Bitcoin is Bad for the Environment - Myth One Debunked

This article is part II in a blog series dispelling the myths around Bitcoin.

When we hit the streets to talk to people about Bitcoin (check out our Crypto Street Pulse videos ) one major concern we hear is its enormous energy consumption. This has even made the news recently with a series of articles being released on the topic. But from our street research, we realize most people we’ve spoken with don’t understand the importance of the technology behind the energy consumption.

Additionally, many of the mainstream articles talking about the high energy consumption fail to place that usage in context with other financial products. Bitcoin is direct competition with the banking industry and other stores of value. It is an alternative that makes the status quo obsolete. When Bitcoin is compared to precious metals or even the banking industry the high energy consumption myth falls flat.

Energy and the Bitcoin Network

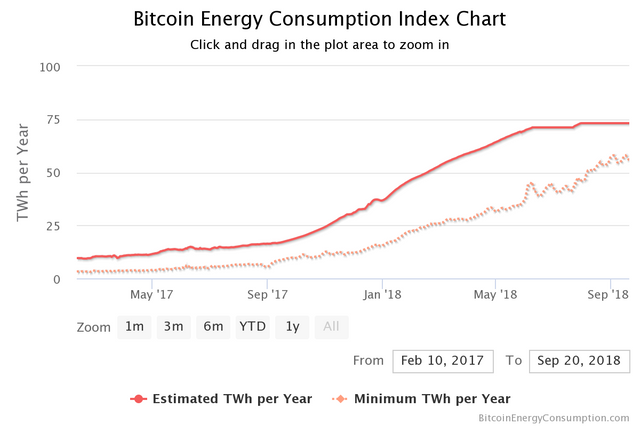

Bitcoin currently runs on an energy intensive ‘proof-of-work’ algorithm known as ‘mining.’ Basically, computers across the globe validate the transactions that are occuring on the Bitcoin network, and as a reward for doing so, they earn Bitcoin.

Supporting the Bitcoin blockchain by mining is notorious for racking up large energy bills, including the cost of cooling to offset the heat generated by mining computers (which can account for as much as 30–40% of the electricity costs).

As of 2018, the yearly electricity cost for maintaining the Bitcoin network is estimated at $3.5 billion per year. But that number alone doesn’t give much perspective, so how does Bitcoin measure up to the energy consumption of other industries?

Energy and Traditional Money

As it turns out, banking, gold mining, gold recycling, and paper currency all use significantly more energy than the Bitcoin network.

Dutch Professor, Harald Vranken estimates that the entire banking system, including bank branches and ATM locations use 650 terawatt-hours of energy annually. “Compared to these numbers the energy used for Bitcoin mining… is relatively small,” Vranken wrote. “Still, the proportion of bitcoin in the current financial system is relatively small, and when bitcoin scales up, so will the effort for bitcoin mining.”

“As it turns out, banking, gold mining, gold recycling, and paper currency all use significantly more energy than the Bitcoin network.”

At $3.5 billion per year, the operation costs of Bitcoin are 500 times less than the global banking industry and 30 times less than gold mining. However, these figures do not include the environmental costs associated with the cleanup of mining operations for gold and other metals associated with physical money or the toxicity load created by the printing of US dollars.

Creating New Efficiencies

A large portion of Bitcoin and cryptocurrency mining is conducted in northern latitudes or high elevations where the cool temperatures offset the cooling costs of mining equipment. Alternative power sources are being used as well. Geothermal power and hydro-power are being used in Iceland, and China’s Tibetan highlands mining operations are using hydropower to offset Bitcoin mining costs.

Other potential solutions for making the Bitcoin network use less energy are: changing the network’s algorithm to require less computing power to support, running as many servers on renewable energy as possible, and even mining the blockchain from solar paneled satellites.

So, yes. It’s true Bitcoin does consume a decent amount of energy to run its blockchain. But compared to other competitor industries Bitcoin’s energy consumption pales in comparison, and because it is a digital currency it is at the leading edge of innovation where technology will continue to make the process more efficient.

But why should the Bitcoin network be supported anyways? Isn’t it mostly used by drug dealers and shady people on the dark web? The next article in this series we’ll discuss this common misconception explain why Bitcoin isn’t the best choice for drug dealers anymore.

Ryan & Stacy are down-to-earth cryptocurrency educators and digital course creators with a passion for cryptos and a mission to inspire crypto-curious weekend warriors to reclaim their value and liberate themselves by transitioning into the hard money Bitcoin revolution.

Visit thecryptocouple.com to connect or learn more.