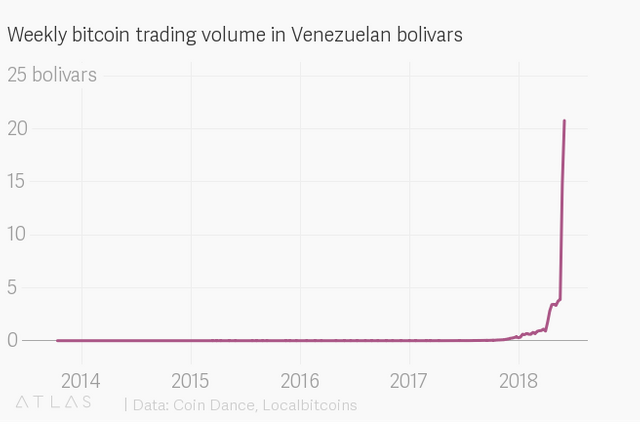

Crypto trading in Venezuela is skyrocketing amid 14,000% inflation

Venezuela’s government, struggling to contain its extreme, world-leading inflation rate, is devaluing its currency by removing three zeros from the bolivar. Local citizens may be taking a different approach: As price increases run rampant, bitcoin transactions denominated in the nation’s currency have skyrocketed, according to Localbitcoins data.

The government’s currency overhaul has been postponed by two months to Aug. 4, according to Reuters, to give the banking industry more time to prepare for new bank notes and transaction systems. But president Nicolas Maduro’s response to hyperinflation, which has devastated the economy, will do little to curtail the crisis. The International Monetary Fund (pdf) expects consumer prices to soar nearly 14,000% this year, a currency collapse that has left millions scrambling to pay for basic necessities such as food

In advanced economies, crypto assets like bitcoin have so far had little purpose apart from speculation and gambling. In countries where the monetary system and financial structures are crumbing, bitcoin may provide an alternative store of value (paywall) relative to the local currency.

The Venezuelan government, meanwhile, having just about destroyed the bolivar, is trying to get in on the action by launching its own cryptocurrency. However, it seems unlikely that investors would trust the “new” currency any more than the old one.