You are viewing a single comment's thread from:

RE: How To Put Bitcoin & Other Cryptocurrencies Into An IRA

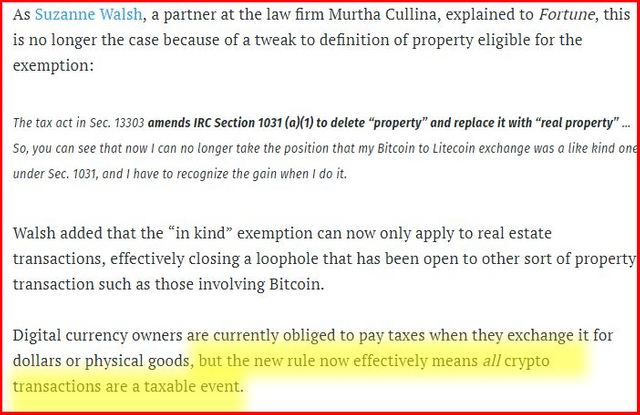

I might be of the subject. I think some might have to know this before the end of the year. Please help to spread awareness. Starting 2018 all crypto transactions are taxable events

Source

I've been reading up on declaration of steemit earnings and gains from crypto trading as taxable income / transactions a lot today and I've read many state the opinion that even for tax year 2017 coin for coin transactions are taxable events, because you're settling a position in the currency you're trading for another coin and the government wants its cut of that. However, they haven't made clear law yet but could retroactively enact this rule. I think the govt would go after the new millionaires first but it does make me nervous because I've made over 100 trades this year. What a headache if I have to file that sh**

But does anyone else know you made those trades? This could get ridiculous for day traders, or stop swing trading at all... Decentralized exchanges better get their shit together, openLedger.io is the one I have been trying...

One day they will force us to pay taxes on our taxes...

https://steemit.com/life/@ragetester/you-know-the-system-is-broken-when-you-are-taxed-2x-from-your-pension

Exactly. I have written about this extensively, The IRS/courts didn't consider gold and silver to be like kind property and also doesn't even consider certain types of gold to be like kind in certain situations; therefore long before the tax reform change to limit the scope of what can be "like kind," most crypto trades were probably not like kind. This is not personal tax advice of course!

does that mean that excludes 2017 for everything?