Bitcoin: Let's Talk Bubbles

Myth Four Debunked

When we hit the streets to talk to people about Bitcoin, (check out our Crypto Street Pulse videos here) one of the more common responses is that Bitcoin is a bubble and that we should stay away from it… haha, too late!

This over-hyped rebuttal to Bitcoin happens to be one of our personal favorites because we get to share the idea that Bitcoin is actually a solution to a far greater bubble — fiat currency.

The Real Bubble

A government-backed currency is called a fiat currency. Fiat is currency that a government has declared legal tender, but is not backed by a physical commodity. Many fiat currencies have existed over the ages, including the currency of the Mongolian and Roman empires, and all have failed for the same reason — dilution of the monetary supply.

Fiat currencies often start off as commodity backed money, backed by tangible assets such as precious metals, until the power to create money is taken too far and eventually the currency is backed by nothing but the government’s word that it has value.

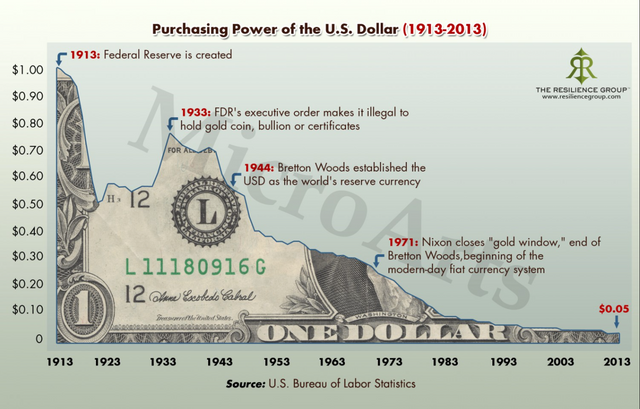

In the US, for most of the country’s history, $20 could buy one ounce of gold. When the Federal Reserve was created in 1913, excessive printing of dollars forced the re-pegging of the value of an ounce of gold to $35 in 1934. In 1974, the US dollar was taken off the gold standard completely and today the cost of one ounce of gold has risen to $1200.

But let’s get real here, it is not the value of gold that has changed. One ounce of gold is still one ounce of gold. The price increase is just a reflection of the US dollar’s decrease in purchasing power.

Since 1913, the US dollar has lost nearly 98% of its purchasing power through the process of inflation. The Federal Reserve continues to print money out of thin air, and the law of supply and demand has made each dollar printed less valuable than the last.

Every Single One of Us is Affected

But one might argue “Well, perhaps things are more expensive in terms of dollars now, but wages and everything else have also increased, right?”

Wrong! Every dollar printed dilutes the supply and decreases the value — but it most drastically decreases the value of those whom it reaches last. In other words, the ones who print the money (i.e. government and banks) receive more in return for their money than those who are paid with the same money further down the line. The more times money changes hands, the less value it has. This process is called the Cantillon effect. Through this process, those who need the money the most are most adversely affected. Welcome to our current financial paradigm.

Hard Money vs. Easy Money

In his book, The Bitcoin Standard, Ammous does a brilliant job explaining the difference between hard money and easy money and providing historical examples of why and how one always wins out.

Money that can easily be increased in supply is referred to as easy money, while money that is scarce or difficult to create is hard money. Gold is an example of hard money because gold can only be procured through mining. This investment of labor stops the market from being flooded with gold, therefore keeping the supply low and the price high.

The reason people value Bitcoin is because it is hard money. Bitcoin’s capped supply of only 21 million makes it scarce, and the creation of new Bitcoin through “mining” is a difficult and electrically intensive task. Bitcoin is hard money because it is both scarce and difficult to create.

“Gold is hard money. If the price of gold goes up it is hard for gold miners to increase the existing supplies of gold, so that’s why gold [like Bitcoin] is a good store of value. The supply is limited”.

— Saifedean Ammous

Fiat on the other hand is easily printable and has no capped supply. Meaning that instead of increasing in value over time, it will do the opposite. Hard money beats out easy money, and those who are the last to hold the easy money will take the hardest hit as the value plummets during the transition to a harder money — as seen when India and China were the last countries to switch from the silver standard to the gold standard.

Enter Bitcoin — The Pin to Pop the Fiat Bubble

Bitcoin is the first successful convergence of currency and technology. In this digital age, Bitcoin balances the portability of digital money with a hard money store of value. Additionally, Bitcoin leverages peer-to-peer technology to create a truly democratic currency that cannot be controlled by any one government entity or central bank.

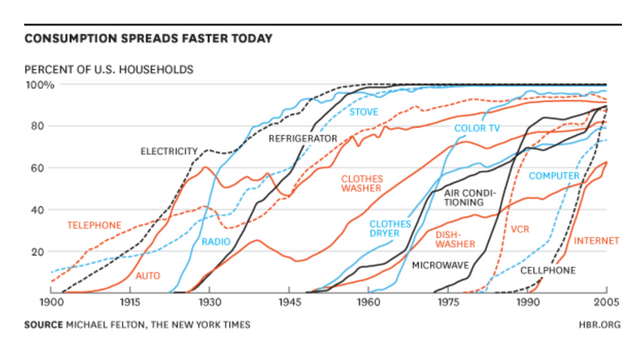

Bitcoin, the idea, has been around for 10 years and its steadily increasing value suggests that the free market desires a decentralized store of value. Along the path towards worldwide adoption we are likely to see bubble tops in the price, and subsequent corrections. This should be expected while the free market tries to decide just how valuable this new monetary technology is. But this does not negate the overall parabolic uptrend which is commonly experienced with new technological adoption.

Yes, we are looking at a bubble here, but it’s not Bitcoin. Due to its disinflationary economic model that respects the law of supply and demand, Bitcoin could be the most promising solution for individuals to maintain their value long-term as the US dollar is continuously devalued.

When it comes down to it, money is a store of our time, and 5 days a week we give our precious time and energy in exchange for money. It makes sense to store our time investment in a currency that is designed to retain value rather than one slowly marching towards zero.

As we continue to hit the streets to film The Crypto Street Pulse, we’ll continue to debunk myths and misconceptions along the way.

Thanks for supporting our work!

To learn more about us and what we do visit our website thecryptocouple.com

You got a 67.97% upvote from @oceanwhale courtesy of @thecrypt0couple! Earn 100% earning payout by delegating SP to @oceanwhale. Visit www.OceanWhaleBot.com for details!