre-mined, with it being split between developers and early interested participants.

Decred calls itself an “autonomous digital currency” - autonomous referring to the network controlling itself. You might wonder how this differs from Bitcoin (BTC), which is also self-governing. The difference here is that Bitcoin doesn’t always lend itself to easy protocol changes.

Additionally, some Bitcoin holders possess a large amount of Bitcoin, and there is some semblance of mining centralization (though not as worrisome as some media outlets make it to be).

The crux of the matter is that Decred wants to be autonomous in a way that Bitcoin is not. I recommend reading the Decred documentation for more information on how the platform is designed.

Decred's mission.

Decred “strives to solve blockchain governance” via decentralized decision making and self-funding. Stakeholders on the network are responsible for making changes to the network protocol, not a set of developers or any other group of individuals. Decred will also support the Lightning Network, cross-chain atomic swaps and cross-platform wallets.

There are 4 main principles that guide the design and development of Decred: being free and open-source, providing incremental privacy and security, resistance to censorship and “multi-stakeholder inclusivity”, the latter referring to having as diverse a set of users as possible.

In the future, the team will create a decentralized exchange (DEX), decentralized control of funds and Decentralized Autonomous Organizations (DAO). The DEX was actually voted on by users, who chose to fund its development.

On the subject of developments, the Decred roadmap offers a rather zig-zag approach to completing tasks. Some milestones from 2017 and 2018 are still being worked on, while others from 2019 have already been completed. It could be that the team has chosen to give priority to certain features over others.

Decred's future development goals

The milestones that have been achieved include several types of wallets, on-chain atomic swaps, an initial privacy release, the exact governance system (called Politeia), among many other things.

Currently, the team is focusing on payment integration support, decentralized treasury control, scalability optimizations and Lightning Network integration. Future development focus will turn to the DEX, DAOs, more scalability optimizations and privacy improvements.

But it all comes down to the exact mechanisms that Decred employs to achieve a high performance, highly scalable and highly decentralized network. What exactly are these unique aspects of Decred?

Decred’s Governance and Hybrid PoW/PoS Systems

Decred’s governance system is by far its most notable feature and is pretty much the basis for Decred’s existence (alright, maybe that’s a bit much, but it’s the prominent feature for sure.)

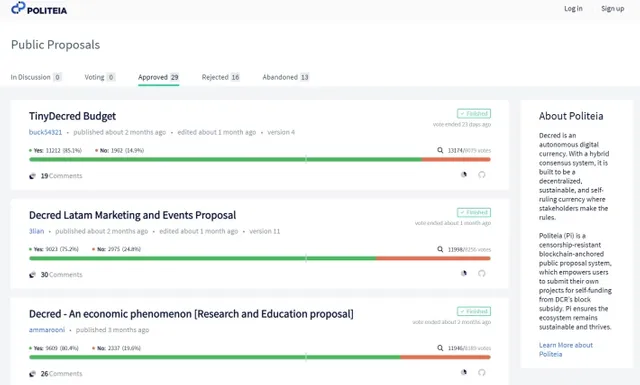

You probably want to view the voting system for yourself. You can see the various proposals that have been made and how they are progressing. The team describes the whole governance mechanism as follows,

Decred has been deliberately engineered to prevent powerful individuals or central planning committees from gaining a disproportionate influence over the future of the project.

The exacting voting mechanism works in the following manner. Those who hold the DCR token can purchase tickets, which can then be used for governance. The more significant decisions, like amendments to Decred’s constitution, are done off-chain via staking through Politeia. The formal decisions are made on Politeia by those who contribute through PoS.

Decred's Politeia system. Seen here is a list of approved proposals.

Voting can influence changes to the consensus rules, validation of miners’ work, treasury project funding and general policy changes.

Also worth mentioning is the hybrid PoW/PoS consensus algorithm. PoW is used for mining, while PoS is used for voting. Essentially, it is the same, but with some caveats. For a more technical look at how the hybrid PoW/PoS design works, read Decred’s technical brief on the matter.

These are by far what separate Decred from other digital currency tokens. For sure it is an interesting concept, but does it make for a good investment? Let’s look at how the price has done in the past and the potential for returns in the future.

DCR's Price History

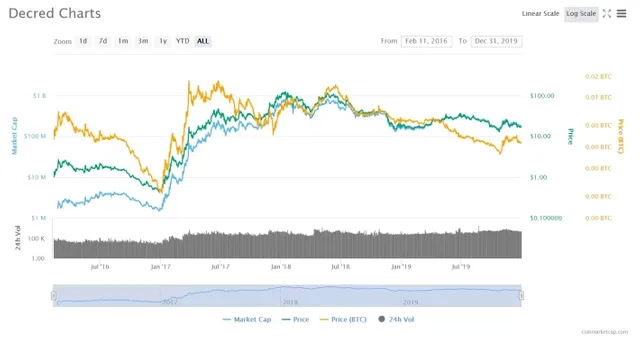

At the time of writing this, the DCR token is ranked 36 on CoinMarketCap with a total market cap of $180 million. Early investors would have received a return on investment of about 1,650% had they purchased the token at the time of its launch.

The token’s current price stands at roughly $16. All-time highs for the token were relatively high, hitting just under $100 in April 2018. The 52 week high and low is also comparable to that of many other altcoins - in terms of relative price changes - standing at roughly $40 and $13 respectively.

All things considered, the DCR token has had a turbulent time in the market, though it seems to be stabilizing at its current price. The past 12 months have been a bit topsy-turvy, but the long term price of the token could become stable, if and when the team releases more features and expands.

Is DCR a Good Investment?

So how good of an investment is Decred? Well, this is a bit of a double-edge investment.

On the one hand, you’re competing with Bitcoin. That’s a tall order. Sure there is room for more than one digital currency token, but in an average Joe’s mind - the person who just wants to use crypto pay for things - they would not look beyond the option that is Bitcoin. As incorrect as it is, to the vast majority of people in the world, the term cryptocurrency is synonymous with Bitcoin.

This great psychological struggle is one of the challenges that all digital currencies, not just Decred, will face, if they want to take up an appreciable share of the market. The end user is not very concerned with how a payments network becomes the best of their kind - they just want to be able to pay their money and see tangible benefits.

So, that being said, if the design principles and unique features of Decred result in visibly better payments systems for those average Joes, then maybe it can find some space along Bitcoin and privacy coins (which at least have the unquestioningly unique and desired feature of anonymity).

Now let’s look at the plus points of Decred and what it could mean for its price in the future.

Conclusion

Ask yourself how big a risk appetite you have. If you’re willing to go beyond Bitcoin, Ethereum (ETH) and the few altcoins that have managed to make a noticeable impact in the space, then perhaps Decred and DCR is not a bad investment for you.

You could also approach this investment in this manner: Some investors like to focus on a few fundamental sectors, use cases or technology unique selling points. For example, cloud computing is a strong use case, as is the energy sector and the uniqueness of a token ecosystem like that of MakerDAO.

On that idea, you could invest in a few payments focused/digital currency tokens, one of which could be Decred. Bear in mind that there are several projects which are equally compelling as payments options.

Whether or not you want to choose Decred is actually quite a tough choice, given the number of candidates in this space. Sure, Decred has some interesting design and development decisions going for it, but is that enough? Maybe it’s just best to watch how Decred develops and make a decision accordingly.

Disclosure

Also you can visit my publish0x Steemit and uptrennd profile where are leteast articles presented: